Stock (Symbol) |

Starbucks (SBUX) |

Stock Price |

$59 |

Sector |

| Retail & Travel |

Data is as of |

| December 10, 2016 |

Expected to Report |

| Jan 26 |

Company Description |

Starbucks Corporation is the premier roaster, marketer and retailer of specialty coffee in the world, operating in 65 countries. The Company purchases and roasts high-quality coffees, along with handcrafted coffee, tea and other beverages and fresh food items, through company-operated stores. The Company sells goods and services under the brands including Teavana, Tazo, Seattle’s Best Coffee, Evolution Fresh, La Boulange and Ethos. The Company has four operating segments: Americas, which is inclusive of the US, Canada, and Latin America; Europe, Middle East, and Africa (EMEA); China/Asia Pacific (CAP) and Channel Development. The Company sells Starbucks and Seattle’s Best Coffee roasted whole bean and ground coffees, Tazo teas, Starbucks VIA Ready Brew, and other coffee and tea related products to institutional foodservice companies that service business &industry, education, healthcare, office coffee distributors, hotels, restaurants, airlines and other retailers. Source: Thomson Financial Starbucks Corporation is the premier roaster, marketer and retailer of specialty coffee in the world, operating in 65 countries. The Company purchases and roasts high-quality coffees, along with handcrafted coffee, tea and other beverages and fresh food items, through company-operated stores. The Company sells goods and services under the brands including Teavana, Tazo, Seattle’s Best Coffee, Evolution Fresh, La Boulange and Ethos. The Company has four operating segments: Americas, which is inclusive of the US, Canada, and Latin America; Europe, Middle East, and Africa (EMEA); China/Asia Pacific (CAP) and Channel Development. The Company sells Starbucks and Seattle’s Best Coffee roasted whole bean and ground coffees, Tazo teas, Starbucks VIA Ready Brew, and other coffee and tea related products to institutional foodservice companies that service business &industry, education, healthcare, office coffee distributors, hotels, restaurants, airlines and other retailers. Source: Thomson Financial |

Sharek’s Take |

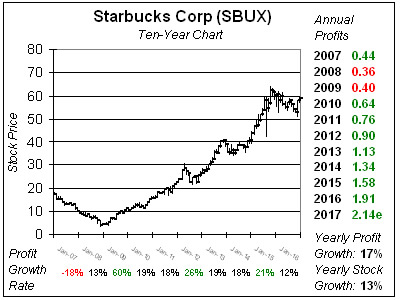

Starbucks’ (SBUX) icon CEO Howard Schultz is leaving his CEO post to focus on Starbucks Reserve Roasteries. But the plans set forth by Schultz for Starbucks to conquer the world are already set in motion. The company now has 25000 locations, with 7000 stores in the U.S. and 2000 in China. Management plans to open 500 more locations in China per year for the next five years and expects the country to become its largest market. Schultz purchased Starbucks for $3.8 million in 1998. He had previously worked at the company as its Director of Marketing in 1982 and left in 1985 to start his own chain, which was modeled after Italian coffee shops. Once Schultz bought Starbucks, he expanded rapidly while retaining ownership of the stores. SBUX stock went public in August 1992. It opened at $0.38 a share (after splits) and stayed pretty-much in an uptrend until December 2006, when it got to $18. Along the way, Schultz retired in 2000 only to come back in 2008. During 2007-early 2009 the stock fell to $4.50 before turning up in March 2009 like many growth stocks did. SBUX then went on an uptrend to $64 of in October 2015, and has been around $55 since. SBUX had been overvalued for a while, and is now Fairly Valued. This stock is such a high quality because of its ability to compound and the company’s ability to stay on top technologically. The stock is suitable for conservative accounts, the yield is 2% and the Estimated Long Term Growth Rate is a robust 16% per year. All-in-all this stock is a good one unless you’re looking for something that’s moving right now as SBUX is caught in a trading range. Starbucks’ (SBUX) icon CEO Howard Schultz is leaving his CEO post to focus on Starbucks Reserve Roasteries. But the plans set forth by Schultz for Starbucks to conquer the world are already set in motion. The company now has 25000 locations, with 7000 stores in the U.S. and 2000 in China. Management plans to open 500 more locations in China per year for the next five years and expects the country to become its largest market. Schultz purchased Starbucks for $3.8 million in 1998. He had previously worked at the company as its Director of Marketing in 1982 and left in 1985 to start his own chain, which was modeled after Italian coffee shops. Once Schultz bought Starbucks, he expanded rapidly while retaining ownership of the stores. SBUX stock went public in August 1992. It opened at $0.38 a share (after splits) and stayed pretty-much in an uptrend until December 2006, when it got to $18. Along the way, Schultz retired in 2000 only to come back in 2008. During 2007-early 2009 the stock fell to $4.50 before turning up in March 2009 like many growth stocks did. SBUX then went on an uptrend to $64 of in October 2015, and has been around $55 since. SBUX had been overvalued for a while, and is now Fairly Valued. This stock is such a high quality because of its ability to compound and the company’s ability to stay on top technologically. The stock is suitable for conservative accounts, the yield is 2% and the Estimated Long Term Growth Rate is a robust 16% per year. All-in-all this stock is a good one unless you’re looking for something that’s moving right now as SBUX is caught in a trading range. |

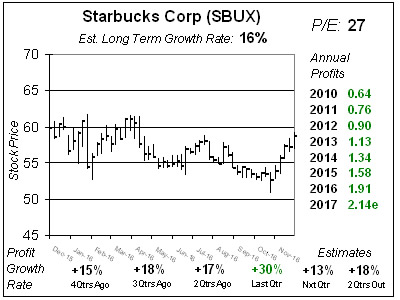

One Year Chart |

Last qtr, SBUX delivered 16% sales growth, including 4% same store sales growth in the U.S., as profits jumped 30%. The company beat the street by a penny, but looking forward profit estimates fell just a bit. I think this stock broke its downtrend in November, and is now looking up. But I also think the P/E of 27 will keep it stuck in this range as qtrly profit growth Estimates are just 13%, 18%, 12% and 7% for the next 4 qtrs. I don’t think those numbers are good enough to take the stock to another level. Last qtr, SBUX delivered 16% sales growth, including 4% same store sales growth in the U.S., as profits jumped 30%. The company beat the street by a penny, but looking forward profit estimates fell just a bit. I think this stock broke its downtrend in November, and is now looking up. But I also think the P/E of 27 will keep it stuck in this range as qtrly profit growth Estimates are just 13%, 18%, 12% and 7% for the next 4 qtrs. I don’t think those numbers are good enough to take the stock to another level. |

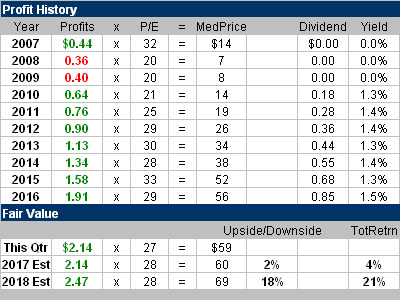

Fair Value |

SBUX often has a P/E over 30 even though profits have been growing in the high-teens for most of the decade. So although the stock’s not a bargain right now, its best to just buy in and wait for what could be the next move higher. The company has its fiscal year end on September 30th, thus I feel around that time next year investors will be looking ahead to 2018 estimates — and higher a Fair Value. SBUX often has a P/E over 30 even though profits have been growing in the high-teens for most of the decade. So although the stock’s not a bargain right now, its best to just buy in and wait for what could be the next move higher. The company has its fiscal year end on September 30th, thus I feel around that time next year investors will be looking ahead to 2018 estimates — and higher a Fair Value. |

Bottom Line |

Starbucks is one of the world’s premier franchises as the stock has consistently delivered growth of more than 15% a year long-term for its investors. Although the CEO is stepping aside, he will be working on a new catalyst in Starbucks Reserve Roasteries, and there’s still ample growth opportunity ahead as the company expands into China. SBUX ranks 18th in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. This stock is also good for conservative accounts and ranks 7th in the Conservative Portfolio Power Rankings. Starbucks is one of the world’s premier franchises as the stock has consistently delivered growth of more than 15% a year long-term for its investors. Although the CEO is stepping aside, he will be working on a new catalyst in Starbucks Reserve Roasteries, and there’s still ample growth opportunity ahead as the company expands into China. SBUX ranks 18th in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. This stock is also good for conservative accounts and ranks 7th in the Conservative Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

18 of 35Aggressive Growth Portfolio 18 of 18Conservative Stock Portfolio 6 of 36 |