The stock market surged on Monday, bouncing back strongly after Friday’s sharp decline. The rally was largely fueled by President Donald Trump’s softer tone on China, which helped eased concerns over a potential escalation of a trade war.

The stock market surged on Monday, bouncing back strongly after Friday’s sharp decline. The rally was largely fueled by President Donald Trump’s softer tone on China, which helped eased concerns over a potential escalation of a trade war.

Overall, S&P 500 rose 1.6% to 6,655, while NASDAQ climbed 2.2% to 22,695.

Tweet of the Day

Oracle $ORCL is Now a BIG Player in #AI With a HUGE Backlog of Business Coming | https://t.co/yYW2IuMdAI

— SchoolofHardStocks (@SchoolHardStock) October 12, 2025

Chart of the Day

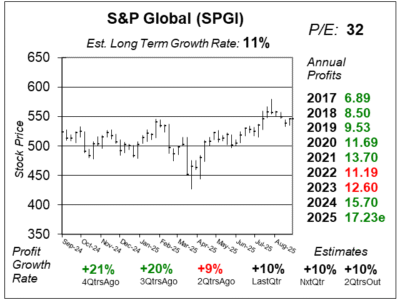

Here is the one-year chart of S&P Global (SPGI) as of September 8, 2025, when the stock was at $546.

Here is the one-year chart of S&P Global (SPGI) as of September 8, 2025, when the stock was at $546.

S&P Global reported modest profit growth of 10% last quarter as revenue climbed a weak 6%. That was not great. This company was growing at a faster rate this past decade, with profits up 14% a year (including 2025’s estimate).

The revenue weakness was because of the company’s Bond Ratings division has had slow revenue growth. During the past four quarters, revenue growth in that segment has fallen from +36% to +27%, +8% and now +1%. Also, management sees flattish Billed Issuance in the 2nd half of 2025.

Sticking with segment growth, S&P Dow Indices had the highest revenue growth last quarter, with +15%. The US stock market dipped in 2025 Q1, then rebounded at the end of April, and has been pushing higher ever since. Indices Assets Under Management (AUM) was driven higher by market appreciation and inflows, with revenue from asset-linked fees up 17% in the quarter.

SPGI is part of our Conservative Growth Portfolio.