Stocks dropped on Wednesday as the Republican red wave failed to materialize in the U.S. midterm elections. In addition, a crypto selloff weighed on markets after Binance said that it is likely to back out in acquiring its competitor FTX after a review of the company’s structure and books.

Stocks dropped on Wednesday as the Republican red wave failed to materialize in the U.S. midterm elections. In addition, a crypto selloff weighed on markets after Binance said that it is likely to back out in acquiring its competitor FTX after a review of the company’s structure and books.

A highly anticipated inflation report is expected to be out on Thursday morning.

Investors felt Republicans would take enough seats to have a majority in the House of Representatives and the Senate. Instead, they only took control of the House. The Big Red Wave wasn’t so big after all.

– David Sharek, Founder of The School of Hard Stocks

Overall, S&P 500 fell 2.1% to 3,749, while NASDAQ declined 2.5% to 10,353.

Tweet of the Day

Big tech returns in 2008 recession…$MSFT: -44%$AAPL: -57%$GOOGL: -56%$AMZN: -45%$QQQ: -42%

Big tech returns in 2022 recession…$MSFT: -32%$AAPL: -23%$GOOGL: -39%$AMZN: -48%$QQQ: -33%

— Charlie Bilello (@charliebilello) November 9, 2022

Chart of the Day

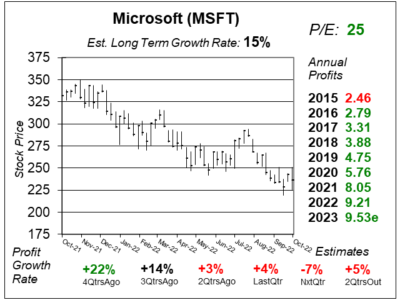

Our chart of the day is the one-year chart of Microsoft (MSFT) as of October 29, 2022, when the stock was at $236.

Our chart of the day is the one-year chart of Microsoft (MSFT) as of October 29, 2022, when the stock was at $236.

Microsoft develops and supports software, services, devices and solutions that help people in business. Its products include computer operating systems such as Windows, productivity applications including Excel and Word, software development tools including Azure, computing devices with its Surface tablets, and video games with its Xbox devices. The company also owns the top social media site for business relationships in LinkedIn.

Microsoft is feeling the pinch of the ongoing recession. Last qtr, it delivered 4% profit growth and beat estimates of 2% growth. Revenue increased 11%, year-on-year. Management noted that revenue growth this year will be led by a strong momentum in their commercial business.

MSFT has an Estimated Long-Term Growth Rate of 15%. It is part of the Growth Portfolio and Conservative Growth Portfolio. David Sharek’s Fair Value on the stock is a P/E of 28.