The stock market ended in the red on Friday, as investors closed out a huge week with Fed’s rate hike pause and inflation data’s slowdown.

The stock market ended in the red on Friday, as investors closed out a huge week with Fed’s rate hike pause and inflation data’s slowdown.

Overall, S&P 500 slid 0.4% to 4,410, while NASDAQ declined 0.7% to 13,690.

Tweet of the Day

Great looking breakout on the weekly chart in $FTNT after a bumpy ride on the daily near highs. Chart by @marketsmith If you can't read the chart they have free coaching: https://t.co/b92IaBrHP5 https://t.co/pO7meJ01VQ pic.twitter.com/dKhbChxhxs

— Leif Soreide (@LeifSoreide) June 15, 2023

Chart of the Day

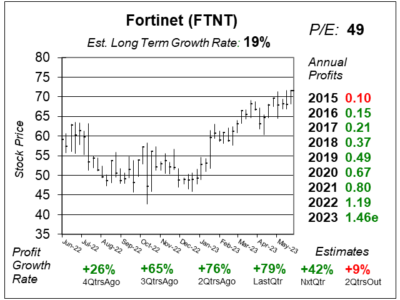

Here is the one-year chart of Fortinet (FTNT) as of February 22, 2023, when the stock was at $60.

Here is the one-year chart of Fortinet (FTNT) as of February 22, 2023, when the stock was at $60.

Fortinet is a one-stop-shop that can handle all the cybersecurity needs for organizations. It delivers hardware, software, and technical support for a range of offerings for cybersecurity. Now, the company offers firewall-based Zero Trust Network Access.

Fortinet is one of our favorite cybersecurity stocks, and the stock proved its worth when it broke out after the company reported last quarter’s earnings. FTNT delivered 76% profit growth last quarter, as sales rose a solid 33%. Revenue grew 33% as billings (future revenue) grew 32%. The company landed some big clients last quarter as $1 million deals jumped 48% year-over-year to 181.

Analysts were impressed with the quarter, as other cybersecurity companies have talked about elongated sales cycles and budget scrutiny. FTNT responded by stating demand is still pretty strong as Fortinet has a better cost solution. The only blemish in the report was management was conservative in its billings growth for next quarter, estimating they will be around 24%.

FTNT is part of our Growth Portfolio. This stock just broke out after the company reported earnings, and that is a bullish sign.