The stock market broke its win streak on Monday as investors awaited for the release of key inflation data. Moody’s also downgraded its outlook on U.S. Aaa rating to “negative” from “stable” due to concerns about the country’s government finances.

The stock market broke its win streak on Monday as investors awaited for the release of key inflation data. Moody’s also downgraded its outlook on U.S. Aaa rating to “negative” from “stable” due to concerns about the country’s government finances.

Overall, S&P 500 fell 0.1% to 4,412, while NASDAQ declined 0.2% to 13,768.

Tweet of the Day

Record-high share of US consumers planning to go on vacation to a foreign country within the next six months. ✈️

(Via Apollo/Slok) $JETS $XAL pic.twitter.com/M9F4Qv0mjo

— Carl Quintanilla (@carlquintanilla) November 12, 2023

Chart of the Day

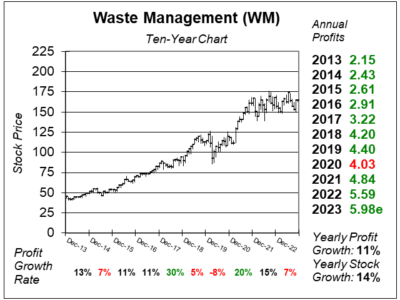

Here is the ten-year chart of Waste Management (WM) as of November 1, 2023, when the stock was at $164.

Here is the ten-year chart of Waste Management (WM) as of November 1, 2023, when the stock was at $164.

Waste Management is North America’s leading provider of comprehensive waste management, providing services throughout the United States and Canada. The company is the biggest recycler and biggest landfill company in North America.

While Waste Management’s profit growth continues to be subpar, moderation of inflation should mean double-digit profit growth starting next quarter. Last quarter, profits was just 4%, while revenue rose 2%. Note that profits were up a solid 24% in the year ago period, so comparisons were tough.

Profit growth for the next four quarters is now expected to be 18%, 13%, 13% and 12%. Management is working to make the company more efficient with better travel routes and more new trucks. The company received more than 1,200 trucks so far to replace its old fleet. As a result, rental truck usage has decreased by 40% since the start of the year, and spending on outside mechanics has been reduced by 23rds since the 2nd half of 2022. The company is also leveraging technology to reduce labor costs with the company’s headcount down by 1,650 positions since January 2022.

WM is part of the Conservative Growth Portfolio. It’s a buy-and-hold Blue Chip stock.