Stock (Symbol) |

Walmart (WMT) |

Stock Price |

$119 |

Sector |

| Retail & Travel |

Data is as of |

| September 30, 2019 |

Expected to Report |

| November 14 |

Company Description |

Walmart Inc., formerly Wal-Mart Stores, Inc., is engaged in the operation of retail, wholesale and other units in various formats around the world. The Company offers an assortment of merchandise and services at everyday low prices (EDLP). The Sam’s Club segment includes the warehouse membership clubs in the United States, as well as samsclub.com. The Company operates approximately 11,600 stores under 59 banners in 28 countries and e-commerce Websites in 11 countries.Source: Thomson Financial Walmart Inc., formerly Wal-Mart Stores, Inc., is engaged in the operation of retail, wholesale and other units in various formats around the world. The Company offers an assortment of merchandise and services at everyday low prices (EDLP). The Sam’s Club segment includes the warehouse membership clubs in the United States, as well as samsclub.com. The Company operates approximately 11,600 stores under 59 banners in 28 countries and e-commerce Websites in 11 countries.Source: Thomson Financial |

Sharek’s Take |

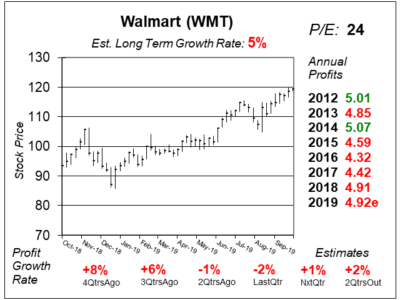

Walmart (WMT) is a hot stock once again as the company is getting a pat on the back for competing with Amazon. Notice I didn’t say successfully competing. Just competing. Walmart’s profits aren’t growing. In 2019 the company is expected to make $4.92 versus $4.91 a year ago. WMT’s All-Time high in profits was in 2014 when it made $5.07. It hasn’t made that much in any year since. Here’s an old timeline of Walmart, from my book the School of Hard Stocks: Walmart (WMT) is a hot stock once again as the company is getting a pat on the back for competing with Amazon. Notice I didn’t say successfully competing. Just competing. Walmart’s profits aren’t growing. In 2019 the company is expected to make $4.92 versus $4.91 a year ago. WMT’s All-Time high in profits was in 2014 when it made $5.07. It hasn’t made that much in any year since. Here’s an old timeline of Walmart, from my book the School of Hard Stocks:

This is my first research report on Walmart. The stock is one of the world’s safest, but the Est. LTG of 5% a year isn’t much. What’s nice is investors get a dividend yield of more than 2% and management has raised the dividend each year since 1975. If you add 5% hypothetical stock growth with a 2% yield that’s a total estimated return of 7% per year. That’s below the 10% I like in the Conservative Portfolio. But, Walmart is doing a good job competing with Amazon. Perhaps that means faster growth down the road?WMT is on the radar for the Conservative Growth Portfolio. I think the stock’s fairly valued right now. |

One Year Chart |

This stock has been trending higher as it is getting favorable reviews in the financial community for its competition vs Amazon. But the numbers suck. This stock has been trending higher as it is getting favorable reviews in the financial community for its competition vs Amazon. But the numbers suck.

The Est. LTG of 5% isn’t high enough for me. But if profit growth could get up to 7-8% I’d be happy. The 24 P/E is fair. |

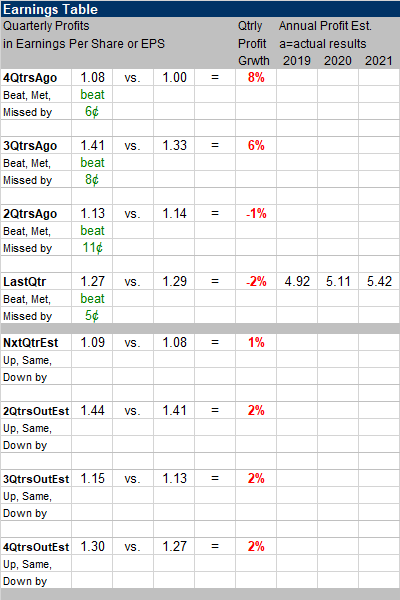

Earnings Table |

Last qtr Walmart had -2% profit growth on 3% sales growth including 3% same store sales. Those numbers suck. E-commerce sales increased 37%, but I couldn’t find out what percentage online sales are of total sales. Last qtr Walmart had -2% profit growth on 3% sales growth including 3% same store sales. Those numbers suck. E-commerce sales increased 37%, but I couldn’t find out what percentage online sales are of total sales.

This is my first qtr covering the stock, thus I don’t know if analysts have been altering Annual Profit Estimates. Qtrly profit Estimates for the next 4 qtrs are 1%, 2% 2% and 2%. Although these numbers suck — currently — WMT has beaten the street by an average of 8 cents the past 4 qtrs. If it beats these figures by 8 cents it will deliver 8%, 8%, 9% and 9% profit growth — which would be pretty good! |

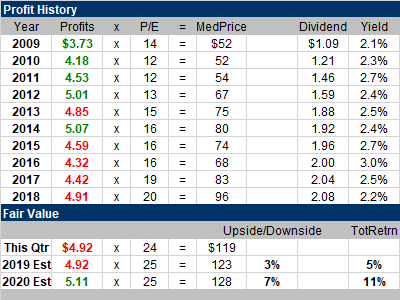

Fair Value |

Notice this stock’s P/E has jumped from 16 to 24 the past few years. Meanwhile profits haven’t been good. Notice this stock’s P/E has jumped from 16 to 24 the past few years. Meanwhile profits haven’t been good.

My Fair Value P/E is 25. I think 30 would be too much for a 6-8% grower. This stock has limited upside, in my opinion. But I must say I think my assumptions are too conservative. My guess is WMT will do better than I think. |

Bottom Line |

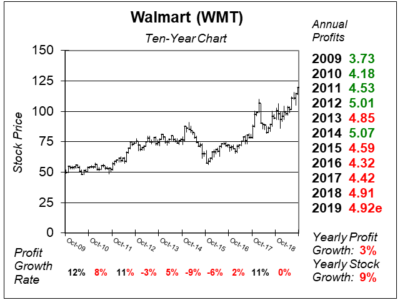

Walmart (WMT) was one of the best stocks in history, then the stock went through a no-growth period, and has now firmly entrenched itself in another move higher. Walmart (WMT) was one of the best stocks in history, then the stock went through a no-growth period, and has now firmly entrenched itself in another move higher.

But in the end, profit growth was just 3% a year during the last decade. That’s not much. A lot of the stock’s growth was because the P/E went from 14 to 24 from 2009 to 2019. And with single-digit growth looking like a possibility in the short-run, I just don’t feel this is a good investment at this price. WMT is on the radar for the Conservative Growth Portfolio. I’d like to buy it if it comes down some. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |