The stock market went down on Thursday as worries about AI valuations resurfaced. In addition, concerns on the state of the country’s labor market have risen, following a wave of layoff announcements in October.

The stock market went down on Thursday as worries about AI valuations resurfaced. In addition, concerns on the state of the country’s labor market have risen, following a wave of layoff announcements in October.

With limited economic reports available, investors closely watching alternative data sources. A survey by Challenger, Gray & Christmas showed that employers announced roughly 153,000 job cuts last month — almost triple September’s rate and 175% higher than in October 2024. This also marks the highest level recorded for the month of October in 22 years.

Meanwhile, the ongoing U.S. government shutdown has now reached its 36th day, making it the longest in history.

Overall, S&P 500 declined 1.1% to 6,720, while NASDAQ fell 1.9% to 23,054.

Tweet of the Day

This is Bearish https://t.co/8K8G6Lfge6

— David Sharek (@GrowthStockGuy) November 5, 2025

Chart of the Day

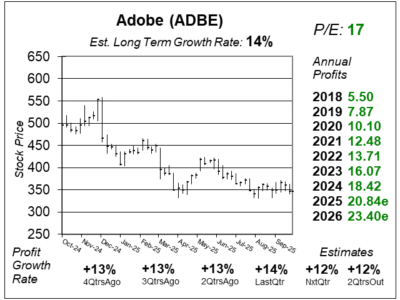

Here is the one-year chart of Adobe (ADBE) as of October 3, 2025, when the stock was at $347.

Here is the one-year chart of Adobe (ADBE) as of October 3, 2025, when the stock was at $347.

At Adobe’s Annual Max Conference last week, the company showed off some remarkable new features including lighting features that can darken the background, turning day to night, and a flashlight feature that allows the user to move light on an object as if they were holding a flashlight on it. Adobe’s Audio Separation feature allows the user to break an audio file up into different layers including words, music, and background noise. Adobe’s software remains the top choice for professional developers.

Meanwhile, profits continue to climb at a steady rate. Last quarter, the company delivered 14% profit growth on 11% revenue growth driven by its Digital Media and Digital Experience segments. Demand for products like Creative Cloud Pro, Firefly, and Acrobat AI Assistant continued to climb. Enterprise clients continued to invest in Adobe Experience Platform (AEP) and GenStudio, using them to speed up video and ad campaign creation.

ADBE is part of our Conservative Growth Portfolio.