Stock (Symbol) |

Trade Desk (TTD) |

Stock Price |

$462 |

Sector |

| Technology |

Data is as of |

| July 10, 2020 |

Expected to Report |

| August 6 |

Company Description |

The Trade Desk, Inc. is a technology company. The Company provides a self-service platform that enables clients to purchase and manage digital advertising campaigns across various advertising formats, including display, video and social, and on a range of devices, including computers, mobile devices, and connected television. Source: Thomson Financial The Trade Desk, Inc. is a technology company. The Company provides a self-service platform that enables clients to purchase and manage digital advertising campaigns across various advertising formats, including display, video and social, and on a range of devices, including computers, mobile devices, and connected television. Source: Thomson Financial |

Sharek’s Take |

The Trade Desk (TTD) is set to hit a tipping point for digital advertising in 2021. The Trade Desk is a cloud-based software platform which allows advertising executives to manage digital ad campaigns across different spectrums — such as TV or the Internet — utilizing real-time data. The company specializes in programmatic advertising, which uses computer programs to purchase ads geared to people who might be interested in buying a product. Data such as age, gender, or what sites you’ve visited in the past can be used to predict your personality, and personality drives buying behavior. What makes The Trade Desk unique is that it pushes ads without a conflict of interest. The company doesn’t own media itself, nor does it keep names, phone numbers, social security numbers or email addresses. The Trade Desk (TTD) is set to hit a tipping point for digital advertising in 2021. The Trade Desk is a cloud-based software platform which allows advertising executives to manage digital ad campaigns across different spectrums — such as TV or the Internet — utilizing real-time data. The company specializes in programmatic advertising, which uses computer programs to purchase ads geared to people who might be interested in buying a product. Data such as age, gender, or what sites you’ve visited in the past can be used to predict your personality, and personality drives buying behavior. What makes The Trade Desk unique is that it pushes ads without a conflict of interest. The company doesn’t own media itself, nor does it keep names, phone numbers, social security numbers or email addresses.

Connected TV (think Roku) was the most strategically important focus in Trade Desk’s business going into 2020. Connected TV had a 137% increase in ad spend on Trade Desk’s platform in 2019, and now with peoplestuck-at-home, TTD management says on-demand TV content has skyrocketed. The Trade Desk has partnerships with Roku, Google, Alibaba, DIRECTV, AT&T, and Spotify. Connected TV inventory is coming from networks such as ABC, CBS, NBC, Fox, Discovery, ESPN, TBS, TNT, Hulu and A&E. In the earnings call, TTD management said impressions were up 30% in just three weeks at NBC Peacock. Free channels (apps) on Amazon Fire have Trade Desk Ads. The company conforms to Chinese law and launched operations there in March 2019. In Asia, trade partners include Baidu, Alibaba and Tencent. You can also get Connected TV ads for the Superbowl, NFL Playoffs, the World Cup, the NBA playoffs and the World Series. Here are some additional facts and stats:

The Trade Desk is one of the fastest growing and most profitable software companies in the world and this stock has growth opportunity comparable to what Google had years ago. Programmatic ads are growing 20% per year, which is 5x the rate of total ad growth (source: Magna Global) and I think this company will hit its tipping point in 2021 when Connected TV is expected to flourish. Therefore, this move in the stock from $150 to $450 since March wasn’t a surprise. This company is perfectly positioned for the move to digital advertising and investors know it. The Trade Desk gets 20% of ad spend that goes through its network. That’s big money. The Trade Desk is one of the best growth stocks around and it’s a top holding in my Growth Portfolio and Aggressive Growth Portfolio. |

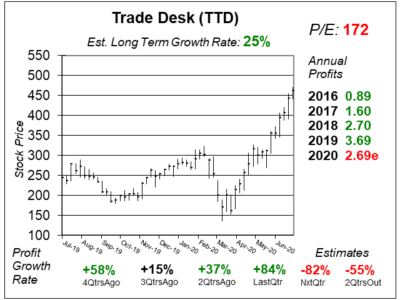

One Year Chart |

Profit growth was exceptional last qtr, but like many companies, TTD is expected to have negative profit growth in the foreseeable future. Investors have shrugged this off. This is the future of advertising. Profit growth was exceptional last qtr, but like many companies, TTD is expected to have negative profit growth in the foreseeable future. Investors have shrugged this off. This is the future of advertising.

The P/E of 172 is high because the stock has run-up a lot and 2020 profit estimates just declined from $3.47 to $2.69. The Est. LTG of 25% a year is very good and but that’s down from 31% last qtr. I continue to believe this Est. LTG is way too low. This stock seems to be a 35% to 50% profit-grower long-term. |

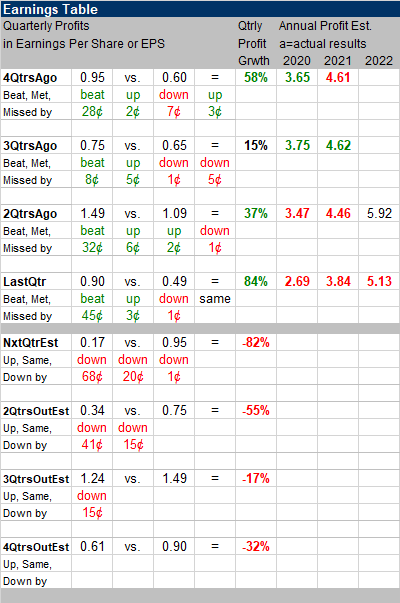

Earnings Table |

Last qtr TTD delivered 84% profit growth, which whipped estimates of -8%. The company was expected to earn a profit of 45 cents and beat the street by 45 cents. Amazing. Revenue rose 33% last qtr, which was January-March. Mobile ad-spend increased 38% and Mobile Video ad spend increased 74%. Last qtr TTD delivered 84% profit growth, which whipped estimates of -8%. The company was expected to earn a profit of 45 cents and beat the street by 45 cents. Amazing. Revenue rose 33% last qtr, which was January-March. Mobile ad-spend increased 38% and Mobile Video ad spend increased 74%.

Annual Profit Estimates got reduced. Investors didn’t seem to mind. The Trade Desk is taking market share. Here’s annual profit estimates going forward: 2020 $2.69 That would be tremendous profit growth. Qtrly profit Estimates are -82%, -55%, -17% and -32%. Are these numbers too low? I think so. Management says there’s significant uncertainty in this macro environment. They cut back 2020 hiring by more than 50% and pulled back on marketing for this qtr by greater than 50%. At first look, it seems like we might have to sit through a period of negative profit growth. But TTD has beaten the street every qtr since the company went public. |

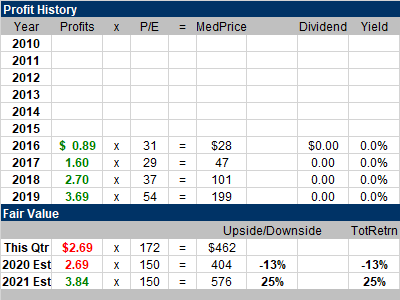

Fair Value |

When calculating a Fair Value today, we have to think about the future. 2024’s profit estimate is $11.06 and if the stock actually earns that and say a 75 P/E hypothetically, the stock would be selling for $11.06 x 75 = $830 in 2024. That’s just a hypothetical. But we have to be honest here and say if it does go there, it was predicable. When calculating a Fair Value today, we have to think about the future. 2024’s profit estimate is $11.06 and if the stock actually earns that and say a 75 P/E hypothetically, the stock would be selling for $11.06 x 75 = $830 in 2024. That’s just a hypothetical. But we have to be honest here and say if it does go there, it was predicable.

Thus, when we come back to today, I have to up my Fair Value P/E from 100 to 150. Companies that grow profits this fast are deserving of high multiples (P/E ratios). Investors often miss out on hot stocks because they thought the stock was too high. These people aren’t clairvoyant. TTDs profits are expected to go from $2.69 to $11.06 in four years. Stock growth often mirrors profit growth over the long-term. This move from $150 to $450 wasn’t a surprise, it was predictable. Last qtr, I had a 2021 Fair Value of $446. Now, around $462, the stock seems to be a little overvalued here. I imagine it will come down some and digest its gains. TTD still has upside to 2021’s Fair Value of $576. |

Bottom Line |

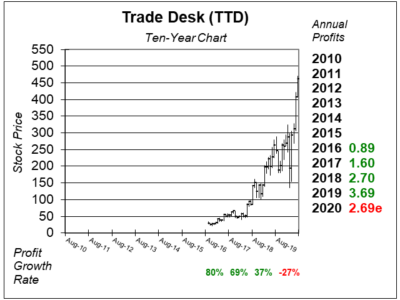

I originally purchased Trade Desk (TTD) for the Growth Portfolio at $53 on May 15, 2017 when the stock was soaring after the company beat the street. You can clearly see the break out in this ten-year chart. I originally purchased Trade Desk (TTD) for the Growth Portfolio at $53 on May 15, 2017 when the stock was soaring after the company beat the street. You can clearly see the break out in this ten-year chart.

The Trade Desk is in-the-zone when it comes to industry growth. Management expects it will reach well over 80 million households in the U.S., while its research suggests cable households could dip below 80 million. The Trade Desk is the largest aggregator of CTV ad impressions across every major content provider (source: TTD last qtr earnings call). TTD ranks 2nd in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. Last qtr I said “I continue to believe The Trade Desk has the most potential of any stock I cover.” Now with the stock above its Fair Value, I think it’ll take a rest. |

Power Rankings |

Growth Stock Portfolio

2 of 45Aggressive Growth Portfolio 2 of 20Conservative Stock Portfolio N/A |