On Wednesday, the stock market sank and bond yields hit a fresh 16-year high, as investors closely watched the conflict in Gaza and awaited corporate earnings results.

On Wednesday, the stock market sank and bond yields hit a fresh 16-year high, as investors closely watched the conflict in Gaza and awaited corporate earnings results.

Overall, S&P 500 was down 1.3% to 4,315, while NASDAQ declined 1.6% to 13,314.

Tweet of the Day

The amount of cash sitting in household and non-profit checking accounts is four times more than what it was before the pandemic, per Bloomberg: pic.twitter.com/8Ov15vj7Od

— unusual_whales (@unusual_whales) October 18, 2023

Chart of the Day

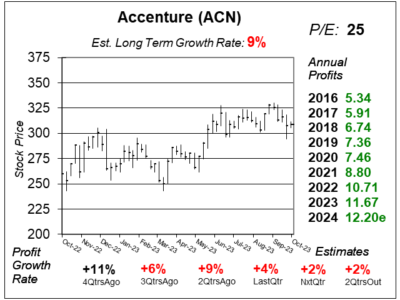

Here is the one-year chart of Accenture (ACN) as of October 5, 2023, when the stock was at $309.

Here is the one-year chart of Accenture (ACN) as of October 5, 2023, when the stock was at $309.

Accenture helps companies and organizations solve business challenges and transform their organizations. Employing more than 700,000 people, the company serves more than three-fourths of the Fortune Global 500. Enterprises use Accenture for Consulting on what to do, then utilize its Outsourcing divisions including finance, accounting, supply chain, marketing, and sales to get work done.

Accenture is seeing its business growth slow as companies are reluctant to spend big on improving their infrastructure. During the past four quarters, revenue growth has been 5%, 5%, 3% and most recently 4%. That’s not much growth. Thus, profit growth has been less than 10% for the past few quarters. In addition, business is not getting any better as management sees a challenging macro environment. This is tougher than what the company anticipated a year ago. Management sees greater caution globally, lower discretionary spend, and slower decision making.

On the bright side, Accenture is benefiting from the accelerating demand for generative AI. It gained $200 million in Generative AI sales last quarter compared to $100 million 2QtrsAgo. While Generative AI is in the early stages, management is confident that the technology is maturing rapidly and could be a significant opportunity for growth. However, AI is a tiny bit of overall company’s revenue.

ACN is part of the Conservative Growth Portfolio.