Stock (Symbol) |

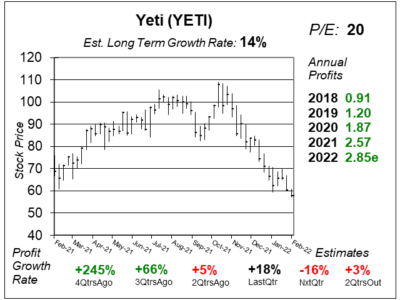

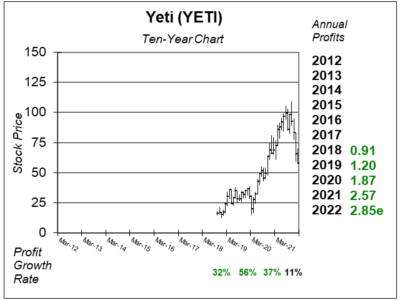

Yeti (YETI) |

Stock Price |

$58 |

Sector |

| Retail & Travel |

Data is as of |

| February 22, 2022 |

Expected to Report |

| May 20 |

Company Description |

YETI Holdings, Inc. (YETI) is a designer, marketer and distributor of products for the outdoor and recreation market. The Company’s product portfolio includes three categories: Coolers & Equipment, Drinkware and Other. The Company’s Coolers & Equipment category consists of hard coolers, soft coolers, and associated accessories. Its Tundra hard coolers, designed to perform in hunting and fishing environments, are also used in boating, whitewater rafting, camping, barbecuing, tailgating, farming and ranching activities. The Company’s Hopper coolers are designed to provide ice retention. Source: Thomson Financial YETI Holdings, Inc. (YETI) is a designer, marketer and distributor of products for the outdoor and recreation market. The Company’s product portfolio includes three categories: Coolers & Equipment, Drinkware and Other. The Company’s Coolers & Equipment category consists of hard coolers, soft coolers, and associated accessories. Its Tundra hard coolers, designed to perform in hunting and fishing environments, are also used in boating, whitewater rafting, camping, barbecuing, tailgating, farming and ranching activities. The Company’s Hopper coolers are designed to provide ice retention. Source: Thomson Financial |

Sharek’s Take |

Yeti (YETI) has been a winner here in America, and now the company is expanding rapidly Internationally. Last qtr, International sales grew 62% to represent 10% of total company sales. And for all of 2021 foreign sales grew 102% to 9.5% of total sales in 2021 versus 6.1% in 2020. The company saw strong growth in Canada, Australia, and Europe. Yeti (YETI) has been a winner here in America, and now the company is expanding rapidly Internationally. Last qtr, International sales grew 62% to represent 10% of total company sales. And for all of 2021 foreign sales grew 102% to 9.5% of total sales in 2021 versus 6.1% in 2020. The company saw strong growth in Canada, Australia, and Europe.

Yeti makes rugged high-quality “leak-proof, ice-for-days, tough-as-nails” coolers that keep ice cold for days at a time. The company offers both hard sided and soft sided coolers, as well as tumblers, bags and other accessories. Yeti was started in 2005 out of Austin, Texas by two brothers who wanted rugged coolers for their fishing trips. The company positioned itself for hunters and fishermen with $300 coolers, which were around 10x the price of store bought ones. The brand grew from YouTube videos and Yeti sections in local sporting goods stores. Independent store owners liked the profits each cooler brought in ($5 on $30 coolers vs. $100 on $300 ones). Today, some of the company’s popular items include a soft sided cooler, a hard sided cooler, a hard sided travel cooler, a big bucket, and a “coolie”. As of 2020, Yeti had nearly 4500 independent retail partners. Here’s some stats from last qtr: Channel Sales Growth

Category Sales growth

The Yeti brand is red-hot amongst consumers but there are other quality cooler brands that are comparable. What makes this company great is its focus on marketing the brand. Yeti has a top-notch team of marketers who position the company very well. The Yeti YouTube channel is outstanding. YETI went through a period when it was growing profits around 50%. But after last qtr’s 18% growth, I think those days are over and this is more of a 20% to 25% grower now. The stock has an Estimated Long Term Growth Rate of 14% per year. YETI is part of the Growth Portfolio. |

One Year Chart |

This stock has been in a quick correction (with the rest of hte growth stocks in the market). It was obvious qtrly profit growth would slow last qtr as profits jumped 103% in the year-ago period when the pandemic caused people to go out into the outdoors more often. This stock has been in a quick correction (with the rest of hte growth stocks in the market). It was obvious qtrly profit growth would slow last qtr as profits jumped 103% in the year-ago period when the pandemic caused people to go out into the outdoors more often.

The P/E of 20 is good. The P/E was 36, 32, 34 and 23 the last 4 qtrs. The Est. LTG declined from 22% to 14% this qtr. It’s good to collect 20% growers in a growth portfolio. |

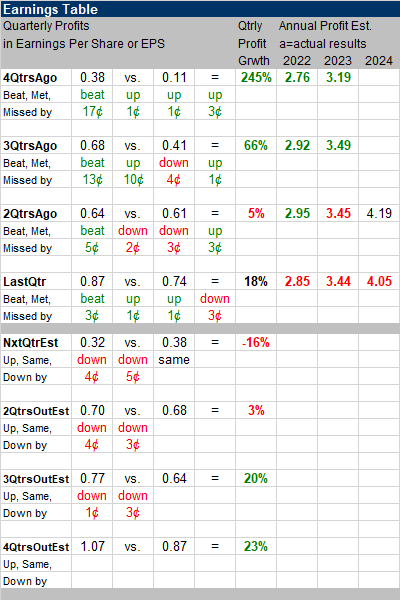

Earnings Table |

Last qtr, Yeti generated 18% profit growth and beat estimates of 14% growth. Revenue increased 18%, from last year. International business jumped 62% and represented around 10% of company sales. Canada, Australia, and Europe delivered strong sales contributions. Last qtr, Yeti generated 18% profit growth and beat estimates of 14% growth. Revenue increased 18%, from last year. International business jumped 62% and represented around 10% of company sales. Canada, Australia, and Europe delivered strong sales contributions.

Sales results, during the qtr, were amplified by sustained strong momentum in both Direct-to-consumer and Wholesale businesses, strong consumer demand for new product releases, demand for product customization, robust digital business, international business expansion, and repeat buyers. Annual Profit Estimates fell this qtr. Management sees 2022 profits of $2.82 to $2.86 per share. For fiscal 2022, management expects annual revenue to grow around 20%. The company anticipates another year of strong growth in 2022; but more biased towards the second half of the year. Qtrly Profit Estimates are for -16%, 3%, 20%, and 23% growth the next 4 qtrs. Qtrly profit growth looks sluggish for the next two qtrs, as more than 50% of product inventory was in transit at qtr end. The company is seeing higher raw material costs in resin and stainless steel. |

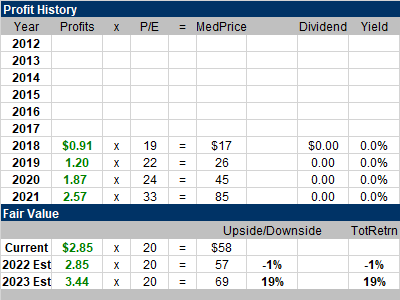

Fair Value |

My Fair Value P/E drops from 28 last qtr to 20 this qtr. Its clear the good times are over for now as profits growth of 18% was weak. I thought the company might deliver 20% growth last qtr. Also, qtrly estimates are very poor for the next 2 qtrs. My Fair Value P/E drops from 28 last qtr to 20 this qtr. Its clear the good times are over for now as profits growth of 18% was weak. I thought the company might deliver 20% growth last qtr. Also, qtrly estimates are very poor for the next 2 qtrs.

This stock is fairly valued here, with around 20% upside to next year’s estimates. |

Bottom Line |

Yeti (YETI) is a hot brand amongst consumers right now, and the momentum continues to amaze me. But the stock has fallen way off its highs, and since the trend is your friend, these shares could go lower. Yeti (YETI) is a hot brand amongst consumers right now, and the momentum continues to amaze me. But the stock has fallen way off its highs, and since the trend is your friend, these shares could go lower.

I’m concerned the inventory shortage will continue, as shipments from overseas are still slow to arrive. Also, commodity prices continue to rise. What’s good is demand is outstripping supply. I like YETI stock, but I will sell it from the Growth Portfolio tomorrow. I still think this is a 20% grower, but I’m trying to cut some stocks out of my research and this stock is more of a niche than a juggernaut. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |