Stock (Symbol) |

Walmart (WMT) |

Stock Price |

$88 |

Sector |

| Food & Necessities |

Data is as of |

| March 10, 2025 |

Expected to Report |

| May 15 |

Company Description |

Walmart Inc. is a technology-powered omnichannel retailer. Walmart Inc. is a technology-powered omnichannel retailer.

The Company is engaged in the operation of retail and wholesale stores and clubs, as well as e-commerce websites and mobile applications, located throughout the United States, Africa, Canada, Central America, Chile, China, India and Mexico. It operates through three segments: Walmart U.S., Walmart International and Sam’s Club. The Walmart U.S. segment includes the Company’s mass merchant concept in the United States, as well as e-commerce, which includes omni-channel initiatives and certain other business offerings such as advertising services through Walmart Connect. It operates under the Walmart and Walmart Neighborhood Market brands. The Walmart International segment consists of the Company’s operations outside of the United States, as well as e-commerce and omni-channel initiatives. The Sam’s Club segment includes the warehouse membership clubs in the United States, as well as e-commerce and omni-channel initiatives. Source: Refinitiv. |

Sharek’s Take |

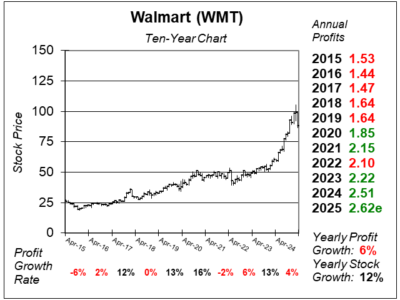

Walmart’s (WMT) profits are expected come under a bit of pressure due to Trump tariffs. US President Donald Trump has been instituting lots of tariffs this month, and this will raise the cost of many of Walmart’s products. The company may have to raise prices, and has asked some Chinese companies to lower their prices by 10%. Meanwhile, WMT stock has been rising as profits are growing nicely. Last quarter, WMT delivered 10% profit growth on 4% revenue as eCommerce sales surged 16% globally. Profit growth has averaged a robust 14% during the past four qtr, but is expected to average just 5% the next 4 qtrs. Maybe WMT can beat the street and deliver 10% profit growth moving forward. Concerns about slowing growth has taken some momentum out of this hot stock. Walmart’s (WMT) profits are expected come under a bit of pressure due to Trump tariffs. US President Donald Trump has been instituting lots of tariffs this month, and this will raise the cost of many of Walmart’s products. The company may have to raise prices, and has asked some Chinese companies to lower their prices by 10%. Meanwhile, WMT stock has been rising as profits are growing nicely. Last quarter, WMT delivered 10% profit growth on 4% revenue as eCommerce sales surged 16% globally. Profit growth has averaged a robust 14% during the past four qtr, but is expected to average just 5% the next 4 qtrs. Maybe WMT can beat the street and deliver 10% profit growth moving forward. Concerns about slowing growth has taken some momentum out of this hot stock.

Here’s a timeline of Walmart, from my book the School of Hard Stocks:

Segment Information (last quarter):

Walmart (WMT) stock has a high safety rating, pays a dividend, and management buys back stock. In 2024 management bought back $4.5 billion in stock and paid out $6.8 billion in dividends. The Estimated Long-Term Growth is only 9%. WMT yields 1%, adding the Est. LTG to the dividend yield might net investors 10% a year long-term. That’s good but not great. Walmart is on the radar for the Conservative Growth Portfolio. |

One Year Chart |

This stock fell out of bed when it announced earnings and lowered profit estimates. The stock’s recovered a bit here, and I’l use the strength to sell. This stock fell out of bed when it announced earnings and lowered profit estimates. The stock’s recovered a bit here, and I’l use the strength to sell.

The Est. LTG of 9% isn’t high enough. 10% to 12% would be better. Notice profits have been growing nicely the past four quarters. But growth is expected to slow (Estimates). Maybe WMT can continue beating the street? The P/E of 34 is a little high for what may be a 10% grower now. I think a 32 P/E is reasonable. |

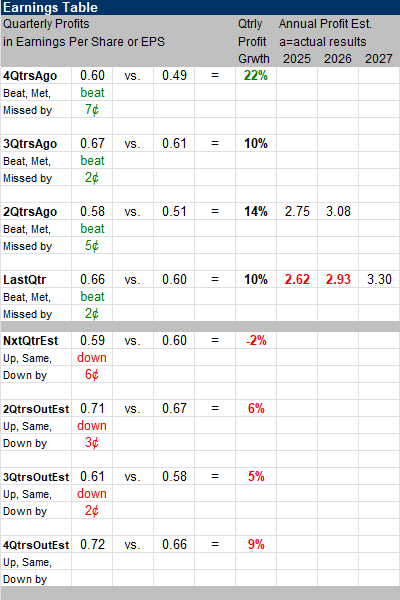

Earnings Table |

Last qtr, WMT delivered a solid 10% increase in profits, and beat estimates of 7%. Sales increased 4%. Same store sales grew 5% and ecommerce grew 16%. Gross Profit rose to 23.9% from 23.3% a year ago. Last qtr, WMT delivered a solid 10% increase in profits, and beat estimates of 7%. Sales increased 4%. Same store sales grew 5% and ecommerce grew 16%. Gross Profit rose to 23.9% from 23.3% a year ago.

Annual Profit Estimates decreased this quarter. Management expects earnings of $2.50 to $2.60 this year, which is below analyst estimates of $2.62. But WMT just finished its fiscal year and management may be underpromising to overdeliver later. Qtrly profit Estimates are for -2%, 6%, 5% and 9% profit growth the next 4 qtrs. Notice qtrly profit estimates declined The CFO didn’t mention tariffs in quarterly guidance, |

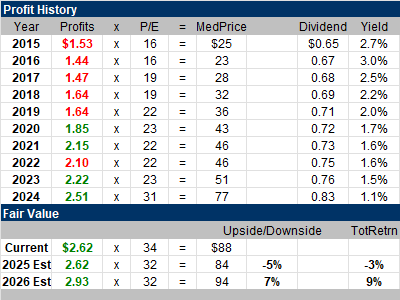

Fair Value |

My Fair Value is a P/E of 34. That equates to $84. ($2.62 x 32 = $84). My Fair Value is a P/E of 34. That equates to $84. ($2.62 x 32 = $84).

The stock is $88 this quarter. So the shares are around fair value. If the P/E doesn’t rise then the stock should grow at the rate profits do, which seems like 10% a year if I had to guess. Notice the median P/E was $31 in 2024. That’s a lot higher than the stock has had in prior years during the past decade. |

Bottom Line |

Walmart (WMT) stock was hot last year. The stock jumped from $53 to $90 during 2024. Alas, the P/E got a little-to-high and the shares have since settled back. Walmart (WMT) stock was hot last year. The stock jumped from $53 to $90 during 2024. Alas, the P/E got a little-to-high and the shares have since settled back.

Trump tariffs might take profit growth down from the double-digit rate this company has been delivering. Slowing growth isn’t good. Profits grew an average of 14% the past 4 qtrs. I think profit growth will slow to around 10% a quarter. WMT is on the radar for the Conservative Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |