The stock market slid on Tuesday as investors continued to monitor developments on the intensifying conflict between Israel and Iran.

The stock market slid on Tuesday as investors continued to monitor developments on the intensifying conflict between Israel and Iran.

President Donald Trump demanded Iran for an “unconditional surrender” as Israel seeks further assistance from the U.S.

Overall, S&P 500 fell 0.8% to 5,983, while NASDAQ dropped 0.9% to 19,521.

Chart of the Day

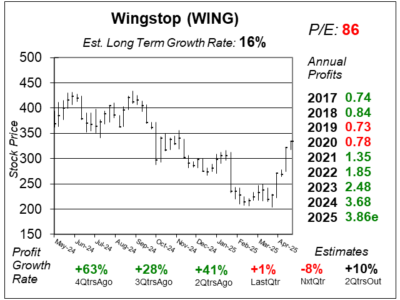

Here is the one-year chart of Wingstop (WING) as of May 19, 2025, when the stock was at $334.

Here is the one-year chart of Wingstop (WING) as of May 19, 2025, when the stock was at $334.

Wingstop delivered slower profit growth last quarter. Profits increased just 1% during the quarter with revenue up 17%. Cost of sales increased 76.0% versus last year’s 74.5%, driven by higher costs for bone-in chicken wings and increased food, beverage, and packaging expenses.

However, year-over-year comparisons were tough as profits jumped 66% in the year-ago period. As such, any year-over-year profit growth should be considered positive.

Management explained 2025 brought a tough economy, with consumer confidence at its second-lowest level since 1952 and even lower than during the pandemic. Domestic same-store sales increased just 1% last quarter. Some consumers were cutting back, but this seemed limited to certain areas, not the whole market.

Wingstop has been through similar slowdowns before, but has maintained its 21-year streak of same-store sales growth. Thanks to strong unit growth with 409 new franchise openings.

Meanwhile, International store growth continued with openings in Kuwait, success in Puerto Rico, and plans to expand into Australia and five new markets in 2025.

WING is part of our Growth Portfolio. The big picture here is that the company has more than 2,500 locations now with a potential of 10,000 locations long-term. Management also sees a path to $3 million in revenue per location.