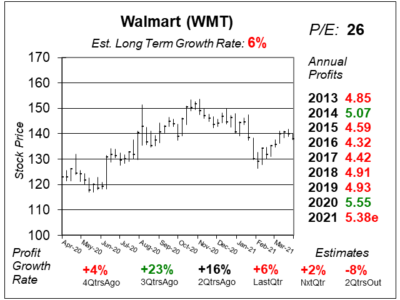

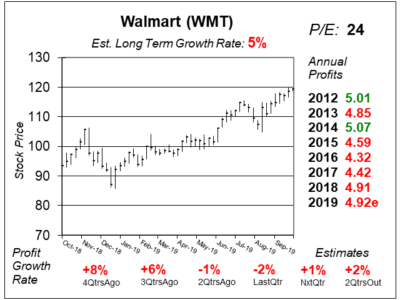

Trump Tariffs Could Cause Profit Growth to Decelerate at Walmart (WMT)

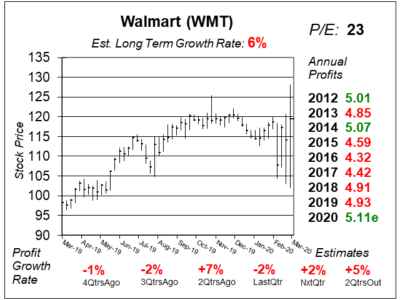

Trump tariffs might take a bit out of Walmart’s (WMT) profits. Can the stock continue higher? Let’s take a closer look at WMT’s fair value.

Trump tariffs might take a bit out of Walmart’s (WMT) profits. Can the stock continue higher? Let’s take a closer look at WMT’s fair value.

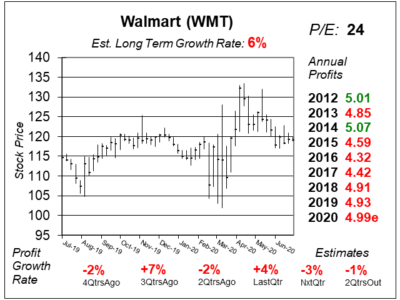

Walmart (WMT) just lowered profit estimates as it will spend on distribution centers. Investors sold on the news, I will too.

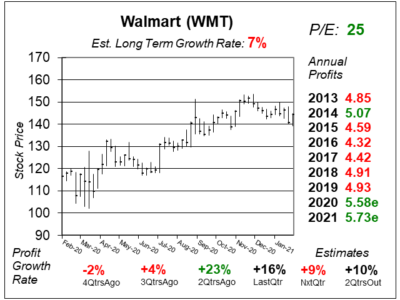

Walmart (WMT) has a catalyst in ecommerce, which had U.S. sales growth of 79% last qtr. And Walmart+ is another catalyst.

Walmart (WMT) might have two catalysts on its hands with Walmart+ unlimited grocery delivery and TikTok.

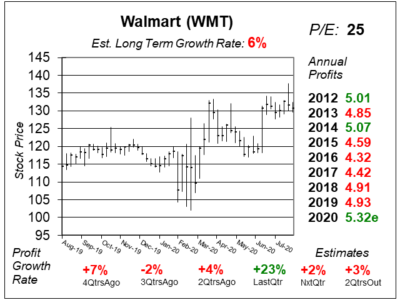

Walmart (WMT) stock is getting a lot of headlines during this Corona-crisis. But the stock is the same price it was last qtr.

Walmart (WMT) has been a strong stock during this Bear Market, but I continue to think the stock has low risk/reward.

Walmart’s (WMT) eCommerce sales jumped 41%, and grocery sales are strong, but profit growth of 7% doesn’t impress.

Walmart’s (WMT) been a hot stock since May, and is now hitting All-Time highs. But the numbers suck, take a look.

Walmart (WMT) is expected to report qtrly profits (EPS) and revenues:

Walmart (WMT) reports qtrly profits (EPS) and revenues:

Walmart (WMT) reports qtrly profits (EPS):

Walmart (WMT) reports qtrly profits (EPS):