The stock market was mixed on Tuesday as June inflation data increased 0.3% from May levels. This brought the annual inflation rate to 2.7% and met consensus poll.

The stock market was mixed on Tuesday as June inflation data increased 0.3% from May levels. This brought the annual inflation rate to 2.7% and met consensus poll.

Overall, S&P 500 fell 0.4% to 6,244, while NASDAQ rose 0.2% to 20,678.

Tweet of the Day

Oscar Health $OSCR is the most popular stock on my X feed. The stock also fits the mold of one I would own in my Growth Portfolio.

But the shares fell last week and look very inexpensive. Why? Well maybe this is why… https://t.co/c2zX0uRpax

— David Sharek (@GrowthStockGuy) July 12, 2025

Chart of the Day

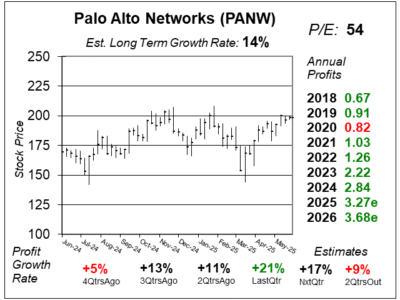

Here is the one-year chart of Palo Alto Networks (PANW) as of June 16, 2025, when the stock was at $198.

Here is the one-year chart of Palo Alto Networks (PANW) as of June 16, 2025, when the stock was at $198.

Palo Alto Networks’ platformization strategy is driving strong customer adoption and larger, multiproduct deals. Last quarter, the company closed over 19 new platformization transactions, bringing the total to approximately 1250 within its top 5000 customers. This growth is fueled by rising demand for simplified security architectures, particularly as enterprises modernize for AI-driven operations.

Management stated products like XSIAM are central to this shift, with its ARR growing over 200% year-over-year and average ARR per customer exceeding $1 million. XSIAM is an all-in one AI security system that watches, detects, and automatically responds to cyber threats across a company’s entire digital environment.

PANW is part of our Growth Portfolio. The stock seems fairly valued here so it is a small position.