Stock (Symbol) |

Palantir (PLTR) |

Stock Price |

$60 |

Sector |

| Technology |

Data is as of |

| November 12, 2024 |

Expected to Report |

| February 3 |

Company Description |

Palantir Technologies Inc. is engaged in building software to assist in counterterrorism investigations and operations. Palantir Technologies Inc. is engaged in building software to assist in counterterrorism investigations and operations.

It has built four principal software platforms, including Palantir Gotham (Gotham), Palantir Foundry (Foundry), Palantir Apollo (Apollo), and Palantir Artificial Intelligence Platform (AIP). Apollo is a cloud-agnostic, single control layer that coordinates ongoing delivery of new features, security updates, and platform configurations, helping to ensure the continuous operation of critical systems. Gotham enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants. Foundry transforms the ways organizations operate by creating a central operating system for their data. AIP enables responsible artificial intelligence (AI)-advantage across the enterprise by using primary, core components built to effectively activate large language models (LLMs) and other AI within any organization. Source: Refinitiv. |

Sharek’s Take |

Palantir (PLTR) reported exceptionally strong quarter as America embraces AI revolution. PLTR deliver 43% profit growth on 30% revenue growth, driven by an intensifying AI revolution that the US is rapidly driving. Management stated that the increase in AI demand had driven their revenue in the US revenue jumped 44% year-over-year. US commercial business grew 54% and US government business grew 40%. Management concluded the United States is winning the AI race and adopting Palantir & AI while Europe is being left behind. Palantir (PLTR) reported exceptionally strong quarter as America embraces AI revolution. PLTR deliver 43% profit growth on 30% revenue growth, driven by an intensifying AI revolution that the US is rapidly driving. Management stated that the increase in AI demand had driven their revenue in the US revenue jumped 44% year-over-year. US commercial business grew 54% and US government business grew 40%. Management concluded the United States is winning the AI race and adopting Palantir & AI while Europe is being left behind.

In terms of year-over-year segment revenue last qtr (sorted by largest segment):

Palantir takes a customer’s data and/or public data and solves complex problems that a regular program can’t solve. Examples include predicting things on the battlefield, where to seat passengers on a flight, logistics, or how much product can be sold to different areas around the world. Management says what’s most exciting about Palantir is the ability to launch products that are literally the only products on the market that will change your life and determine who fails across enterprise, both government and commercial (source: 2023 Q1 Earnings Call). Palantir has four principal software platforms:

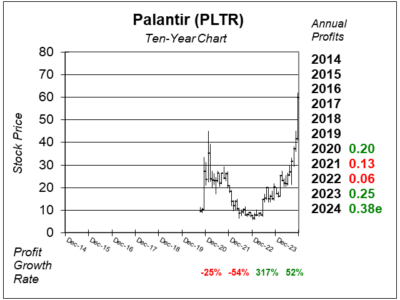

PLTR has an excellent Estimated Long Term Growth Rate of 59% but that’s an analyst estimate for profit growth, not stock growth (and certainly not revenue growth). PLTR made little in profits years ago investing in AI, and that’s not paying off with profits climbing at rapid rates. Investors are thinking ahead with this stock as growth is accelerating, thus the P/E of127 is high. Management doesn’t pay a dividend, but does repurchase stock. PLTR is currently in our Growth Portfolio. |

One Year Chart |

PLTR stock is on a parabolic run higher. Note this charts of from 11/12 when the stock was $60. Today, 12/2, the shares closed at $66. It’s dangerous to buy a lot of stock up here. PLTR stock is on a parabolic run higher. Note this charts of from 11/12 when the stock was $60. Today, 12/2, the shares closed at $66. It’s dangerous to buy a lot of stock up here.

PLTR has a P/E of 127, up from 76 last qtr. That’s a high P/E. Note since we are in the company’s Q4 I calculated the P/E using 2025 profit estimates. The Est. LTG is 59% this qtr. That’s an estimated 3-5 year profit growth estimate. Qtrly profit growth is very strong. I like those Estimates too. |

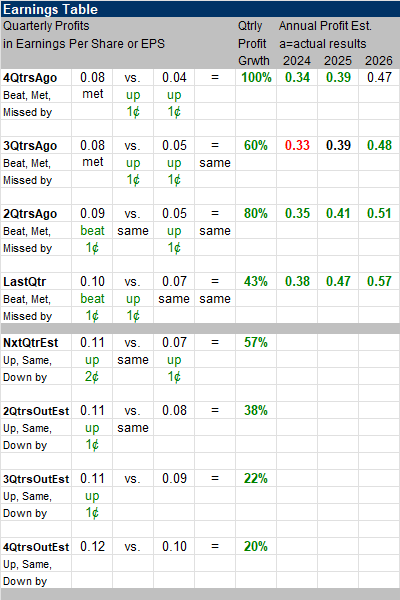

Earnings Table |

Last qtr, Palantir recorded 43% profit growth as it delivered a profit of $0.10 versus $0.07 a year ago, compared to estimated 29% profit growth. Revenue increased 30%, year-over-year versus estimates of 24%. Customer count increased 39% year-over-year. Adjusted Gross Margin was 82%. Operating Margin increased for the 8th straight qtr to 38% compared to 29% year ago. Last qtr, Palantir recorded 43% profit growth as it delivered a profit of $0.10 versus $0.07 a year ago, compared to estimated 29% profit growth. Revenue increased 30%, year-over-year versus estimates of 24%. Customer count increased 39% year-over-year. Adjusted Gross Margin was 82%. Operating Margin increased for the 8th straight qtr to 38% compared to 29% year ago.

Here’s the revenue mix by geography: United States : 44% year-or-year growth, 69% of total revenue. Annual Profit Estimates increased at healthy rates. For 2024, management increased its full year revenue guidance to 26% year-over-year. Qtrly Profit Estimates are for 57%, 38%, 22%, and 20% profit growth in the next 4 qtrs. Analysts think revenue will grow 24% next qtr. |

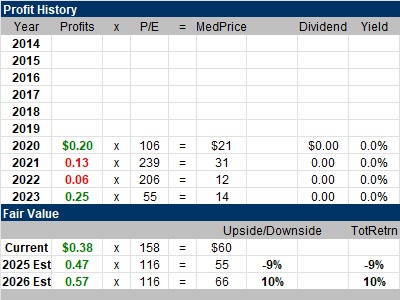

Fair Value |

PLTR had its IPO in September 2020, and at the end of September ended the month at $9.50 with a market cap of $16.4 billion. PLTR did $772 million in sales that year, thus the stock was selling for 21x 2020 revenue at the time. PLTR had its IPO in September 2020, and at the end of September ended the month at $9.50 with a market cap of $16.4 billion. PLTR did $772 million in sales that year, thus the stock was selling for 21x 2020 revenue at the time.

This qtr, PLTR sells for 48x 2024 revenue estimates. That’s super high and analysts are suggesting the stock’s on a hype train. But we are likely underestimating future sales and profits. My Fair Value is 35x revenue estimates. When we plug that into 2024 and 2025 revenue estimates:: Current: 2024 Fair Value: 2025 Fair Value: |

Bottom Line |

Palantir (PLTR) was at one time one of the hottest IPOs of 2020. Its software is unique and can deliver results other companies can not. But back then, the company wasn’t making profits. So after a brief run up, the stock fell down. Now, profit growth is rolling in, and the stock is on a parabolic move higher. Palantir (PLTR) was at one time one of the hottest IPOs of 2020. Its software is unique and can deliver results other companies can not. But back then, the company wasn’t making profits. So after a brief run up, the stock fell down. Now, profit growth is rolling in, and the stock is on a parabolic move higher.

PLTR’s growth is accelerating due to unheard of demand from both corporations and the government too. But I’d wait for the stock to settle down before buying in after a quick double in price. PLTR moves up from 11th to 9th in Growth Portfolio Power Rankings. I should have bought the stock earlier for the Aggressive Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

9 of 31Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |