The stock market saw a sharp reversal on Thursday, giving up strong early gains. Lofty AI valuations and uncertainty about the Federal Reserve’s next move weighed on investors sentiment. Cryptocurrencies added to the pressure, with Bitcoin slipping below $87,000 and dragging related tech stocks lower.

The stock market saw a sharp reversal on Thursday, giving up strong early gains. Lofty AI valuations and uncertainty about the Federal Reserve’s next move weighed on investors sentiment. Cryptocurrencies added to the pressure, with Bitcoin slipping below $87,000 and dragging related tech stocks lower.

Overall, S&P 500 fell 1.6% to 6,539, while NASDAQ dropped 2.2% to 22,078.

Tweet of the Day

The BIG story of the week is Optimus will be able to perform medical procedures better than a surgeon will.

Tesla $TSLA has a lot of great catalysts:

The Megapack battery storage segment revenue jumped 44% you last qtr. Still, its only 12% of company revenue.

New full-self… https://t.co/R0NZkl8sov

— David Sharek (@GrowthStockGuy) November 15, 2025

Chart of the Day

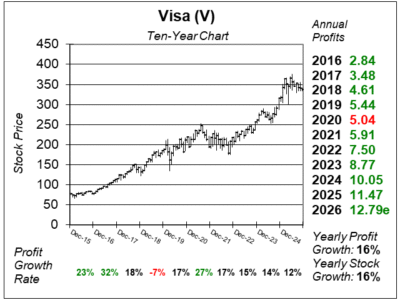

Here is the ten-year chart of Visa (V) as of November 10, 2025, when the stock was at $337.

Here is the ten-year chart of Visa (V) as of November 10, 2025, when the stock was at $337.

In last quarter’s earnings call, Visa’s management said the company has become a “hyperscaler,” which means it enables anyone that wants to be in the money movement or payments business to build on top of its global infrastructure.

The company now connects around 12 billion end points around the world, covering cards, bank accounts, and digital wallets.

After concerns two quarters ago about blockchain advancements reducing Visa’s potential revenue, the company’s stablecoin initiatives are gaining momentum. Stablecoins are cryptocurrencies that are designed to have a constant value of one dollar. It now has over 130 stablecoin-linked card issuing programs in over 40 countries. Visa has already launched stablecoin-linked cards with partners like Bridge, Rain, and Baanx, letting users spend stablecoins like regular currency.

Like its rival Mastercard (MA), Visa is also moving into agentic commerce, where AI agents are making transactions over the payment network without humans being involved. Visa’s Intelligent Commerce allows its partners to deploy secure and personalized digital commerce experiences.

V is part of our Conservative Growth Portfolio and Growth Portfolio.