The stock market climbed on Friday but still ended the week lower, following an inflation report that aligned with expectations. The Personal Consumption Expenditures (PCE) index rose by 2.7% in August, up from 2.6% in July, matching forecasts.

The stock market climbed on Friday but still ended the week lower, following an inflation report that aligned with expectations. The Personal Consumption Expenditures (PCE) index rose by 2.7% in August, up from 2.6% in July, matching forecasts.

Overall, S&P 500 rose 0.6% to 6,644, while NASDAQ increased 0.4% to 22,484.

Chart of the Day

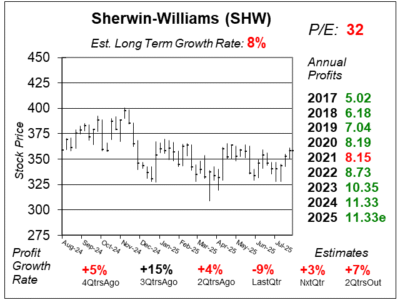

Here is the one-year chart of Sherwin-Williams (SHW) as of August 12, 2025, when the stock was at $358.

Here is the one-year chart of Sherwin-Williams (SHW) as of August 12, 2025, when the stock was at $358.

Sherwin-Williams is struggling to grow in a sluggish market. Last quarter, the company posted a 9% profit decline on just 1% revenue growth.

Analysts think Sherwin-Williams will make the same in profits (EPS) as it did last year ($11.33). Weaker demand, particularly in DIY and certain industrial markets, weighed on volumes in the Consumer Brands Group and Performance Coatings Group.

The company expects the slowdown to persist or worsen this year, with no signs of improvement in customer sentiment or consumer demand. Even so, management is pressing ahead with Paint Stores Group expansion, calling it a “once-in-a-career” chance to win market share as rivals cut staff and raise prices during peak season, disrupting customers. And even though business isn’t growing, the stock is expensive. I think its overvalued.

SHW was sold from the Conservative Growth Portfolio. David Sharek, Founder of School of Hard Stocks, thought that the stock is overvalued. The stock is expensive even though business is not growing.