Stock (Symbol) |

RH (RH) |

Stock Price |

$544 |

Sector |

| Retail and Travel |

Data is as of |

| December 22, 2021 |

Expected to Report |

| March 22 |

Company Description |

RH, formerly Restoration Hardware Holdings, Inc., is a retailer in the home furnishings marketplace. As of January 28, 2017, the Company had two segments: RH Segment and Waterworks. It offers merchandise assortments across a range of categories, including furniture, lighting, textiles, bathware, decor, outdoor and garden, tableware, and child and teen furnishings. The Company classifies its sales into furniture and non-furniture product lines. The Furniture category includes both indoor and outdoor furniture. The Non-furniture category includes lighting, textiles, fittings, fixtures, surfaces, accessories and home decor. The Company’s business is integrated across its channels of distribution consisting of its stores, Source Books and Websites. The Company also owns a controlling interest in Design Investors WW Acquisition Company, LLC, which owns the business operating under the name ‘Waterworks’. Source: Thomson Financial RH, formerly Restoration Hardware Holdings, Inc., is a retailer in the home furnishings marketplace. As of January 28, 2017, the Company had two segments: RH Segment and Waterworks. It offers merchandise assortments across a range of categories, including furniture, lighting, textiles, bathware, decor, outdoor and garden, tableware, and child and teen furnishings. The Company classifies its sales into furniture and non-furniture product lines. The Furniture category includes both indoor and outdoor furniture. The Non-furniture category includes lighting, textiles, fittings, fixtures, surfaces, accessories and home decor. The Company’s business is integrated across its channels of distribution consisting of its stores, Source Books and Websites. The Company also owns a controlling interest in Design Investors WW Acquisition Company, LLC, which owns the business operating under the name ‘Waterworks’. Source: Thomson Financial |

Sharek’s Take |

There’s big things “in store” for RH (RH) in 2022 as the company introduces a fresh set of catalysts in what management calls 2022: the Year of the New. These additions to the company’s brand will take it from a furniture store to an International luxury brand for the wealthy and affluent, and this might take the stock price to amazing places. There’s big things “in store” for RH (RH) in 2022 as the company introduces a fresh set of catalysts in what management calls 2022: the Year of the New. These additions to the company’s brand will take it from a furniture store to an International luxury brand for the wealthy and affluent, and this might take the stock price to amazing places.

RH, formerly known as Restoration Hardware, is a luxury furniture store with bathtubs, vanities, bed linens, rugs, wall decor, and even cabinet hardware. The company has evolved from a shopping center furniture retailer into a high-end brand with big lavish mansions that draw buyers in with restaurants and rooftop cafes, which is called the RH Hospitality experience. RH has what it believes is the most comprehensive and compelling collection of luxury home furnishings in the world. The company debuted this new concept in 2015 in Houston. In 2016, management shifted from a promotional to a membership model, which simplified and streamlined its business, and enabled the company to move up from selling products to selling spaces. RH Members Program provides a set discount every day across all RH brands, for an annual fee. In Fiscal Year ending January 31, 2021 79% of sales in the core RH business was from the program’s 434,000 members. The company also produces catalogs (Source Books) and websites which act as virtual extensions of the stores. Here’s a rundown of what’s in store for 2022, the Year of the New:

RH wants to be considered a premier luxury brand, alongside names like Louis Vuitton, Gucci, Cartier, Chanel and Hermes. And truth be told, company has executed its plan to become the premiere luxury furniture brand, while RH stock has been a premium investment. From the IPO on November 2, 2012 to January 1, 2021, RH stock did better than Amazon, Google, Facebook, LVMH and Hermes — but not Tesla. This company is making big profits, has a healthy Estimated Long-Term Growth Rate of 24%, and the stock has a reasonable P/E of 21. With this pipeline of potential catalysts set to launch in 2022, I think the P/E should be 30, and that equates to a hypothetical gain of 69% in 2022. Adjusted Operating Margin was 21.8% last year — that’s better than LVMH — and management sees 25%-plus during the next several years (it was 27.7% last qtr). Last qtr, the company had $145 million in free cash flow and total debt of $178 million. Management had plans to be debt free by the end of this fiscal year. RH is part of the Growth Portfolio. This stock has what it takes to be a true market leader in 2022. |

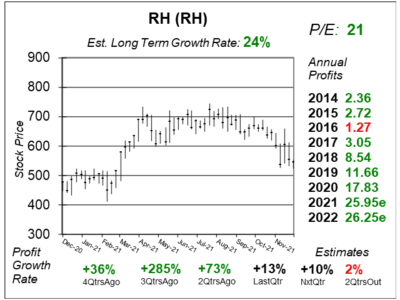

One Year Chart |

This stock has been in a downturn, as growth stocks have fallen the past couple of months in general. Speculative growth stocks have been in a Bear Market, but I wouldn’t call this stock speculative with a P/E of only 21. Last qtr the P/E was 25. This stock is cheap. This stock has been in a downturn, as growth stocks have fallen the past couple of months in general. Speculative growth stocks have been in a Bear Market, but I wouldn’t call this stock speculative with a P/E of only 21. Last qtr the P/E was 25. This stock is cheap.

The Est. LTG of 24% seems low to me, as I think this stock should bee a 30% profit-grower the next 3-5 years. Qtrly profit growth just slowed, which is probably another reason for the stock’s decline. RH is dealing with port delays. |

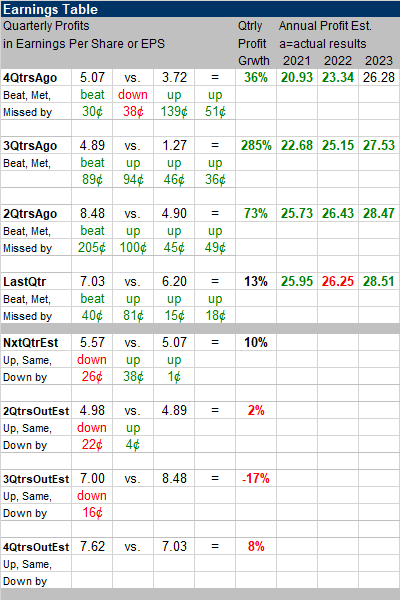

Earnings Table |

Last qtr, RH delivered 13% profit growth and beat estimates of 7%. Revenue increased 19%, from a year ago. Adjusted operating margin was 27.7%, up from 26.7% in the year-ago period. Last qtr, RH delivered 13% profit growth and beat estimates of 7%. Revenue increased 19%, from a year ago. Adjusted operating margin was 27.7%, up from 26.7% in the year-ago period.

Sales performance was driven by strong customer demand in furniture and furnishing products as the company’s supply chain is starting to catch up with the increased demand, growth in RH hospitality business due to easing of COVID-19 restrictions, new restaurant openings, and continued demand in residential constructions and investments by wealthy homeowners, last qtr. Annual Profit Estimates have been increasing for the past year. RH is expected to do $3.8 billion in revenue this year, while management envisions $20 to $25 billion worldwide someday. In addition to sales growth, this company is a beast when it comes to profit margins. Since 2016, Gross Profit Margin has increased from 32% to 34%, 29%, 41%, and 47% each year. While Operating Income as a percent of sales has jumped from 2% to 3%, 9%, 13% and 16% during that span. If RH hits profit estimates this qtr, it will have grown profits (EPS) 37%, 53% and 46% the past 3 years. Qtrly Profit Estimates are for 10%, 2%, -17%, and 8% growth the next 4 qtrs. I’m ok with these poor estimates as the company will be spending on multiple launches. |

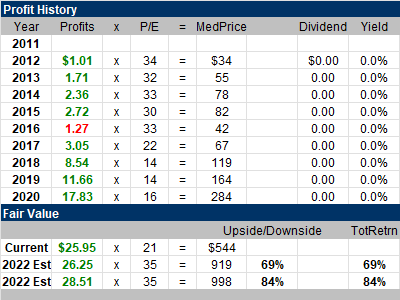

Fair Value |

My Fair Value P/E moves up from 32 to 35 as the company has a slew of catalysts coming this year. My Fair Value P/E moves up from 32 to 35 as the company has a slew of catalysts coming this year.

My Fair Value of $919 is 69% above this qtr’s stock price of $544. RH has great upside as we look into 2022. |

Bottom Line |

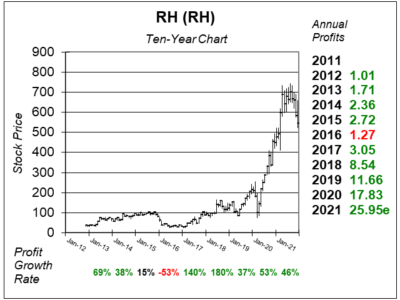

RH (RH) has taken its investors on some wild rides. I purchased RH stock at $98 on June 29, 2015, then after a series of disappointments sold the stock at $29 on October 26, 2016. Note in the ten-year chart that profits fell in 2016. That’s a sell signal for me, so I sold. But I should have gotten back in during June 2018 when the stock broke out and jumped up to $165. I eventually bought back in at $605 on April 6, 2021. RH (RH) has taken its investors on some wild rides. I purchased RH stock at $98 on June 29, 2015, then after a series of disappointments sold the stock at $29 on October 26, 2016. Note in the ten-year chart that profits fell in 2016. That’s a sell signal for me, so I sold. But I should have gotten back in during June 2018 when the stock broke out and jumped up to $165. I eventually bought back in at $605 on April 6, 2021.

2022 will be the Year of the New for RH, and this may usher the company into a new world in terms of luxury brands. What’s so amazing about all this is investors can pick up the stock with a ridiculously low 21 P/E. It’s like a sample sale for the stock. RH moves up from 16th to 4th in the Growth Portfolio Power Rankings. I’ll add to my position tomorrow. |

Power Rankings |

Growth Stock Portfolio

4 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |