The stock market was down on Thursday as President Donald Trump’s tariffs on China reached 145%, further intensifying the trade tensions between US and China.

The stock market was down on Thursday as President Donald Trump’s tariffs on China reached 145%, further intensifying the trade tensions between US and China.

Overall, S&P 500 fell 3.5% to 5,268, while NASDAQ declined 4.3% to 16,387.

Tweet of the Day

Tariffs are the big story today. https://t.co/O4hmnNPkxF

— David Sharek (@GrowthStockGuy) April 9, 2025

Chart of the Day

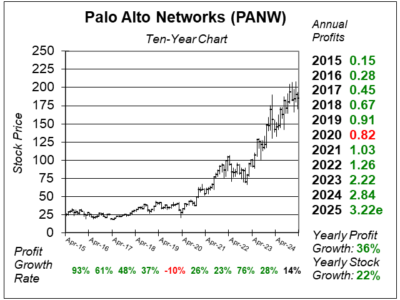

Here is the ten-year chart of Palo Alto Networks (PANW) as of March 17, 2025, when the stock was at $185.

Here is the ten-year chart of Palo Alto Networks (PANW) as of March 17, 2025, when the stock was at $185.

Palo Alto Networks stock is holding up nice even though profit growth isn’t great. Last quarter, the company delivered unimpressive results, with 11% profit growth on 13% revenue growth. With a P/E of 57, the stock is priced for profit higher growth (say 35% to 30%). So why didn’t the stock decline?

Palo Alto Networks is in a transition phase where the company gives some upgrades away to try and cover the customer’s entire cybersecurity need. They call it Platformization. Last quarter, the company delivered 75 new Platformizations, up from 45 in the year-ago period. It now has greater than 1,150 Platformizations within its top 5,000 customers. It seems Platformization is working well.

PANW is part of our Growth Portfolio.