About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

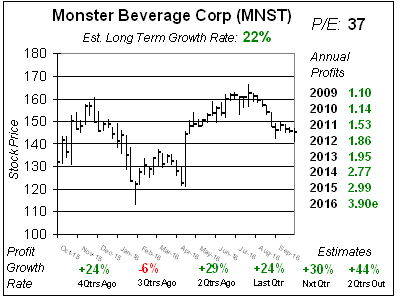

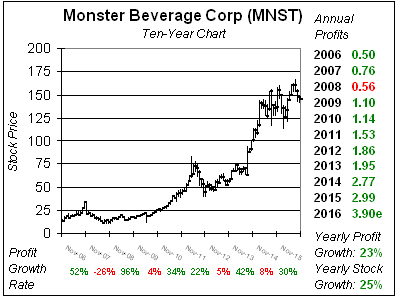

Monster Beverage (MNST) is in the midst of a huge International expansion. In June 2015 Coca-Cola bought a 17% stake in Monster, got all Monster’s non-energy drinks, with the arrangement that Coke would handle all Monster’s International distributing. MNST also got all Coke’s energy drinks. Monster had gotten only 1/4 of its sales abroad, and is now using Coca-Cola bottlers to quickly expand into other countries. It just transitioned to the new bottlers in South Africa and is now headed to North Africa to gain entry in more than 8 other countries. Other opportunities lie in Turkey, the Middle East, Australia, New Zealand and Singapore. This deal with Coca-Cola also gave MNST a ton of cash to use for acquisitions and stock buybacks. Management had issued a $2 billion share buyback program, and just bumped it up by another $250 million. It also acquired its principal flavor supplier American Fruits and Flavors — or AFF — getting ownership and intellectual property. The company is developing specialized drinks for certain lifestyles, like NASCAR or Burning man crowds, and those give NST more shelf space in coolers. Profits are expected to climb 33% on average the next 4 qtrs, which is one of the best growth rates of any stock I follow. I have traveled to Asia within the past two years and Monster drinks were rarely in the coolers. The International expansion story is real and gives this stock solid growth opportunity for the foreseeable future.

Monster Beverage (MNST) is in the midst of a huge International expansion. In June 2015 Coca-Cola bought a 17% stake in Monster, got all Monster’s non-energy drinks, with the arrangement that Coke would handle all Monster’s International distributing. MNST also got all Coke’s energy drinks. Monster had gotten only 1/4 of its sales abroad, and is now using Coca-Cola bottlers to quickly expand into other countries. It just transitioned to the new bottlers in South Africa and is now headed to North Africa to gain entry in more than 8 other countries. Other opportunities lie in Turkey, the Middle East, Australia, New Zealand and Singapore. This deal with Coca-Cola also gave MNST a ton of cash to use for acquisitions and stock buybacks. Management had issued a $2 billion share buyback program, and just bumped it up by another $250 million. It also acquired its principal flavor supplier American Fruits and Flavors — or AFF — getting ownership and intellectual property. The company is developing specialized drinks for certain lifestyles, like NASCAR or Burning man crowds, and those give NST more shelf space in coolers. Profits are expected to climb 33% on average the next 4 qtrs, which is one of the best growth rates of any stock I follow. I have traveled to Asia within the past two years and Monster drinks were rarely in the coolers. The International expansion story is real and gives this stock solid growth opportunity for the foreseeable future.