Stock (Symbol) |

Adobe (ADBE) |

Stock Price |

$382 |

Sector |

| Technology |

Data is as of |

| July 8, 2025 |

Expected to Report |

| September 11 |

Company Description |

Adobe Inc. is a software company. It offers a line of products and services used by professionals, communicators, businesses, and consumers for creating, managing, delivering, measuring, optimizing, engaging and transacting with content and experiences across various digital media formats. Adobe Inc. is a software company. It offers a line of products and services used by professionals, communicators, businesses, and consumers for creating, managing, delivering, measuring, optimizing, engaging and transacting with content and experiences across various digital media formats.

Its segments include Digital Media, Digital Experience and Publishing and Advertising. The Digital Media segment provides products, services and solutions that enable individuals, teams and enterprises to create, publish and promote their content anywhere. Digital Media segment is centered around Adobe Creative Cloud and Adobe Document Cloud. The Digital Experience segment provides an integrated platform and set of applications and services through Adobe Experience Cloud that enable brands and businesses to create, manage, execute, measure, monetize and optimize customer experiences. The Publishing and Advertising segment consists of products and services that address diverse market opportunities. Source: Refinitiv |

Sharek’s Take |

Adobe’s (ADBE) AI innovation is driving steady growth. Last quarter, the company delivered 13% profit growth on 11% revenue growth. The Firefly app stood out with the introduction of Image Model 4 and the 4 Ultra version for hyper-detailed visuals, as well as the Firefly Video Model, enabling users to generate 4K video from text prompts. Firefly now integrates not only Adobe’s own commercially safe models but also third-party AI models from Google, OpenAI, and Black Forest Labs, offering creators flexibility in their workflows. Firefly app traffic was up over 30% quarter-over-quarter (QoQ), paid subscriptions nearly doubling, and first-time subscribers increasing 30% QoQ. Management said that AI-powered products like Acrobat AI Assistant, Firefly, and GenStudio were already driving billions in annual recurring revenue. The management said these tools were on track to surpass the $250 million ARR goal by the end of fiscal year 2025. Adobe’s (ADBE) AI innovation is driving steady growth. Last quarter, the company delivered 13% profit growth on 11% revenue growth. The Firefly app stood out with the introduction of Image Model 4 and the 4 Ultra version for hyper-detailed visuals, as well as the Firefly Video Model, enabling users to generate 4K video from text prompts. Firefly now integrates not only Adobe’s own commercially safe models but also third-party AI models from Google, OpenAI, and Black Forest Labs, offering creators flexibility in their workflows. Firefly app traffic was up over 30% quarter-over-quarter (QoQ), paid subscriptions nearly doubling, and first-time subscribers increasing 30% QoQ. Management said that AI-powered products like Acrobat AI Assistant, Firefly, and GenStudio were already driving billions in annual recurring revenue. The management said these tools were on track to surpass the $250 million ARR goal by the end of fiscal year 2025.

Adobe’s software is making the Internet work from videos, images, movies, ecommerce to marketing. The company has two main segments: Digital Media and Digital Experience:

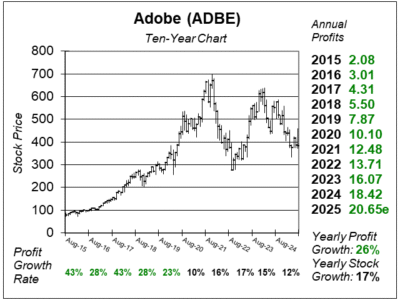

I believe ADBE is a tech stock that’s suitable for conservative investors. The stock currently has a Estimated Long-Term Growth Rate of 13% per year, and a reasonable P/E of 19. Although Adobe doesn’t pay a dividend any longer, management does buy back stock. ADBE is part of the Conservative Growth Portfolio. I think profits — and perhaps the stock — could grow 12% to 15% a year long-term. But there’s a “cloud” having over the stocks, and that’s the risk of competition from companies like Canva, offering similar services for a fraction of the cost, and Figma, which allows multiple users to work on the same image/video at the same time. |

One Year Chart |

ADBE stock chart shows a clear downtrend with lower highs and lower lows, indicating bearish momentum. Investors are shying away from this stock, anticipating slower growth ahead. ADBE stock chart shows a clear downtrend with lower highs and lower lows, indicating bearish momentum. Investors are shying away from this stock, anticipating slower growth ahead.

But ADBE is growing profits consistently, with 13% growth the past three qtrs. The good news is the shares are a nice value here. The P/E is just 19. My Fair Value is a 25 P/E, giving this $382 stock a Fair Value of $516. The Estimated Long Term Growth Rate of 13% a year is on target, in my opinion. |

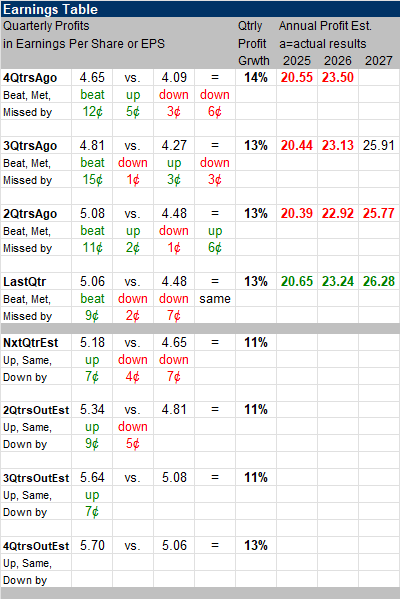

Earnings Table |

Last qtr, Adobe delivered 13% profit growth and beat expectations of 11% growth. Revenue increased 11%, year-on-year, and slightly above estimates of 10% growth. Operating Margin was 45.5% compared to 46.0% in the year ago period. Last qtr, Adobe delivered 13% profit growth and beat expectations of 11% growth. Revenue increased 11%, year-on-year, and slightly above estimates of 10% growth. Operating Margin was 45.5% compared to 46.0% in the year ago period.

Annual Profit Estimates increased this qtr. Wow, that has not happened in a while. Qtrly profit Estimates are 11%, 11%, 11%, and 13% for the next 4 qtrs. Analysts believe Adobe revenue will grow 9% next quarter. |

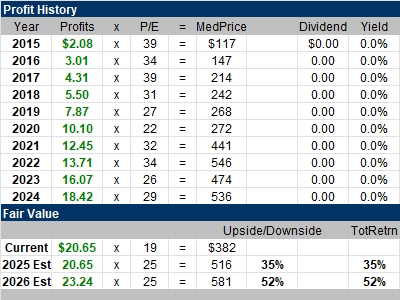

Fair Value |

ADBE currently has a P/E of 19. My Fair Value is a P/E of 25. ADBE currently has a P/E of 19. My Fair Value is a P/E of 25.

My Fair Value is $516, giving the stock upside of 35%. My 2026 Fair Value is $581, giving the stock an upside of 52%. The stock has good upside. Note the company has a November 30th Fiscal Year end. |

Bottom Line |

Adobe (ADBE) has been on a wild ride the past five years. The reason for the fall was the stock had a lofty P/E of 51 in August 2021. That was too high. So the stock digested its gains when it declined in price. In September 2022, the stock’s P/E was just 18 and that was around the bottom. Adobe (ADBE) has been on a wild ride the past five years. The reason for the fall was the stock had a lofty P/E of 51 in August 2021. That was too high. So the stock digested its gains when it declined in price. In September 2022, the stock’s P/E was just 18 and that was around the bottom.

Adobe’s got the high-end graphics programs. And AI is making them better But competition from the likes of Canva and Figma makes investors question the long-term outlook. ADBE drops from 5th to 10th in the Conservative Growth Portfolio Power Rankings. There’s nice upside, but I could be wrong about that. Investors are driving the valuation lower due to uncertanty about slowign growth. I sold ADBE from the Growth Portfolio on February 1, 2022 and the stock was $528 that day. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 10 of 20 |