On Friday, the stock market ended a volatile day with mixed results, as the NASDAQ rebounded from its three-day losing streak. Investors are now looking ahead to upcoming economic reports before Federal Reserve’s next rate decision in December.

On Friday, the stock market ended a volatile day with mixed results, as the NASDAQ rebounded from its three-day losing streak. Investors are now looking ahead to upcoming economic reports before Federal Reserve’s next rate decision in December.

Overall, S&P 500 was down 1.0% to 6,734, while NASDAQ increased 0.1% to 22,901.

Tweet of the Day

This is Bullish. Steady consumer spending means no recession. The Bull Market remains. https://t.co/9BOEK2NGJE

— David Sharek (@GrowthStockGuy) November 14, 2025

Chart of the Day

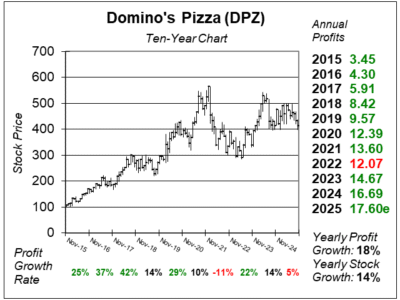

Here is the ten-year chart of Domino’s (DPZ) as of October 27, when the stock was at $413.

Here is the ten-year chart of Domino’s (DPZ) as of October 27, when the stock was at $413.

In the earnings release, management stated there was an unfavorable charge associated with the company’s investment in DPC Dash.

Overall, revenue grew 6% due to higher supply chain revenue and US franchise royalties. Sales in the US grew 7% as same-store sales increased 5% as Domino’s Best Deal Ever promo and Parmesan Stuffed Crust Pizza were big hits. The carryout business posted 9% comparable sales growth, supported by continued growth in the pizza chain’s loyalty program. Delivery increased 3% in the first quarter that the company fully rolled out its partnership with DoorDash nationwide. Internationally, sales increased 6% as same-store sales grew 2%, with sales particularly strong in India.

DPZ is part of our Conservative Growth Portfolio. Robots or driverless vehicles could boost the company’s growth rate.