Stock (Symbol) |

Palantir (PLTR) |

Stock Price |

$10 |

Sector |

| Technology |

Data is as of |

| May 10, 2023 |

Expected to Report |

| August 7 |

Company Description |

Palantir Technologies Inc. is engaged in building software to assist in counterterrorism investigations and operations. Palantir Technologies Inc. is engaged in building software to assist in counterterrorism investigations and operations.

The Company’s three principal software platforms include Palantir Gotham (Gotham), Palantir Foundry (Foundry), and Palantir Apollo (Apollo). Gotham enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants. It also facilitates the hand-off between analysts and operational users, helping operators plan and execute real-world responses to threats. Foundry transforms the ways organizations operate by creating a central operating system for their data. Apollo is a cloud-agnostic, single control layer that coordinates ongoing delivery of new features, security updates, and platform configurations, helping to ensure the continuous operation of critical systems and allowing its customers to run their software in virtually any environment. Source: Refinitiv. |

Sharek’s Take |

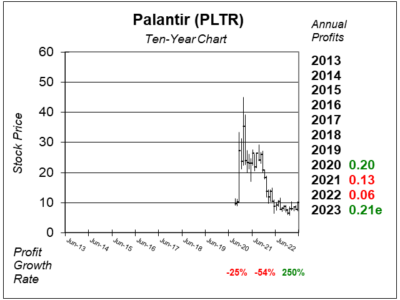

Palantir (PLTR) has gone from an unprofitable organization to a profitable one, and investors are sending shares of the stock higher on the news. Last qtr, PLTR’s profit jumped to 150% as a result of re-acceleration of US commercial business and continued spending control. The company had accelerated growth in the Commercial side of the business, which is a big positive as the company can increase services with these clients over time. US commercial customer count rose 50% year-over-year from 103 customers to 155. That’s a 7-fold increased in just two years. PLTR’s CEO says demand is the highest he’s seen in his 20 years of being involved with the company. Palantir (PLTR) has gone from an unprofitable organization to a profitable one, and investors are sending shares of the stock higher on the news. Last qtr, PLTR’s profit jumped to 150% as a result of re-acceleration of US commercial business and continued spending control. The company had accelerated growth in the Commercial side of the business, which is a big positive as the company can increase services with these clients over time. US commercial customer count rose 50% year-over-year from 103 customers to 155. That’s a 7-fold increased in just two years. PLTR’s CEO says demand is the highest he’s seen in his 20 years of being involved with the company.

Palantir takes a customers data and/or public data and solves complex problems that a regular program can’t solve. Examples include predicting things on the battlefield, where to seat passengers on a flight, logistics for COVID-19 vaccines, or how much product (i.e. candy bars) can be sold to different areas around the world — depending on the weather — and if you’re missing one key ingredient for that candy bar, which customers will be affected most and by how much. Management says what’s most exciting about Palantir is the ability to launch products that are literally the only products on the market that will change your life and determine who fails across enterprise, both government and commercial (source: 2023 Q1 Earnings Call). Palantir has built two principal software platforms:

Management predicts profits for the next couple of quarters, which makes it possible for the company to join the S&P 500. Joining the S&P would bring a flood of investment dollars into the stock. But there’s already a flood of money flowing into the stock now. PLTR has an excellent Estimated Long Term Growth Rate of +70%. And the P/E of 47 is reasonable for a company just breaking into profitability. In 2022, Palantir’s revenue grew 27%, on top of 41% growth in 2021. Palantir will be added to the Growth Portfolio today. The stock has been jumping on HUGE volume which suggests to me there’s big institutional dollars backing the shares. |

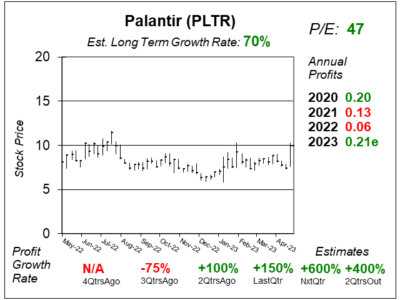

One Year Chart |

PLTR is looking very good right now. These charts adan tables were done on 5/10 when the stock was $10. Today is 5/19 and the shares are now $12. PLTR had a spike higher in February on HIGH VOLUME after earnings were released. Then the shares settled back down, and have once again jumped on HIGH VOLUME after earnings. PLTR is looking very good right now. These charts adan tables were done on 5/10 when the stock was $10. Today is 5/19 and the shares are now $12. PLTR had a spike higher in February on HIGH VOLUME after earnings were released. Then the shares settled back down, and have once again jumped on HIGH VOLUME after earnings.

PLTR has (had) a P/E of 47. That’s reasonable for this stock. The Est. LTG is 70% this qtr. That’s an estimated 3-5 year profit growth estimate. Profits have been growing the past two quarters. I think this stock has turned up. |

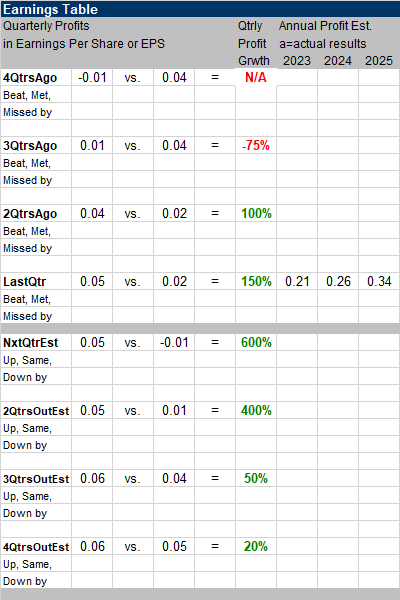

Earnings Table |

Last qtr, Palantir recorded 150% profit growth as it delivered a profit of $0.05 versus $0.02 a year ago. That was the second consecutive qtr of positive earnings growth, and the second consecutive quarter of positive GAAP net income (GAAP EPS of $0.01 per share). Revenue increased 18%, year-over-year. Commercial revenue grew 15% and accelerated from 11% 2QtrsAgo while Government revenue increased 20%, which was less than the 23% delivered 2QtrsAgo. Customer count increased 41% year-over-year, while US commercial customer count grew 50%. Last qtr, Palantir recorded 150% profit growth as it delivered a profit of $0.05 versus $0.02 a year ago. That was the second consecutive qtr of positive earnings growth, and the second consecutive quarter of positive GAAP net income (GAAP EPS of $0.01 per share). Revenue increased 18%, year-over-year. Commercial revenue grew 15% and accelerated from 11% 2QtrsAgo while Government revenue increased 20%, which was less than the 23% delivered 2QtrsAgo. Customer count increased 41% year-over-year, while US commercial customer count grew 50%.

Revenue growth was driven by high demand in Artificial Intelligence Platform (AIP) from both governments and enterprises as well as ongoing strength in US commercial business and continued costs management. Annual Profit Estimates are for profits of $0.21 per share fo 2023. For 2023, management expects revenue to grow around $2.19 billion to $2.24 billion. Qtrly Profit Estimates are for 600%, 400%, 50%, and 20% profit growth the next 4 qtrs. For the next couple of qtrs, management expects continued profitability as they see meaningful growth and expansion from new customers. Analysts think that PLTR revenue will grow 12% next qtr. |

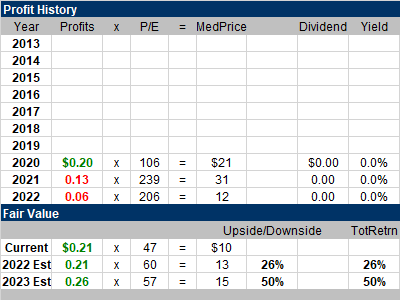

Fair Value |

PLTR had its IPO in September 2020, and at the end of September and ended the month at $9.50 with a market cap of $16.4 billion. PLTR did $772 million in sales that year, thus the stock was selling for 21x 2020 revenue at the time. PLTR had its IPO in September 2020, and at the end of September and ended the month at $9.50 with a market cap of $16.4 billion. PLTR did $772 million in sales that year, thus the stock was selling for 21x 2020 revenue at the time.

This qtr, PLTR sells for 10x 2023 revenue estimates. I think 12x revenue is fair. My Fair Value is 12x revenue estimates, or $13 a share: Current: 2023 Fair Value: 2024 Fair Value: |

Bottom Line |

Palantir (PLTR) was at one time one of the hottest IPOs of 2020. It’s software is unique and can deliver results other companies can not. But back then, the company wasn’t making profits. Now, management is committed to profitability. Palantir (PLTR) was at one time one of the hottest IPOs of 2020. It’s software is unique and can deliver results other companies can not. But back then, the company wasn’t making profits. Now, management is committed to profitability.

Palantir has a robust government business. And now U.S. corporations are getting on board. AI is creating huge demand for Palantir’s services. This could be the beginning of a multi-year run higher for the stock. PLTR will be added into the Growth Portfolio today. The stock will rank 15th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

15 of 28Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |