About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

Walgreens Boots Alliance, Inc. (Walgreens Boots Alliance) is a holding company. The Company is a global pharmacy-led, health and wellbeing enterprise. Walgreens Boots Alliance operates through three divisions, including Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The Company’s products are marketed under a number of brands, which include No7, the Botanics range, Almus (generic medicines), Boots Pharmaceuticals and Soap & Glory (bathing and beauty brand). In addition, the Company has investments in Guangzhou Pharmaceuticals Corporation and Nanjing Pharmaceutical Company Limited. The Company operates in around 25 countries, which include the wholesale and distribution network with over 340 distribution centers and more than 180,000 pharmacies, health centers and hospitals in 19 countries. Source: Thomson Financial

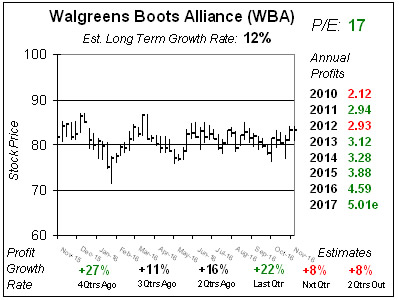

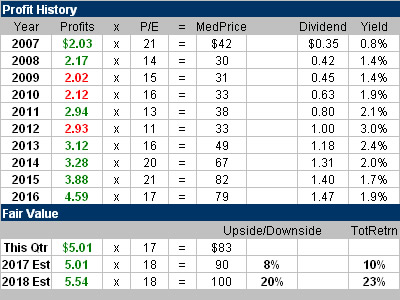

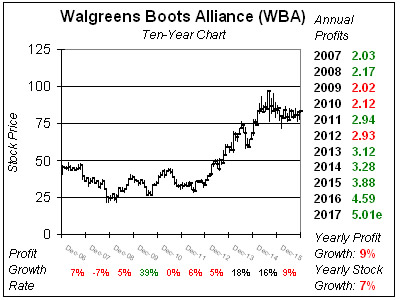

Walgreens Boots Alliance, Inc. (Walgreens Boots Alliance) is a holding company. The Company is a global pharmacy-led, health and wellbeing enterprise. Walgreens Boots Alliance operates through three divisions, including Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The Company’s products are marketed under a number of brands, which include No7, the Botanics range, Almus (generic medicines), Boots Pharmaceuticals and Soap & Glory (bathing and beauty brand). In addition, the Company has investments in Guangzhou Pharmaceuticals Corporation and Nanjing Pharmaceutical Company Limited. The Company operates in around 25 countries, which include the wholesale and distribution network with over 340 distribution centers and more than 180,000 pharmacies, health centers and hospitals in 19 countries. Source: Thomson Financial Walgreens Boots Alliance (WBA) is all ready to break out to new highs, but might not have the power to with profit growth expected to slow. WBA just closed its 2015 fiscal year with 16% profit growth (fueled by Boots Alliance) but is expected to have 8% profit growth this fiscal year. On December 31, 2014 Walgreen’s merged with Alliance Boots, which is made up Boots UK, the UK’s leading pharmacy-led health and beauty retailer, and Alliance Healthcare, the largest pharmaceutical wholesaler in the UK. The influx of new management has transformed Walgreen’s to a leaner, more efficient machine with improved merchandising. WBA has beaten the street the last 4 qtrs and will have to continue to do so to keep the momentum going. Profits are expected to grow 8% in each of the next 2 qtrs, and with a P/E of 17 I think WBA needs to come in with teens profit growth for the stock to break out and move higher. Still, at $83 the stock is at the top of its trading range and could break out anytime. Walgreen’s did negotiate a deal to take 40 million prescriptions from competitor CVS Caremark, but there’s a question to whether this business will be high margin or low margin. The company is also trying to buy Rite Aid, which would help make the company bigger but hurt stock buybacks, so it doesn’t matter to me either way. This is a safe stock with a 2% yield and its dividend has increased every year since 1976. But the Est LTG of 12% a year might be too optimistic. Overall this is a solid selection for conservative accounts, but I may sell it from growth accounts in the near future.

Walgreens Boots Alliance (WBA) is all ready to break out to new highs, but might not have the power to with profit growth expected to slow. WBA just closed its 2015 fiscal year with 16% profit growth (fueled by Boots Alliance) but is expected to have 8% profit growth this fiscal year. On December 31, 2014 Walgreen’s merged with Alliance Boots, which is made up Boots UK, the UK’s leading pharmacy-led health and beauty retailer, and Alliance Healthcare, the largest pharmaceutical wholesaler in the UK. The influx of new management has transformed Walgreen’s to a leaner, more efficient machine with improved merchandising. WBA has beaten the street the last 4 qtrs and will have to continue to do so to keep the momentum going. Profits are expected to grow 8% in each of the next 2 qtrs, and with a P/E of 17 I think WBA needs to come in with teens profit growth for the stock to break out and move higher. Still, at $83 the stock is at the top of its trading range and could break out anytime. Walgreen’s did negotiate a deal to take 40 million prescriptions from competitor CVS Caremark, but there’s a question to whether this business will be high margin or low margin. The company is also trying to buy Rite Aid, which would help make the company bigger but hurt stock buybacks, so it doesn’t matter to me either way. This is a safe stock with a 2% yield and its dividend has increased every year since 1976. But the Est LTG of 12% a year might be too optimistic. Overall this is a solid selection for conservative accounts, but I may sell it from growth accounts in the near future.