Stock (Symbol) |

Pinterest (PINS) |

Stock Price |

$88 |

Sector |

| Technology |

Data is as of |

| February 16, 2021 |

Expected to Report |

| May 3 |

Company Description |

Pinterest, Inc. is a visual discovery engine. The Company operates a visual discovery platform, where users can create and manage theme-based image collections and share inspirations for their lives. Its visual discovery platform acts like a virtual Pinboard, where people uses pins to share their weddings, home decorating ideas, travel destinations, save images and videos on Web and organize their favorite recipes. Its offered platform is also integrated with image recognition technology, which allows users to take pictures through their smartphones and provides related information and ideas to the object. It offers online marketing services to brands, which allows brands to connect with people on the basis of their shared tastes and interests. It offered Pins include Recipe Pins, Video Pins, Product Pins and Shop the Look. Source: Thomson Financial Pinterest, Inc. is a visual discovery engine. The Company operates a visual discovery platform, where users can create and manage theme-based image collections and share inspirations for their lives. Its visual discovery platform acts like a virtual Pinboard, where people uses pins to share their weddings, home decorating ideas, travel destinations, save images and videos on Web and organize their favorite recipes. Its offered platform is also integrated with image recognition technology, which allows users to take pictures through their smartphones and provides related information and ideas to the object. It offers online marketing services to brands, which allows brands to connect with people on the basis of their shared tastes and interests. It offered Pins include Recipe Pins, Video Pins, Product Pins and Shop the Look. Source: Thomson Financial |

Sharek’s Take |

Pinterest (PINS) is looking like the next advertising juggernaut as the company’s focus on conversion ads is paying big dividends. Conversion ads are ads that are placed on social media platforms with the intent to sell a product or service. For instance, place a conversion ad for a shirt and the company shows the ad to consumers who are likely to buy the shirt. During the past year Pinterest management has invested in conversion optimization ads and better automation to help advertisers boost sales. And it worked, as shopping advertisers were up 6x last qtr. Here are some other stats from last qtr: Pinterest (PINS) is looking like the next advertising juggernaut as the company’s focus on conversion ads is paying big dividends. Conversion ads are ads that are placed on social media platforms with the intent to sell a product or service. For instance, place a conversion ad for a shirt and the company shows the ad to consumers who are likely to buy the shirt. During the past year Pinterest management has invested in conversion optimization ads and better automation to help advertisers boost sales. And it worked, as shopping advertisers were up 6x last qtr. Here are some other stats from last qtr:

Pinterest is a website where 442,000,000 people (affectionately called Pinners) go to get new ideas and “Pin” these to their personal collections, called boards. Ideas range from cooking ideas, what to wear, remodeling a house, training for a sport, or planning a wedding or dream vacation. Pinterest has invested heavily in computer vision that “see” the content of each Pin and make recommendations to help take action on the Pins they’ve found (source: 2019 Annual Report). As of December 31, 2019 Pinners saved 240 billion pins across 5 billion boards. Two-thirds of Pinners are female, including 8 of 10 moms. For advertisers, the company offers brand and performance ads, with performance ads representing 2/3rds of revenue in 2019. Brand revenue is billed via impressions or video views. Performance revenue is derived from clicks or conversion events (like adding to cart or purchasing). Pinterest ads appear in the news feed and on search results pages. New innovations include Augmented Reality (AR) products like Eye Shadow Try On. Ad formats are:

Pinterest primarily competes with search or e-commerce companies such as Facebook, Instagram, Google, Snap and Twitter. PINS spends very little on marketing, with user acquisition driven by traffic. But the company also expanded its sales team in Western Europe, and plans to expand monitization into Latin America in the first half of this year. What’s great about this stock is profits are expected to climb from $0.42 in 2020 to $3.10 in 2024. PINS was added to the Growth Portfolio last qtr, and I will increase my position in these client accounts today. I will also add PINS to the Aggressive Growth Portfolio. This is my type of stock. |

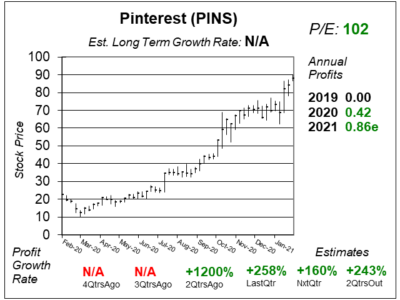

One Year Chart |

This stock has broken out three times within the past year: in July, October, and this month. The first two breakouts were on very high volume. This past one didn’t have the same impact. You can see the moves here. This stock has broken out three times within the past year: in July, October, and this month. The first two breakouts were on very high volume. This past one didn’t have the same impact. You can see the moves here.

Profits have been fantastic the past two qtrs, and triple-digit growth is expected to continue the next two qtrs. PINS has a P/E of 102. I think that’s reasonable. In the grand scheme, this is a $88 stock that’s expected to earn $3.10 a few years from now. So its selling for 28x future estimates. Not bad. It doesn’t have an Estimated Long-Term Growth Rate. If I had to guess I’d say this is a 65% grower long-term (I thought it was a 50% grower last qtr). |

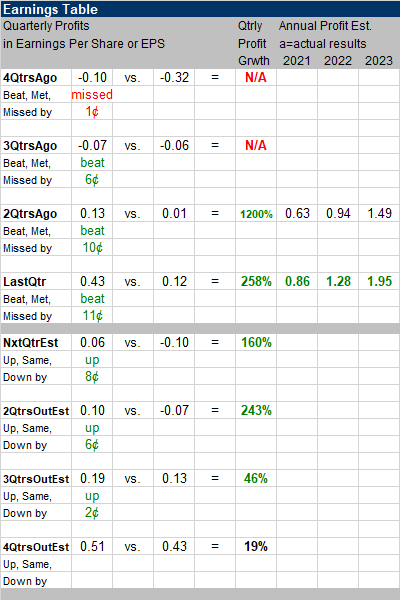

Earnings Table |

Last qtr, PINS delivered 258% profit growth and beat estimates of 167%. Revenue grew 76% and that was accelerating growth from 58% growth 2QtrsAgo. Last qtr, PINS delivered 258% profit growth and beat estimates of 167%. Revenue grew 76% and that was accelerating growth from 58% growth 2QtrsAgo.

Annual Profit Estimates rose, and there looks to be strong growth ahead: 2021 $0.86 Qtrly profit Estimates are for 160%, 243%, 46% and 19% profit growth the next 4 qtrs. That 4QtrsOut estimate probably needs time to adjust as PINS just beat the street and analysts are often slow to increase this far-out number. I like the triple-digit growth ahead. That may continue for a while longer than what is shown here as the company has beaten profit estimates by a wide margin the last 3 qtrs. |

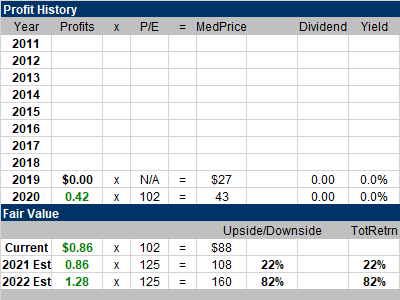

Fair Value |

My Fair Value P/E on PINS is 125. But I;ve only covered the stock for a little while, and haven’t gotten a good grasp on what the valuation should be. My Fair Value P/E on PINS is 125. But I;ve only covered the stock for a little while, and haven’t gotten a good grasp on what the valuation should be.

The big picture is analysts expect the company to make $3.10 in 2024. That’s a big number. If PINS gets a 75 P/E on $3.10 it could be a $233 stock in three years. There’s HUGE upside here. Since annual profit estimates have been rising, the company might earn a lot more than $3 a few years from now. |

Bottom Line |

Pinterest (PINS) had its IPO in April 2012 and opened at $24 share. The stock has been a hot-stock recently, and is now on a parabolic run. Still, I think the move is justified as big profits are expected to come in the years ahead. Pinterest (PINS) had its IPO in April 2012 and opened at $24 share. The stock has been a hot-stock recently, and is now on a parabolic run. Still, I think the move is justified as big profits are expected to come in the years ahead.

This was an outstanding performance put on by Pinterest, and I feel this company can make a lot of money with conversion ads. PINS jumps from 53rd to 4th in the the Growth Portfolio Power Rankings. I will add to my position in that portfolio. I will also add the stock to the Aggressive Growth Portfolio. This stock reminds me of Facebook in 2013 after the company put ads into its newsfeed. |

Power Rankings |

Growth Stock Portfolio

4 of 58Aggressive Growth Portfolio 4 of 24Conservative Stock Portfolio N/A |