Stryker (SYK) Might Now Be a Slower-Growing Medical Device Company

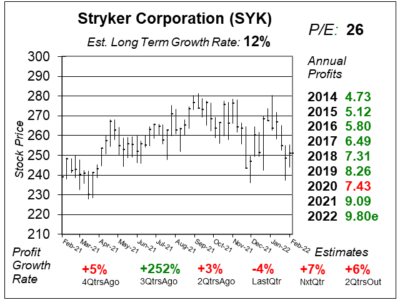

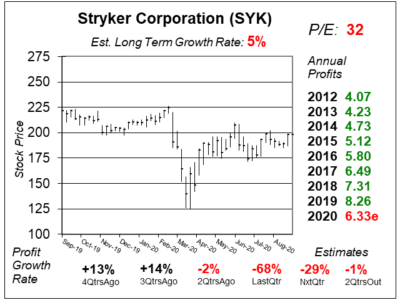

Stryker’s (SYK) gross profit margins have been in decline, as have profit estimates. Perhaps this isn’t a 10-12% grower anymore.

Stryker’s (SYK) gross profit margins have been in decline, as have profit estimates. Perhaps this isn’t a 10-12% grower anymore.

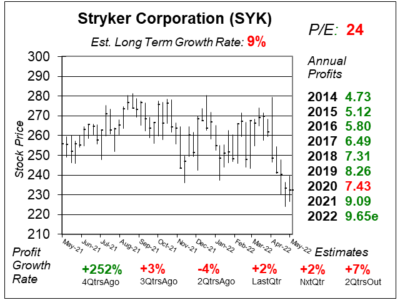

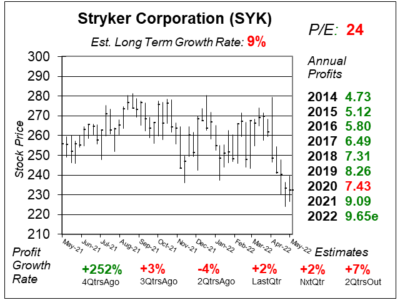

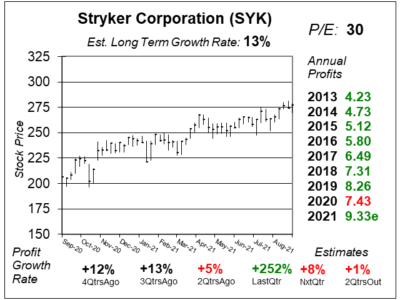

Stryker (SYK) delivered just 3% profit growth last qtr as nurse staffing shortages held back surgeries of hips, knees and spines.

Volatility from COVID and the shortage of healthcare staffing is hindering the healthcare recovery for Stryker (SYK) products.

Stryker (SYK) is seeming good momentum in its business, but it looks like things won’t be back to normal until 2022.

Shares of medical device company Stryker (SYK) seem fairly valued. We think the stock will climb 10% to 12% a year from here.

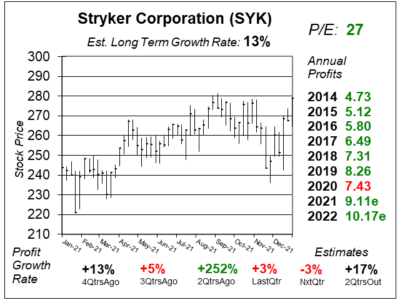

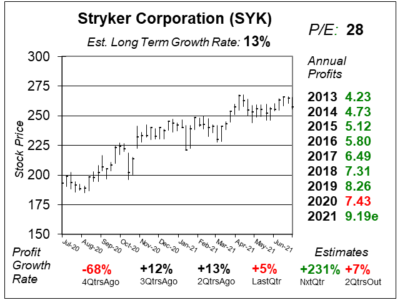

Stryker (SYK) didn’t hit a record high for profits in 2020, a rare occurrence. Now, the company is back-on-track.

Stryker (SYK) stock hit an All-Time high earlier this month as the company saw acceleration in elective surgeries.

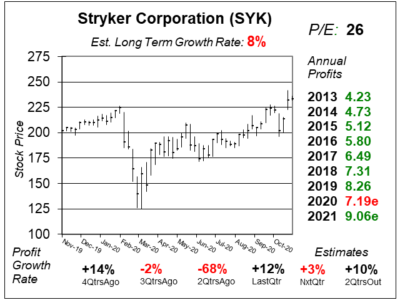

Stryker (SYK) is hurt by elective surgeries being postponed. But that should mean more business than expected in 2021.

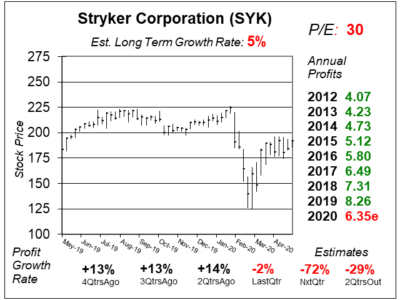

Stryker (SYK) saw dramatic declines in its businesses during March. What’s the outlook look like moving forward?

Stryker (SYK) is a leader in hospital beds, and with the Coronavirus spreading, government leaders want more beds.

International markets are expected to deliver rubust sales growth for medical device company Striker (SYK) for years to come.

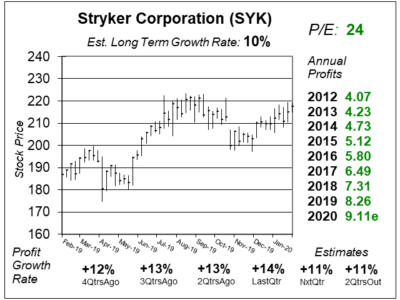

Stryker (SYK) is growing sales and profits at a nice rate. And with solid momentum, we feel SYK deserves a high multiple.

Medical device company Stryker (SYK) is a model of certainty and consistency, with profit growth in 19 of the last 20 years.

Investors got all excited about Stryker (STYK) after the company reported earnings, as profit estimates have been on the rise.

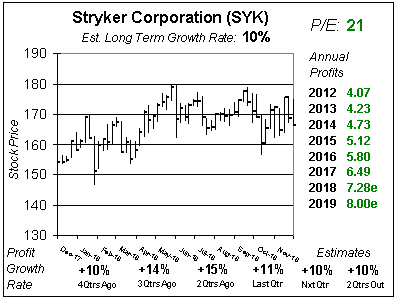

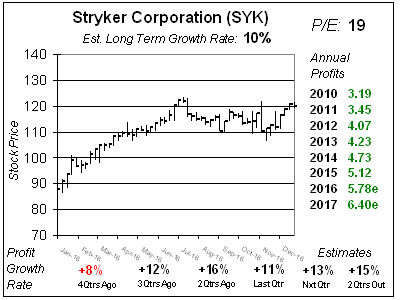

For conservative investors, a 10% return is a nice return. And 10% is showing up a lot in my latest review of Stryker (SYK).

Stryker’s (SYK) profits — and its stock — has grown 10% a year the past decade, but profits are growing faster than that now.

Last week, shares of Stryker (SYK) declined on news it was attempting to acquire Boston Scientific (BSX) — which would be a good move.

Stryker (SYK) has been on a nice run the past 5 years. But profit growth is expected to slow to 10% in 2018, and SYK will likely need acquisitions and stock buybacks to enhance results.

Shares of Stryker (SYK) are up around 30% in 2017, leaving little upside to my 2018 Fair Value. Still, continued acquisitions could lead to further gains.

Stryker (SYK), known for its replacement hips and hospital beds, is having a surge in growth due to acquisitions it made last year, which boosted sales an extra 12% last qtr.

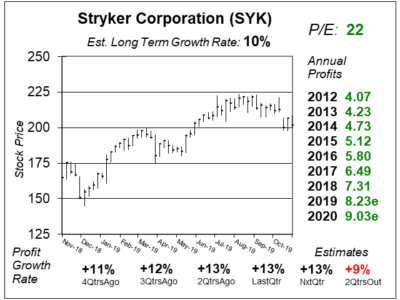

Stryker (SYK) has shot higher the past 12-months it delivered strong double-digit profit growth. Now growth is expected to be in the single-digits the next 4 qtrs.

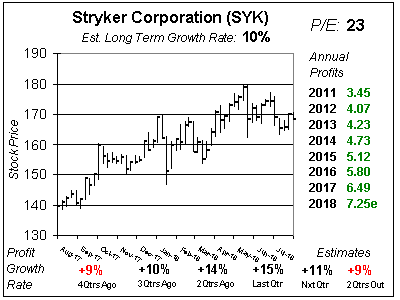

Shares of medical device company Stryker (SYK) have been hot the last year as acquisitions have plumped up profits an average of 13% the past four qtrs.

Stryker (SYK) is back to double-digit profit growth due to the help of acquisitions. Profits have grown at least 11% the last 3 qtrs, and that looks to continue.

For the past nine years Stryker (SYK) has grown profits in the double digits one year, only to have single digit growth the next. With profits set to grow 13% this year, can SYK keep growing?

Stryker’s (SYK) profit growth rate just jumped from 8% to 12% last qtr as new medical equipment helped profit margins.

Stryker (SYK) provides safety, certainty and consistency to conservative accounts, but at this juncture I feel the stock is fairly valued.

Stryker (SYK) is a solid choice for risk-averse investors needing safe growth with a dividend, but the stock is fairly valued at this time.

Stryker (SYK) isn’t the 20% grower like it used to be — not even close. So why is the stock up around 25% in the last year and sporting a 20 P/E ratio? It’s overdelivering.