Upstart (UPST) Tanks After Taking Loans on its Ballance Sheet

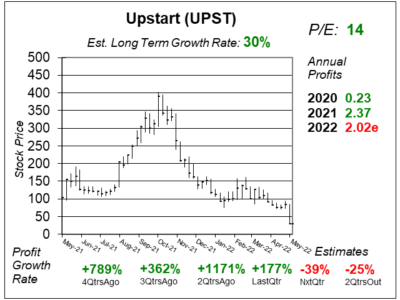

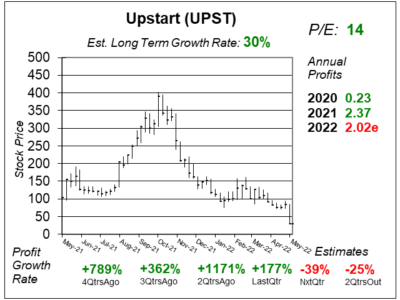

Upstart (UPST) took a lot of loans on to its ballance sheet last qtr, instead of passsing them onto banks. That’s too much risk.

Upstart (UPST) took a lot of loans on to its ballance sheet last qtr, instead of passsing them onto banks. That’s too much risk.

Upstart (UPST) has been doing well with personal loans, and now the company has a new catalyst in automobile loans.

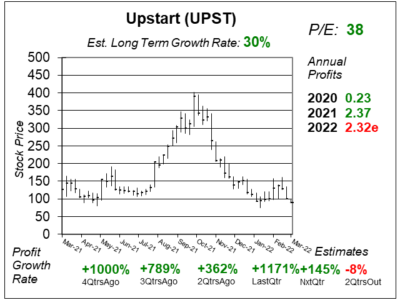

Upstart (UPST) is generating loan approvals with AI instead of FICO scores. Revenue/profits are soaring, but what about credit risk?

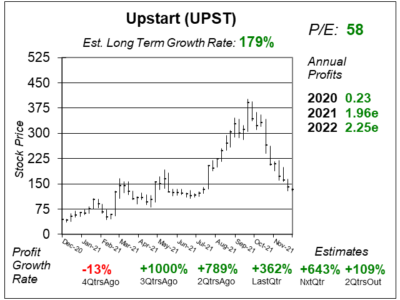

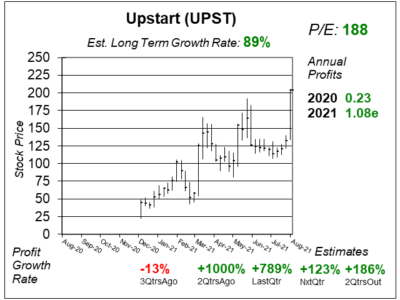

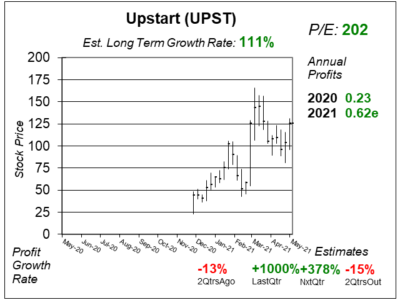

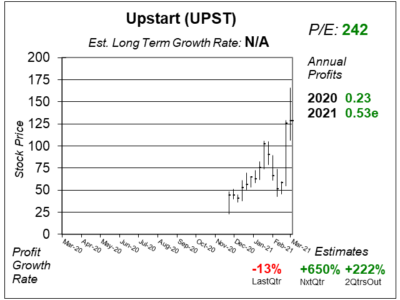

Upstart (UPST) stock soared from $135 to $205 this week. And for good reason. Revenue is soaring and estimates are climbing.

Upstart (UPST) is proving itself as a stock market leader — if you’re still OK with speculative stocks in this market.

Upstart (UPST) has a loan platform that uses Artificial Intelligence to make loan decisions, then sell the loan as well.