The stock market bounced back on Friday, but still ended the week with sharp losses, mainly driven by concerns on AI and tech valuations. Nevertheless, investors are hopeful after New York Federal Reserve President John Williams said the central bank could cut interest rates again in December.

The stock market bounced back on Friday, but still ended the week with sharp losses, mainly driven by concerns on AI and tech valuations. Nevertheless, investors are hopeful after New York Federal Reserve President John Williams said the central bank could cut interest rates again in December.

Overall, S&P 500 went up 1.0% to 6,603, while NASDAQ increased 0.9% to 22,273.

Tweet of the Day

Great take on Japan: https://t.co/Ze6bUrQhc0

— David Sharek (@GrowthStockGuy) November 21, 2025

Chart of the Day

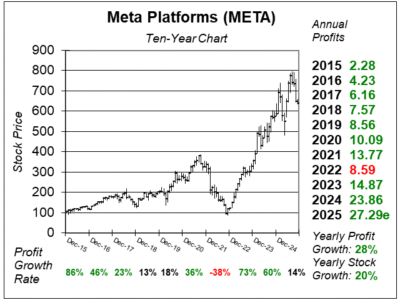

Here is the ten-year chart of Meta Platforms (META) as of November 3, 2025, when the stock was at $638.

Here is the ten-year chart of Meta Platforms (META) as of November 3, 2025, when the stock was at $638.

Meta Platforms is aggressively building out infrastructure for powering anticipated AI and “Superintelligence” in the coming years. This excessive spending caused expenses to grow faster (+32%) than revenue (+26%) last quarter.

The company’s CapEx reached 37% of revenue last quarter. In addition, higher expected CapEx expenses for next year spooked investors, who sold the stock.

Management believes that aggressively building infrastructure is the right strategy so that it is ideally positioned to capitalize when the “Superintelligence” arrives sooner. If not, Meta Platforms will use the extra processing power to accelerate its core business. Management said if it delivers even a fraction of the opportunity ahead, the next few years will be the most exciting period in the company’s history.

META is part of our Growth Portfolio and Aggressive Growth Portfolio.