The stock market closed lower today, with S&P 500 and NASDAQ fell 1.2% and 1.9%, respectively. Currently, S&P 500 was at 3,921 level, while NASDAQ at 11,563. The decline in the stock market was said to be attributable to weak retail outlook and lower consumer confidence.

The stock market closed lower today, with S&P 500 and NASDAQ fell 1.2% and 1.9%, respectively. Currently, S&P 500 was at 3,921 level, while NASDAQ at 11,563. The decline in the stock market was said to be attributable to weak retail outlook and lower consumer confidence.

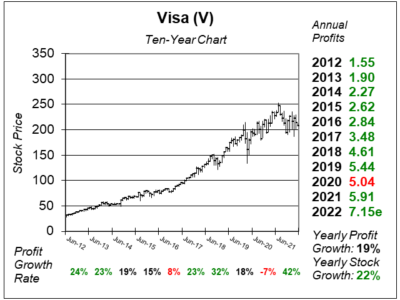

In other news, Visa’s (V) profits are growing this year, even though we are in a recession.

Visa is a compounder. It’s easy to get caught up in the Bear Market hype that you have to sell your stocks in times like this. But I think it’s best to hold quality stocks like this, and sell the shitcos. – David Sharek, Founder of The School of Hard Stocks

Tweet of the Day

https://twitter.com/BrianFeroldi/status/1551925726332452872

Chart of the Day

V bears the street after hours tonight. This chart was done prior to the announcement on May 2, 2022.

V is the world’s leader in digital payments, with more than 15,400 financial institutional clients as of 2020. The company was founded more than 60 years ago with the idea to make payments between consumers and businesses, also known as C2B. Today, V is working on expanding the ways that money can flow digitally, via person-to-person payments (P2P), business-to-consumer transactions (B2C), and business-to-business (B2) transactions.

This qtr, the stock has a P/E of 35. That’s close to the median P/E the stock had pre-pandemic. But we have to acknowledge transactions are still below where they should be. V once had a $8.32 profit estimate for 2022. I think that figure should be used as a barometer for what profits would be, had it not been for COVID. I think this stock should have a 30 P/E on that $8.32 estimate, which is a Fair Value of $250. If we divide $250 by the current 2022 profit estimate of $7.15 it works out to a 35 P/E for the Fair Value.

V is part of the Conservative Growth Portfolio.