Stock (Symbol) |

The Trade Desk (TTD) |

Stock Price |

$75 |

Sector |

| Technology |

Data is as of |

| December 20, 2023 |

Expected to Report |

| February 13 |

Company Description |

The Trade Desk through its self-service, cloud-based platform, and ad buyers can create, manage, and optimize data-driven digital advertising campaigns across ad formats and channels, including display, video, audio, in-app, native and social, on a multitude of devices, such as computers, mobile devices, and connected television (CTV). The Trade Desk through its self-service, cloud-based platform, and ad buyers can create, manage, and optimize data-driven digital advertising campaigns across ad formats and channels, including display, video, audio, in-app, native and social, on a multitude of devices, such as computers, mobile devices, and connected television (CTV).

It offers a self-service omnichannel software platform that enables its clients to purchase and manage data driven digital advertising campaigns. The Company’s platform allows clients to manage integrated advertising campaigns across various advertising channels and formats. Its platform’s integrations with inventory, data partners, and publisher provides ad buyers reach and decisioning capabilities, and its enterprise application programming interfaces (APIs) enable its clients to develop on top of the platform. It offers solutions to advertising agencies and other service providers for advertisers. Source: Refinitiv |

Sharek’s Take |

The Trade Desk’s (TTD) continues to reap rewards from the shift of viewers from cable TV to streaming services, or Connected TVs. The COVID-19 pandemic accelerated the shift to CTV, with more people now watching streaming services than traditional TV. And content companies spearheaded the move, with Disney, Paramount, Peacock and Netflix introducing ad supported channels with programmatic advertising. The Trade Desk is growing at twice the rate of the digital ad space, and 4x the US advertising industry. The US ad industry is growing 5% in 2023, with digital ads growing 10%. TTD is growing revenue faster than 20%. The Trade Desk’s (TTD) continues to reap rewards from the shift of viewers from cable TV to streaming services, or Connected TVs. The COVID-19 pandemic accelerated the shift to CTV, with more people now watching streaming services than traditional TV. And content companies spearheaded the move, with Disney, Paramount, Peacock and Netflix introducing ad supported channels with programmatic advertising. The Trade Desk is growing at twice the rate of the digital ad space, and 4x the US advertising industry. The US ad industry is growing 5% in 2023, with digital ads growing 10%. TTD is growing revenue faster than 20%.

The Trade Desk is a cloud-based software platform which allows advertising executives to manage digital ad campaigns across different spectrums, such as TV or the Internet, utilizing real-time data. The company specializes in programmatic advertising, which uses computer programs to purchase ads geared to people who might be interested in buying a product. Programmatic ads are growing 20% per year, which is 5x the rate of total ad growth (Source: Magna Global). What makes TTD unique is that it pushes ads without a conflict of interest. The company does not own media itself, nor does it keep names, phone numbers, social security numbers or email addresses. TTD has partnerships with Roku, TikTok, Google, Alibaba, DIRECTV, AT&T, and Spotify. The company has a couple catalysts going for it:

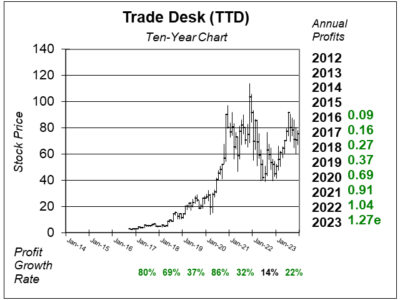

Ad spend on the The Trade Desk platform has grown consistently over time. Ad spend has grown from $2.4 billion in 2018 to $3.1 billion in 2019, $4.2 billion in 2020, $6.2 billion in 2021, and $7.8 billion in 2022. TTD gets 20% of ad spend that goes through its network. TTD stock has a robust Estimated Long-Term Growth Rate of 24% a year. TTD is a core holding in the Growth Portfolio. I think this company has a bright future as targeted ads become more popular in video. |

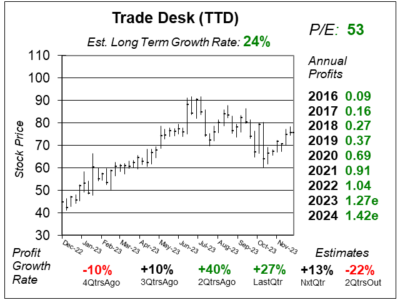

One Year Chart |

TTD has climbed nicely this year. Right now the stock is channeling lower. But if you hold a ruler up to the recent highs, it seems the stock might break out of this range if if goes past $80. TTD has climbed nicely this year. Right now the stock is channeling lower. But if you hold a ruler up to the recent highs, it seems the stock might break out of this range if if goes past $80.

I used 2024 profit estimates to calculate the P/E in this chart. The P/E is 53, which is lower than the 62 I have for the stock’s Fair Value. ThE P/E was 67 last quarter. The Est. LTG of 24% is unchanged since last quarter, but I believe this figure could be around 30% to 35%. Quarterly profit growth is often erratic with this stock. Also, TTD is known to beat the street (sometimes by a big margin) so I wouldn’t read much into these less-than-robust quarterly estimates. |

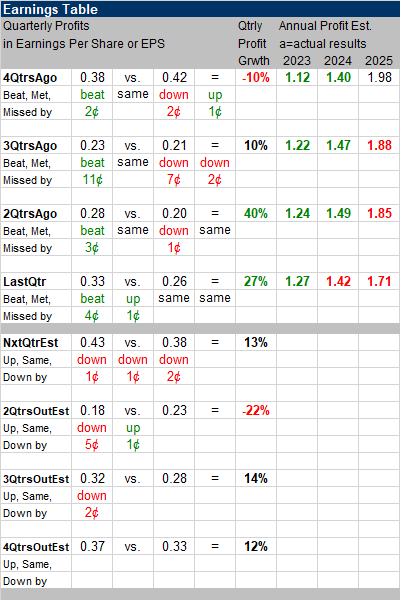

Earnings Table |

Last qtr, The Trade Desk generated 27% profit growth and beat expectations of 12% growth. Revenue increased 25%, year-over-year and beat estimates of 23%. Revenue grew 23% 2QtrsAgo, so growth is accelerating and that’s a good thing. Video represented mid-40% of spend; mobile was mid-30%; display had a low double-digit percentage; and audio around 5%. Customer retention remained over 95%. Last qtr, The Trade Desk generated 27% profit growth and beat expectations of 12% growth. Revenue increased 25%, year-over-year and beat estimates of 23%. Revenue grew 23% 2QtrsAgo, so growth is accelerating and that’s a good thing. Video represented mid-40% of spend; mobile was mid-30%; display had a low double-digit percentage; and audio around 5%. Customer retention remained over 95%.

Here are the ads spend results by geography:

CTV lead TTD’s growth by a wide margin. CTV is growing rapidly in Europe and across Asia, with a focus on maximizing the potential of CTV, identity, and retail media. Annual Profit Estimates are mixed this quarter. Qtrly Profit Estimates are for 13%, -22%, 14%, and 12% growth the next four qtrs. For next qtr, management expects sales of at least $580 million, which represents 18% growth, slightly below analysts’ expectations of 19%. |

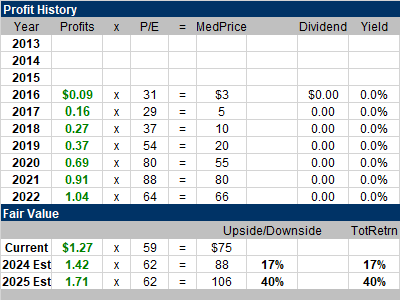

Fair Value |

My Fair Value P/E is 62, which equates to $88 for 224, around 17% higher than the recent quote. My Fair Value P/E is 62, which equates to $88 for 224, around 17% higher than the recent quote. |

Bottom Line |

I originally purchased Trade Desk (TTD) for the Growth Portfolio at $5 on May 15, 2017 when the stock was soaring after the company beat the street. It’s been a ten-bagger for clients. But notice the stock hasn’t been a good investment the past two-plus years. That’s because the stock went on a parabolic run in 2020 and is still digesting those gains. I originally purchased Trade Desk (TTD) for the Growth Portfolio at $5 on May 15, 2017 when the stock was soaring after the company beat the street. It’s been a ten-bagger for clients. But notice the stock hasn’t been a good investment the past two-plus years. That’s because the stock went on a parabolic run in 2020 and is still digesting those gains.

The Trade Desk delivered results last quarter that I’m accustomed to. And the stock has decent upside going into 2024. What would get me more excited about TTD is a pick up in overall advertising spend. TTD moves up from 28th to 22nd in the Growth Portfolio Power Rankings. TTD is also on the radar for the Aggressive Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

22 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |