Stock (Symbol) |

Upstart (UPST) |

Stock Price |

$128 |

Sector |

| Financial |

Data is as of |

| March 25, 2021 |

Expected to Report |

| June 17 |

Company Description |

Upstart Holdings, Inc. is a cloud-based artificial intelligence (AI) lending platform. The Company’s platform aggregates consumer demand for loans and connects it to its network of Upstart AI-enabled bank partners. The Company’s AI models are provided to bank partners within a consumer-facing cloud application that streamlines the end-to-end process of originating and servicing a loan. It has built a configurable, multi-tenant cloud application designed to integrate seamlessly into a bank’s existing technology systems. Its configurable platform allows each bank to define its own credit policy and determine the parameters of its lending program. The AI models use and analyze data from all of its bank partners. Consumers can discover Upstart-powered loans in one of two ways: either via Upstart.com or through a white-labeled product on its bank partners’ Websites. Source: Thomson Financial Upstart Holdings, Inc. is a cloud-based artificial intelligence (AI) lending platform. The Company’s platform aggregates consumer demand for loans and connects it to its network of Upstart AI-enabled bank partners. The Company’s AI models are provided to bank partners within a consumer-facing cloud application that streamlines the end-to-end process of originating and servicing a loan. It has built a configurable, multi-tenant cloud application designed to integrate seamlessly into a bank’s existing technology systems. Its configurable platform allows each bank to define its own credit policy and determine the parameters of its lending program. The AI models use and analyze data from all of its bank partners. Consumers can discover Upstart-powered loans in one of two ways: either via Upstart.com or through a white-labeled product on its bank partners’ Websites. Source: Thomson Financial |

Sharek’s Take |

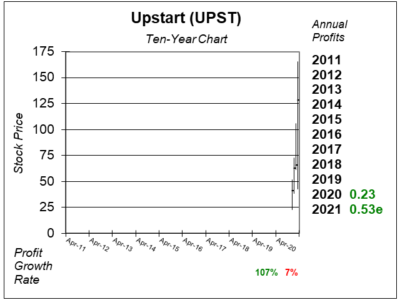

Upstart (UPST) is currently one of the hottest stocks in the land. But this recent IPO fits-the-mold of a high flying growth stock, and those are risky at this time as momentum is shifting away from growth stocks and into value stocks. Upstart (UPST) is currently one of the hottest stocks in the land. But this recent IPO fits-the-mold of a high flying growth stock, and those are risky at this time as momentum is shifting away from growth stocks and into value stocks.

Upstart began as a lender, then decided to sell its technology to banks and credit unions to reduce risk by using AI to determine a borrower’s creditworthiness when doing personal loans. The company offers a cloud based software package that allows banks to process and (perhaps) approve loans, then keep them or sell them. And last week management announced its acquiring Prodigy Software, a cloud-based automotive retail software developer. This makes for an easy expansion into auto loans, which the company began originating in September 2020. Upstart claims it saves borrowers $72 per month. Here’s the process (via 2020 Upstart Annual Report):

Upstart whooped earnings estimates and revenue estimates last qtr, then called for a HUGE increase in 2020 revenue estimates. This company is red-hot. One negative is the AI software being utilized might not be as respected by industry experts. UPST will be added to the Aggressive Growth Portfolio. |

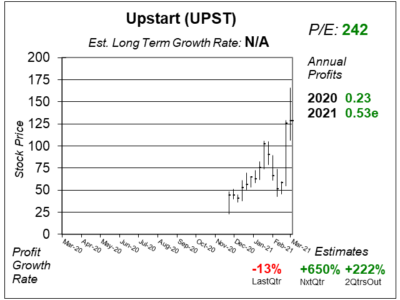

One Year Chart |

UPST surged from $59 to $125 last week as the company reported profits. The big news was the company upped 2021 revenue estimates from $360 million to $500 million. UPST surged from $59 to $125 last week as the company reported profits. The big news was the company upped 2021 revenue estimates from $360 million to $500 million.

This company just went public last year, and used a traditional IPO instead of a Special Purpose Acquisition Company (SPAC). That’s good as The P/E of 183 is high, but the P/E was 200 last qtr. The P/E is high because profits are expected to jump in the upcoming years. |

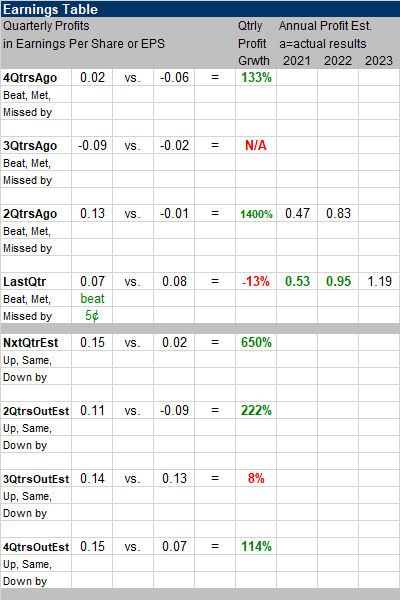

Earnings Table |

Last qtr was UPST’s first qtr reporting as a public company and it bear estimates of $0.02 by delivering a profit of $0.07. Note the table shows the company made $0.08 a year-ago, but that has to be taken wit ha grain of salt because the company wasn’t public then. Last qtr was UPST’s first qtr reporting as a public company and it bear estimates of $0.02 by delivering a profit of $0.07. Note the table shows the company made $0.08 a year-ago, but that has to be taken wit ha grain of salt because the company wasn’t public then.

Annual Profit Estimates increased a bit this qtr, but the big news was revenue estimates jumped, with management saying it will sail past the $360 million estimate and deliver revenue of $500 million. To me, half-a-billion dollars sounds like a round number. That sounds bullish. I wonder if revenue will come in above that figure, and management just put out some round number that’s conservative? Qtrly profit Estimates are for 650%, 222%, 8% and 114% profit growth the next 4 qtrs. I like that this company is actually making profits, and is expected to make profits in each of the next four qtrs. |

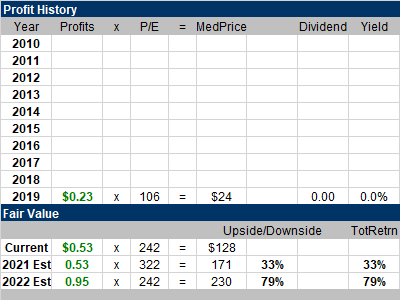

Fair Value |

UPST currently sells for 19x 2021 revenue estimates of $505 million. My Fair Value is 25x estimates, which works out to the following: UPST currently sells for 19x 2021 revenue estimates of $505 million. My Fair Value is 25x estimates, which works out to the following:

2021 Est: 2022 Est: |

Bottom Line |

|

The Prodigy acquisition will get the company firmly entrenched into the automobile loan market. That’s a big catalyst. At the same time, the housing market is strong. But there are risks. Will another company copy this software? Is my Fair Value revenue multiple of 25 too high? What should this valuation be? I’d rather Upstart not hold loan itself, and just be a software company. UPST will be added to the Aggressive Growth Portfolio and will rank 22nd in the Power Rankings. There are only 23 stocks in this portfolio, I’m being cautious with my entry by making this a small position.

|

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 22 of 23Conservative Stock Portfolio N/A |

Upstart (UPST) is one of the new “upstarts” in the stock market. The stock has been red-hot in a stock market that’s been punishing high-growth high-P/E names. I think this stock is showing some market leadership.

Upstart (UPST) is one of the new “upstarts” in the stock market. The stock has been red-hot in a stock market that’s been punishing high-growth high-P/E names. I think this stock is showing some market leadership.