The stock market ended Tuesday on a mixed note, with S&P 500 and NASDAQ finishing lower following China’s retaliation to a series of actions by President Donald Trump. In response, Beijing imposed sanctions on the U.S. subsidiaries of South Korean shipbuilder Hanwha Ocean, and both China and the U.S. introduced new port fees on each other’s vessels. Additionally, President Trump threatened to halt U.S. imports of Chinese cooking oil products.

The stock market ended Tuesday on a mixed note, with S&P 500 and NASDAQ finishing lower following China’s retaliation to a series of actions by President Donald Trump. In response, Beijing imposed sanctions on the U.S. subsidiaries of South Korean shipbuilder Hanwha Ocean, and both China and the U.S. introduced new port fees on each other’s vessels. Additionally, President Trump threatened to halt U.S. imports of Chinese cooking oil products.

Overall, S&P 500 fell 0.2% to 6,644, while NASDAQ dropped 0.8% to 22,522.

Chart of the Day

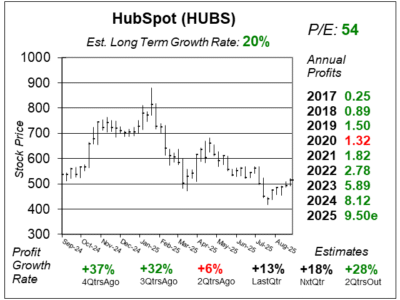

Here is the one-year chart of HubSpot (HUBS) as of September 18, 2025, when the stock was at $513.

Here is the one-year chart of HubSpot (HUBS) as of September 18, 2025, when the stock was at $513.

The Software industry is weak because investors feel that AI will become easier and companies will be able to control the software they need to operate and not have to rely on outside vendors as much.

HubSpot’s revenue grew a solid 19% last quarter, but profits increased just 13%.

In the earnings call, management pointed out 42% of its Annual Recurring Revenue (ARR) uses HubSpot’s three key hubs: Marketing, Sales, & Service. Sales and Service Hubs are thriving, fueled by rapid AI innovation. Sales Hub is seeing strong adoption of AI features like deal intelligence with guided actions to take the next steps. Furthermore, more than 40% of Service Hub customers are now using AI features.

HUBS is part of our Growth Portfolio.