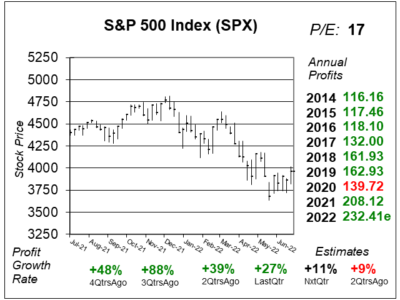

The S&P 500 ended the week with a 0.9% decline to 3,962. NASDAQ likewise fell 1.9% to 11,834.

The S&P 500 ended the week with a 0.9% decline to 3,962. NASDAQ likewise fell 1.9% to 11,834.

The stock market has been on a nice rally this month. Maybe too nice of a rally. – David Sharek, Founder of The School of Hard Stocks

He added that stocks are getting higher on a valuation basis, while citing S&P 500.

The S&P 500 has risen from a low of 3,637 in June to close at 3,962 last Friday. Although 9% from the lows does not sound like much, stocks are getting higher on a valuation basis.

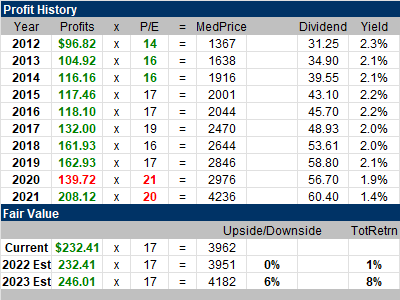

According to him, analysts think that S&P 500 companies will earn $232 in profits this year. That means the “stock market” has a P/E of 17. Meanwhile, David Sharek’s Fair Value for S&P 500 is a P/E of 17 if things are good. He added that since the economy could be in a recession, it could mean a P/E of 15 for the market, or 3,486 on the index.

So basically, the market seems fairly valued here with a downside of 14%.

Chart of the Day

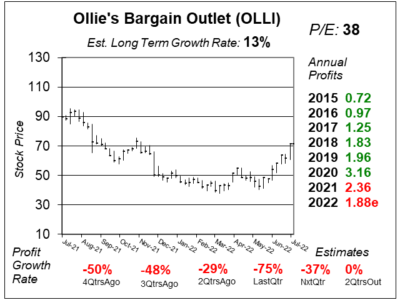

Our chart of the day is the one-year chart of Ollie’s Bargain Outlet (OLLI) on July 9 when the stock was at $71.

Our chart of the day is the one-year chart of Ollie’s Bargain Outlet (OLLI) on July 9 when the stock was at $71.

OLLI delivers “good stuff cheap” by offering closeout products bought at a discount and then selling them for 20-70% off retail prices. The company has no-frills warehouse style stores that average 33,000 square feet in a treasure-hunt shopping experience with the slogan ‘when it’s gone, it’s gone”.

The company looks to head higher as recession has likely already begun. OLLI is one I consider to be a 15% to 20% grower. But profits (EPS) fell from a record $3.16 in 2020 to $2.36 in 2021. This year, estimates are for $1.88, but that will likely change as the company is set up to get some bargains from stores that have too much inventory (like maybe Target). The stock has a an Estimated Long-Term Growth Rate of 13% a year, and with a P/E of 38, the shares seem expensive. OLLI has very little debt, and management buys back stock. Like most growth stocks there isn’t a dividend. OLLI is on the radar for the Growth Portfolio.

My Fair Value P/E is 32 this qtr while the stock is currently has a P/ E of 38.