Starbucks (SBUX) Misses Expectations, But the Stock Looks Like a Good Buy

Starbucks (SBUX) missed profit and revenue expectations due to China weakness and political issues. But the stock looks good..

Starbucks (SBUX) missed profit and revenue expectations due to China weakness and political issues. But the stock looks good..

There seems to be a Starbucks (SBUX) in every neighborhood. And management still sees profits growing 15% to 20% this year.

Starbucks (SBUX) customers are wanting to cool down in this hot Summer, as 75% of its US beverage sales are ice cold drinks.

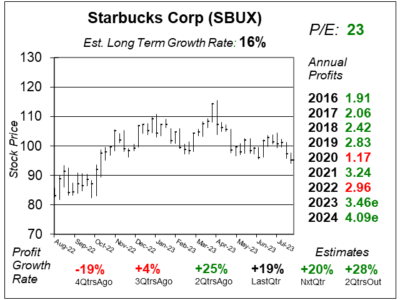

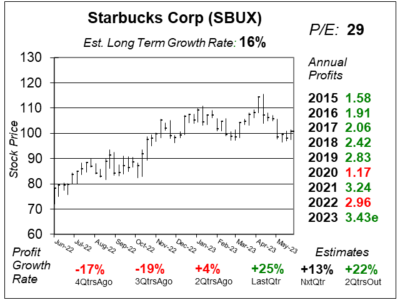

Starbucks (SBUX) is growing great again as new products such as Oleato helped North American sales climb 17% last quarter.

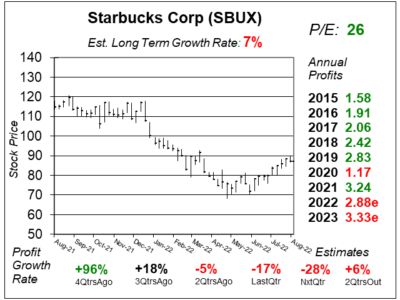

Starbucks (SBUX) has had great sales growth outside of China. A China rebound could really make sales and profits zoom higher.

Starbucks (SBUX) seems to be back on the road to high-teens annual profit growth. And a pick up in China could be the catalyst.

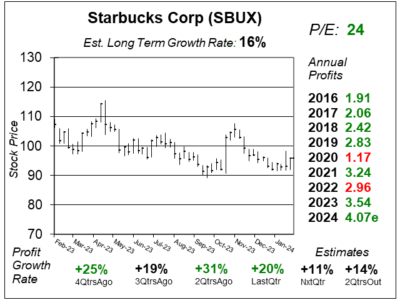

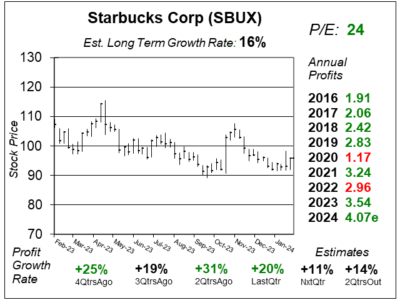

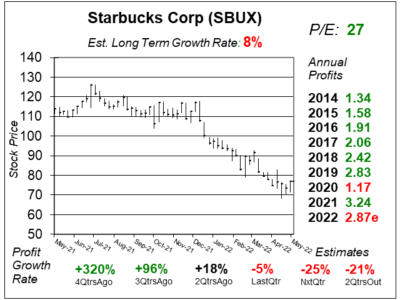

Starbucks (SBUX) delivered poor results last qtr, as China sales fell 40%. But we see 15% upside in the stock over the next year.

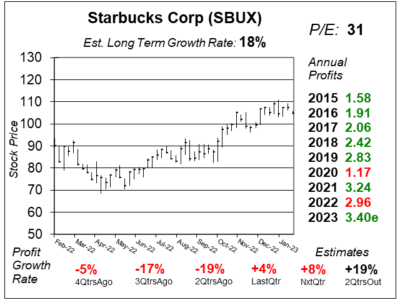

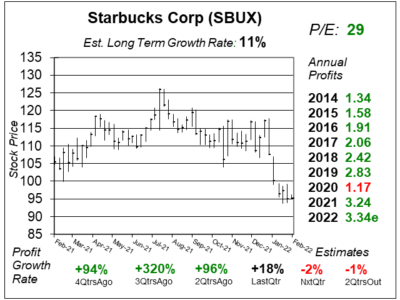

Starbucks (SBUX) grew revenue a solid 15% last qtr, but COVID-19 closures in China, higher inflation, and labor costs cut into profits.

Global consumer demand for Starbucks (SBUX) is strong, but higher costs due to COVID are putting pressure on company profits.

Comparable store sales for Starbucks (SBUX) in China were quiet; but comparable store sales in the US were strong

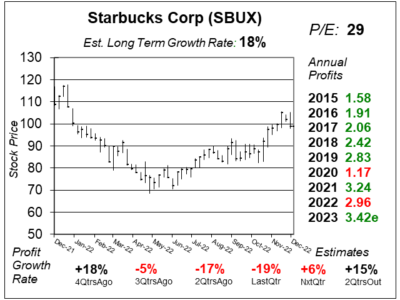

Starbucks (SBUX) is more of a digital company than it was 2 years ago, so profits could be better than we used to expect.

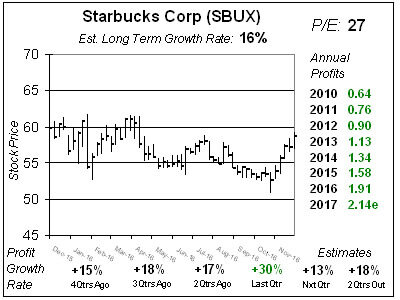

Starbucks (SBUX) used to have a P/E between 28 and 32. Now, with a P/E of 28, SBUX seems overvalued. But I don’t so.

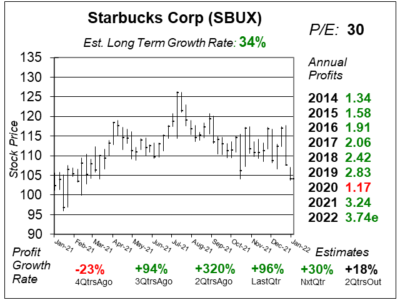

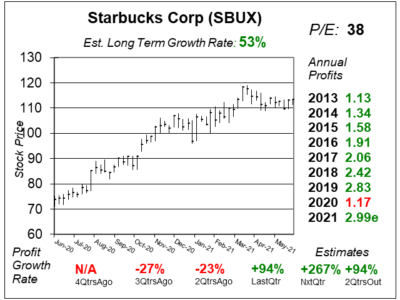

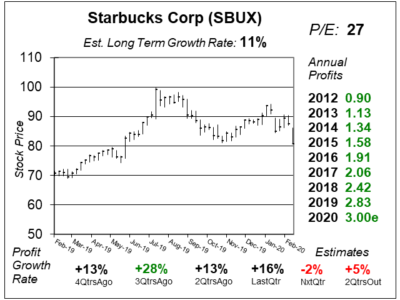

Starbucks (SBUX) had poor results the past 4 qtrs due to the pandemic. Now, profit growth is expected to return in a big way.

Starbucks (SBUX) see its stores in the United States fully recovered by next qtr. But wit ha P/E of 36, that news seems priced in.

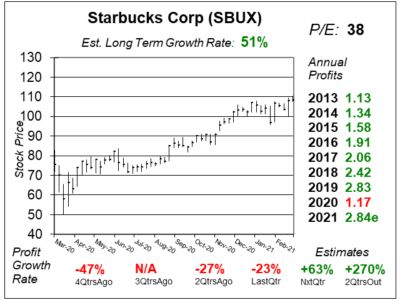

In a neverending theme of dead money, Starbucks (SBUX) stock might be this price one year from now.

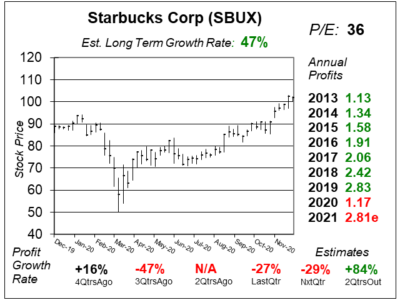

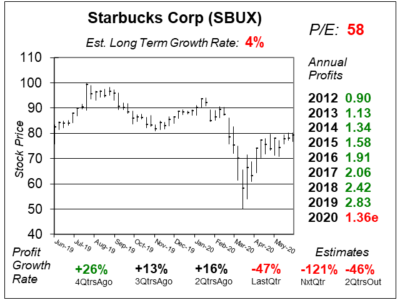

Starbucks (SBUX) lowered profit estimates due to the Coronavirus. Let’s take a look at the new (lower) numbers.

Starbucks (SBUX) had to close some China locations due to the Coronavirus. Still, the long-term opportunity remains.

Starbucks (SBUX) might go sideways for a year or two as slower profit growth means the P/E should come down a bit.

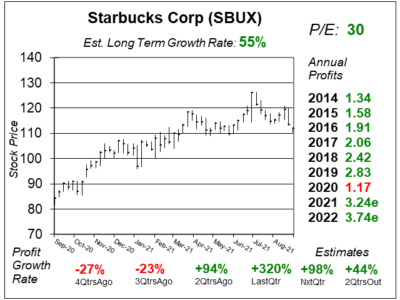

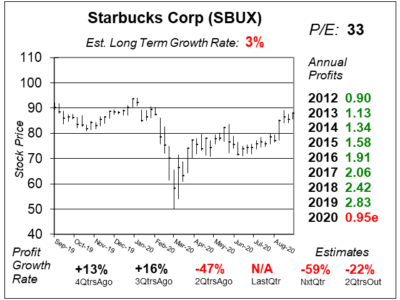

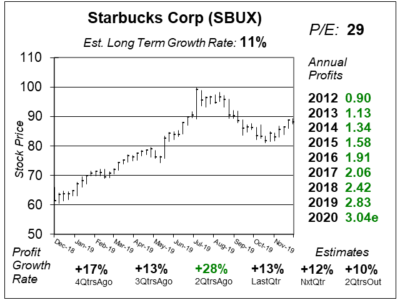

Starbucks (SBUX) said it expects <10% profit growth in 2020. Meanwhile in real life, SBUX profits just grew 28%.

Starbucks (SBUX) is growing profits at a faster rate than we had expected, and the stock is on a roll because of it.

Starbucks (SBUX) is growing rapidly in China with 18% store growth the last year. But the company has stiff competition in Luckin Coffee.

Starbuck’s (SBUX) is thriving in China, as sales jumped 41% last qtr. But don’t get your hopes up too much with SBUX stock, it’s not as fast a grower as it used to be.

Starbucks (SBUX) stock hasn’t moved in three years, but help has arrived as I’m going to explain how to get the stock moving again.

China is proving to be a catalyst for Starbuck’s (SBUX) growth, as sales in the China/Asia Pacific region rose 54% from the same qtr a year ago.

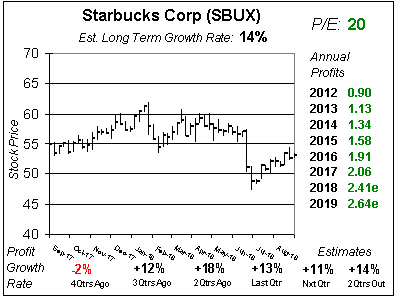

Starbucks (SBUX) has had a case of slowing profit growth. So even though profits are growing double-digits the stock is stuck in neutral as the P/E has been in a slow decline.

Even though Starbucks (SBUX) has been building a base for more than two years, the stock still isn’t undervalued by my measures and looks to continue its sideways chart pattern.

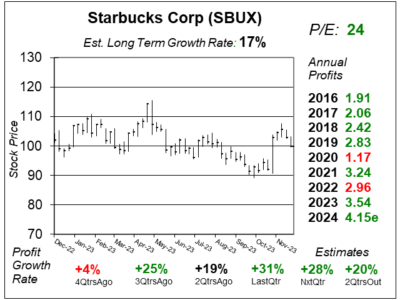

Starbucks’ (SBUX) fundamentals are deteriorating, as in estimates have been on the decline. Also, growth has slowed. But, with a P/E of 23 this stock is nicely priced.

Starbucks (SBUX) continues to grind out double-digit profit growth. Last qtr the company grew profits 15% helped by Mobile Order and Pay as well as China.

Starbucks (SBUX) hasn’t hit All-Time highs in almost a year. The stock is doing well, but other stocks are doing better. Is this a good time to take profits?

Starbucks’ (SBUX) CEO Howard Schultz is stepping aside in April, but the plans for Starbucks to conquer the world are already set in motion.

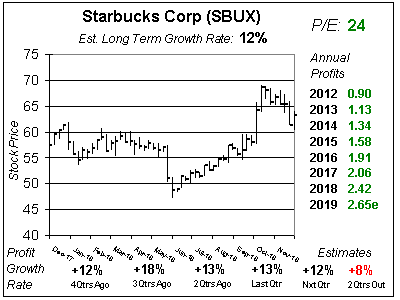

Starbucks (SBUX) is on a dip after posting light sales figures last qtr. At 24 times earnings, is the stock a good buy or will it get cheaper? Let’s dig into the numbers.

Starbucks (SBUX) sees the China market someday eclipsing the U.S., and that gives this core stock solid growth opportunity.

Starbucks’ (SBUX) Mobile Order Pay is helping drive sales — and profits — for the coffee retailer.

Starbucks (SBUX) is growing at a high-teens rate, but at 33x earnings this stock is a bit rich.

Starbucks (SBUX) is executing perfectly, but at 31x earnings after a 50% rise I think SBUX needs to take a breather.

Starbucks (SBUX) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $0.82 vs. $0.74 = +11%

Revenue Est: +6%