Stock (Symbol) |

Starbucks (SBUX) |

Stock Price |

$88 |

Sector |

| Retail & Travel |

Data is as of |

| December 18, 2019 |

Expected to Report |

| January 28 |

Company Description |

Starbucks is a roaster, marketer and retailer of coffee. As of October 2, 2016, the Company operated in 75 countries. Its Channel Development segment includes roasted whole bean and ground coffees, Tazo teas, Starbucks- and Tazo-branded single-serve products, a range of ready-to-drink beverages, such as Frappuccino, Starbucks Doubleshot and Starbucks Refreshers beverages and other branded products sold across the world through channels, such as grocery stores, warehouse clubs, specialty retailers, convenience stores and the United States foodservice accounts. Source: Thomson Financial Starbucks is a roaster, marketer and retailer of coffee. As of October 2, 2016, the Company operated in 75 countries. Its Channel Development segment includes roasted whole bean and ground coffees, Tazo teas, Starbucks- and Tazo-branded single-serve products, a range of ready-to-drink beverages, such as Frappuccino, Starbucks Doubleshot and Starbucks Refreshers beverages and other branded products sold across the world through channels, such as grocery stores, warehouse clubs, specialty retailers, convenience stores and the United States foodservice accounts. Source: Thomson Financial |

Sharek’s Take |

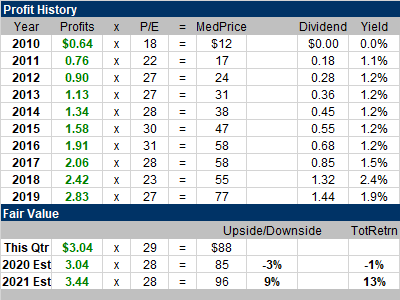

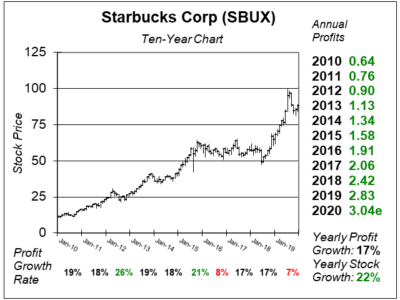

Starbucks (SBUX) has had great year, but that level was hard to sustain as in September management said SBUX would have less than 10% profit growth in Fiscal 2020, down from the previous expectation of 13%. Today, as I update by spreadsheet data, analysts expect 2020 profit growth of just 7%. These little adjustments are important because we money managers have to adjust our Fair Value P/E ratios. Last qtr My Fair Value was a P/E of 30, which equated to a $93 stock price (when the stock was $96). This qtr I have to take my Fair Value down because earnings estimates declined a bit. So now I think a P/E of 28 is more suitable. 28 x $3.04 = a $85 Fair Value. The stock is $88 today. Starbucks just ended Fiscal 2019 with 31,256 stores in operation, an increase of 7% from 2018. Around half the stores are company-operated, with the other half licensed. China is a growth catalyst for the company, and Starbucks already has 4000 stores in that country. Cold beverages are also delivering growth, lead by Nitro Cold Brew and a new Pumpkin Cream Cold Brew. U.S. Starbucks Rewards grew to 17.6 million active members in Fiscal 2019, a year-over-year increase of 15%. The company plans to add 2000 new stores in Fiscal 2020, with over half in the U.S. and China combined. Starbucks is a well-oiled machine stock with a good safety rating, an attractive Est. LTG of 11% a year, a 2% dividend yield, and a management team that buys back stock. That’s a recipe for success for quality stocks. Which is why the stock’s P/E is double its profit growth rate. The company returned $12 billion to shareholders in Fiscal 2018, consisting of both dividends and stock repurchases, up from $9 billion a year earlier. SBUX is part of the Conservative Growth Portfolio. But after a big run higher these last 12 months, I think the stock will go sideways for a while. |

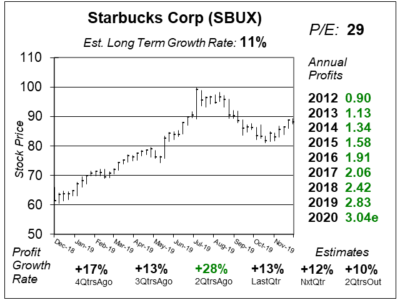

One Year Chart |

Profit growth slowed from 28% 2QtrsAgo to 13% LastQtr. What’s not shown here is SBUX beat analyst estimates of 16% and delivered 28% profit growth. So the stock briefly touched $100 a share, while the P/E was 32. A P/E of 32 is fair for a company that just grew profits 28%. Profit growth slowed from 28% 2QtrsAgo to 13% LastQtr. What’s not shown here is SBUX beat analyst estimates of 16% and delivered 28% profit growth. So the stock briefly touched $100 a share, while the P/E was 32. A P/E of 32 is fair for a company that just grew profits 28%.

But last qtr SBUX merely met estimates, and delivered a paltry 13% growth. Thus the stock wasn’t worthy of a 32 P/E anymore. The stock declined until the P/E got into the high-20s. The Est. LTG has pretty-much been trending lower since 2016 when it was 19% a year. This qtr it dropped to a new-low of 11% per year. But I’d take 11% stock growth with a 2% dividend yield for the Conservative Portfolio. The P/E of 29 is fair for this stock. I like how profits have hit record highs every year in this chart. |

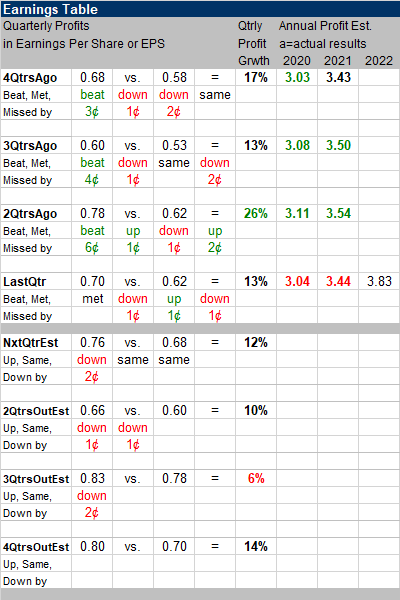

Earnings Table |

Last qtr SBUX delivered 13% profit growth, which met analyst estimates. Revenue increased a modest 7%, but same store sales growth of 5% was good. Last qtr SBUX delivered 13% profit growth, which met analyst estimates. Revenue increased a modest 7%, but same store sales growth of 5% was good.

Annual Profit Estimates declined a bit, but since the company is going into Fiscal 2020 Q1, management might be setting expectations low so it will be easier to meet (or beat) expectations as the year progresses. That’s often a trick company managers use at the beginning of a fiscal year. Qtrly Estimates show 11%, 10%, 6% and 14% growth expected the next 4 qtrs. These numbers are OK. |

Fair Value |

Since estimates declined a bit and the company didn’t beat the street, I’m taking my Fair Value P/E from 30 to 28. The stock is above my 2020 Fair Value. So I don’t see any upside here. Since estimates declined a bit and the company didn’t beat the street, I’m taking my Fair Value P/E from 30 to 28. The stock is above my 2020 Fair Value. So I don’t see any upside here.

In addition, this is a large company with a steady stream of revenue. It’s going to be tough for Starbucks to really knock my socks off because it is almost impossible for the company to boost estimates by a lot. I don’t think we will check back next qtr and see 2020 profit estimates at $3.50. |

Bottom Line |

Starbucks (SBUX) is a high quality stock that conservative investors should have in their portfolios. It possesses an Estimated Long-Term Growth Rate of 11% per year in addition to a 2% dividend yield. Management also buys back stock. That’s a recipe for success. Starbucks (SBUX) is a high quality stock that conservative investors should have in their portfolios. It possesses an Estimated Long-Term Growth Rate of 11% per year in addition to a 2% dividend yield. Management also buys back stock. That’s a recipe for success.

But the stock has had some periods when the stock didn’t rise. The most recent was 2016-2018 when profit growth slowed and the P/E fell from the 30s to the mid-20s. Now growth has slowed once again. And since the 29 P/E is more than double the rate profits are growing at, I don’t think the stock has the juice to move higher. I think SBUX will continue to go sideways for a while. This stock is dead money. SBUX drops from 19th to 26th in the Conservative Portfolio Power Rankings. The stock doesn’t have enough juice for the Growth Portfolio, as that portfolio has companies that grow profits 15-20% or more. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 26 of 34 |