On Wednesday, the stock market ended on a mixed note despite optimism that the 43-day U.S. government shutdown was nearing its end.

On Wednesday, the stock market ended on a mixed note despite optimism that the 43-day U.S. government shutdown was nearing its end.

Overall, S&P 500 was 0.1% to 6,851, while NASDAQ declined 0.3% to 23,406.

Tweet of the Day

This is correct. I would expect a correction in semiconductor stocks.

I own these semiconductor stocks for clients:

*NVIDIA $NVDA

Broadcom $AVGO

Advanced Micro Devices $AMD*Our #1 top holding https://t.co/DXf8VtULWp

— David Sharek (@GrowthStockGuy) October 29, 2025

Chart of the Day

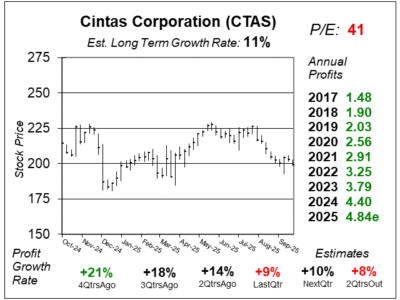

Here is the one-year chart of Cintas Corporation (CTAS) as of October 6, 2025, when the stock was at $199.

Here is the one-year chart of Cintas Corporation (CTAS) as of October 6, 2025, when the stock was at $199.

Cintas Corporation has seen its stock price decline as profit growth has slowed.The stock was at $224 in our last report and is at $199 this quarter. The reason for the decline is profit growth has slowed during the last four quarters from 21% to 18%, 14% and most recently 9%.

Management was upbeat in the earnings call, and mentioned strong execution from its employees and success in converting “no-programmers” (businesses that used to handle their own uniforms and safety gear) into full-service clients.

The company also grew by selling more products and services to existing customers and keeping retention high. David Sharek, Founder of School of Hard Stocks, thinks the stock is too expensive to buy with a P/E of 41, especially considering profit growth has slowed so much.

CTAS is on the radar for our Conservative Growth Portfolio. We are looking for the stock to pull back so we can invest.