The stock market closed higher on Wednesday as investors’ confidence were lifted by a summary of the Federal Reserve’s recent policy meeting. It indicated that most officials were agreeing on a September rate cut if inflation continued to improve.

The stock market closed higher on Wednesday as investors’ confidence were lifted by a summary of the Federal Reserve’s recent policy meeting. It indicated that most officials were agreeing on a September rate cut if inflation continued to improve.

Overall, S&P 500 increased 0.4% to 5,621, while NASDAQ rose 0.6% to 17,919.

Tweet of the Day

Too many of these high-growth high-P/E stocks are not moving forward. I bought Dutch Bros $BROS before earnings and the stock dropped right after.

The problem is we are all looking at the same potential leaders but the companies aren't dependable enough. https://t.co/F0a7uURc7w

— David Sharek (@GrowthStockGuy) August 19, 2024

Chart of the Day

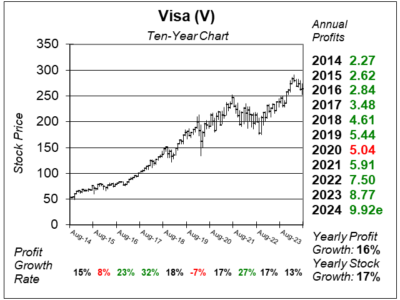

Here is the ten-year chart of Visa (V) as of July 30, 2024, when the stock was at $264.

Here is the ten-year chart of Visa (V) as of July 30, 2024, when the stock was at $264.

Visa’s main business drivers remained stable, but it experienced slower growth in payment volumes in the US and Asia Pacific. In the US, there was steady growth in high-spending consumers, but low-spending consumer growth decreased due to high inflation. On the other hand, Asia Pacific payment volume grew by less than 0.5% due to the macroeconomic conditions in Mainland China. Overall, payment volumes increased by 7%, with US volumes up by 5% and international volumes up by 10%. Cross-border volumes (excluding intra-Europe) rose 14%, and processed transactions increased 10%. In total, Visa saw 12% profit growth on 10% revenue growth.

Visa is part of the Conservative Growth Portfolio, Growth Portfolio, and Aggressive Growth Portfolio.