Stock (Symbol) |

Supermicro Computer (SMCI) |

Stock Price |

$682 |

Sector |

| Technology |

Data is as of |

| February 6, 2024 |

Expected to Report |

| April 30 |

Company Description |

Super Micro Computer, Inc. provides Silicon Valley-based accelerated compute platforms that are application-optimized server and storage systems for various markets, including enterprise data centers, cloud computing, artificial intelligence, fifth generation (5G) and edge computing. Super Micro Computer, Inc. provides Silicon Valley-based accelerated compute platforms that are application-optimized server and storage systems for various markets, including enterprise data centers, cloud computing, artificial intelligence, fifth generation (5G) and edge computing.

The Company’s solutions include artificial intelligence (AI) and high-performance computing (HPC), enterprise applications and data analytics, data management, cloud and virtualization, 5G, edge computing and Internet of things (IoT), and hyperscale infrastructure. The Company also provides global support and services to help customers install, upgrade, and maintain their computing infrastructure. The Company offers an array of products which include servers and storage, building blocks, IoT and embedded, networking, and workstations and gaming products. The Company operates in United States, Asia and Europe. Source: Refinitiv |

Sharek’s Take |

Supermicro Computer (SMCI) is one of the hottest stocks in the world as the shares have rocketed from around $100 to around $700 during the past year as its NVIDIA based AI racks “rack up” sales. And now management sait its entering an accelerated demand phase. WOW! SMCI’s AI rack-scale solutions based on the NVIDIA HGX H100 are gaining high popularity, with the demand for AI inferencing systems growing. AI inference, a process in machine learning in which programs learn from new information outside its training data. For example, if you’re training the computer to identify what a person is, you first feed the machine pictures of people, then the computer can utilize inference to identify other people. In last quarter’s earnings call management said this AI boom will continue for another many quarters, if not many years. And together with inferencing and other computer requirements, demand could last for decades to come in this AI revolution. Supermicro Computer (SMCI) is one of the hottest stocks in the world as the shares have rocketed from around $100 to around $700 during the past year as its NVIDIA based AI racks “rack up” sales. And now management sait its entering an accelerated demand phase. WOW! SMCI’s AI rack-scale solutions based on the NVIDIA HGX H100 are gaining high popularity, with the demand for AI inferencing systems growing. AI inference, a process in machine learning in which programs learn from new information outside its training data. For example, if you’re training the computer to identify what a person is, you first feed the machine pictures of people, then the computer can utilize inference to identify other people. In last quarter’s earnings call management said this AI boom will continue for another many quarters, if not many years. And together with inferencing and other computer requirements, demand could last for decades to come in this AI revolution.

Super Micro Computer (aka Supermicro) is a Silicon Valley-based manufacturer of server and storage systems for enterprise data centers, cloud computing, artificial intelligence (AI), 5G, and edge computing. It is the only US-based large-scale AI platform designer and manufacturer. The company is headquartered in Silicon Valley. Its Products are manufactured in plants in the Netherlands and Taiwan, then more than half the production is completed in San Jose, California. The Taiwan plant has lower production and operational costs that benefit profit margins. The company also has a new Malaysia campus that will provide even better profit margin and will double the company’s capacity. Its Silicon Valley and Taiwan facilities can support $18 billion in annual revenue, while the new Malaysia facility will improve costs and take capacity to much higher than $20 billion in annual revenue. SMCI also plans to open another campus in North America to support domestic demand. Overall, management sees the ability to have all plants doing 25 billion in annual revenue. Here are some other facts on SMCI:

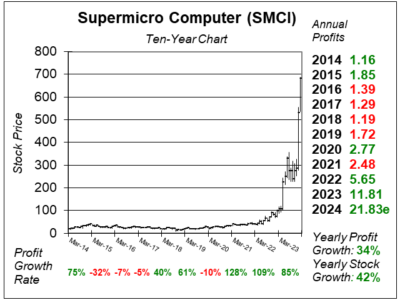

Supermicro (SMCI) is expanding so rapidly it reminds me of Dell Computer back in the 1990s. Dell was also a “simple” company in putting computers together, but the company’s profits soared during the decade due to its low prices. Management raised its Fiscal Year 2024 revenue projections from around $10.5 billion to around $14.5 billion. Note SMCI has a Fiscal Year end on June 30th, which is only two quarters away. The company is making good profits, and uses some to buy back its cheap stock. SMCI is the top holding in my Growth Portfolio and Aggressive Growth Portfolio. The stock just corrected after a parabolic run, but the numbers still look great. The company did $7 billion in revenue in 2023 And in 2023 it was expected to do $20 billion in 2028. Now in 2024, SMCI’s expected to do $19 billion in 2025 (basically next Fiscal Year). |

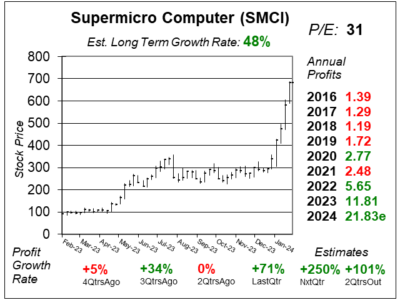

One Year Chart |

This stock had a parabolic run from May to July 2023 then corrected 23% on August 9 after SMCI reported earnings and issued disappointing sales estimates (which was last quarter’s results). On January 19 the shares surged from $311 to $423 after management stated it would beat the street. SMCI is on a parabolic run higher. This is a good time to sell some shares. But I wouldn’t sell a lot as my 2025 Fair Value is almost $1000 a share. This stock had a parabolic run from May to July 2023 then corrected 23% on August 9 after SMCI reported earnings and issued disappointing sales estimates (which was last quarter’s results). On January 19 the shares surged from $311 to $423 after management stated it would beat the street. SMCI is on a parabolic run higher. This is a good time to sell some shares. But I wouldn’t sell a lot as my 2025 Fair Value is almost $1000 a share.

The stock has a P/E of 31, up from 17 last quarter. A 17 P/E was obviously too low My Fair Value is a P/E of 25. Quarterly profits growth just accelerated, and up ahead its triple-digit profit growth. Excellent! The Est. LTG of 48% seems about right. Notice profits are expected to climb from ~$12 last year to ~$22 this year. |

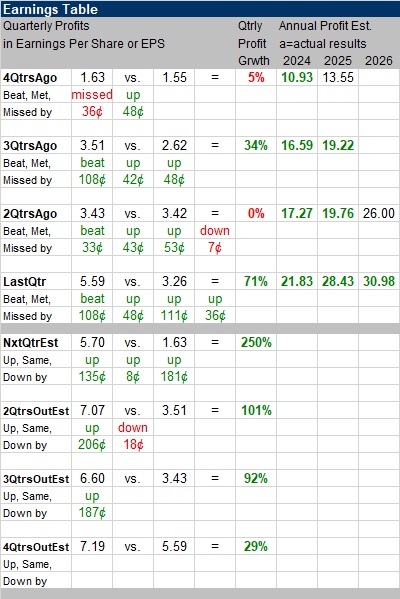

Earnings Table |

Last qtr, SMCI delivered 71% profit growth and surpassed estimates of 38% growth. Revenue increased to a whopping 103%, year-over-year, versus estimates of 52%. Gross profit margin decreased to 15.4% from 18.7% last year. Last qtr, SMCI delivered 71% profit growth and surpassed estimates of 38% growth. Revenue increased to a whopping 103%, year-over-year, versus estimates of 52%. Gross profit margin decreased to 15.4% from 18.7% last year.

In the earnings release, management stated its winning new partners, while current customers continue to demand its AI computer platforms and Total IT solutions. That’s why revenue is compounding. Here are the company’s segments:

Here are the geographical results during the period:

Annual Profit Estimates increased this qtr. Management increased outlook for Fiscal 2024 revenue from around $10.5 billion to around $14.5 billion. That’s huge! There’s only two quarters left in the Fiscal Year! Qtrly Profit Estimates are for 250%, 101%, 92%, and 29% growth over the next four qtrs. Note the 4QtrsOut estimate probably needs time to adjust higher as SMCI just beat the street last week. The bump up in revenue guidance takes next qtr’s revenue estimate to $3.9 billion vs. $1.3 billion a year ago (+202%) and $4.8 billion vs. $2.2 billion a year ago (+119%). |

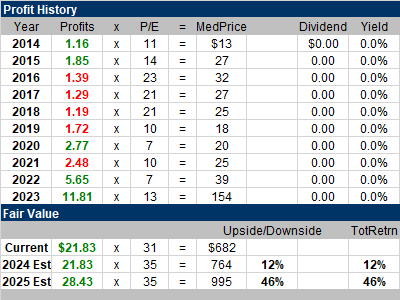

Fair Value |

This stock has historically had a low P/E as its been in a low-margin business. But the company has advanced its offerings, and I think its deserving of a higher multiple now. This stock has historically had a low P/E as its been in a low-margin business. But the company has advanced its offerings, and I think its deserving of a higher multiple now.

My Fair Value is P/E of 35, up from 25 last quarter. The reason for the raise in the multiple (P/E) is growth is exeptional and the stock just jumped on HIGH VOLUME. Thus, my Fair Value for this fiscal year is $764. SMCI has a Fiscal Year end June 30th, and the company is in Fiscal 2024 now. Next quarter I will begin to look ahead to 2025 estimates as it will be just a quarter away. My Fiscal 2025 Fair Value is $995. So SMCI looks to be on its way towards $1000 per share. |

Bottom Line |

Supermicro Computer (SMCI) is on a parabolic run higher. Prior to this ithad a rocky history of stock growth. Supermicro Computer (SMCI) is on a parabolic run higher. Prior to this ithad a rocky history of stock growth.

Last quarter with the stock at $288 I stated “NVIDIA is getting all the attention for AI, but this company is benefiting from AI growth as well”. This quarter, SMCI is a more popular investment than NVIDIA itself. SMCI stays 2nd in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. NVIDIA is still the king! |

Power Rankings |

Growth Stock Portfolio

2 of 34Aggressive Growth Portfolio 2 of 17Conservative Stock Portfolio N/A |