Today in the stock market, decreasing commodity prices made investors bullish on some of the more aggressive growth stocks.

Today in the stock market, decreasing commodity prices made investors bullish on some of the more aggressive growth stocks.

If inflation simmers down, it could signal to the Federal Reserve that more rate increases aren’t necessary. And inflation is what has been hurting the market since last November.

Overall, the S&P 500 was up 0.2% to 3831 on the day while the tech-heavy NASDAQ composite was up 1.8%.

Speculative tech stocks were big winners on the day:

- Datadog (DDOG) was up 7% to close at $108.

- MongoDB (MDB) was up 13% to $304.

- Bill.com (BILL) rose 11% to $126.

Tweet of the Day

Commodity prices have been falling hard this past month. And oil broke below $100 a barrel today, which is a very positive sign.

Commodity Prices Month-To-Date not looking so inflationary anymore… pic.twitter.com/GD6xEoL37a

— Q-Cap (@qcapital2020) July 5, 2022

Chart of the Day

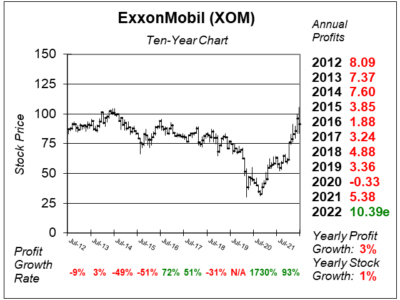

Our chart of the day is this ten-year chart of ExxonMobil (XOM).

Our chart of the day is this ten-year chart of ExxonMobil (XOM).

ExxonMobil is one of the world’s largest energy providers and chemical manufacturers. The company operates in most of the world’s countries and markets fuels, lubricants and chemicals under four main brands, Exxon, Mobil, Esso and ExxonMobil.

With gasoline prices high, it seems like XOM stock would be a good investment. But it doesn’t look that way. Notice the stock had been a poor investment for much of the past ten years. In addition, the profit history through the decade has been lackluster. 2022 is shaping up to be the first year of annual record profits this decade.

XOM doesn’t fit the mold we are looking for in our client portfolios.