Stock (Symbol)

|

3M (MMM)

|

Stock Price

|

$178

|

Sector

|

| Food & Necessities |

Data is as of

|

| December 10, 2016 |

Expected to Report

|

| Jan 24 |

Company Description

|

3M Company operates in five business segments: Industrial, which serves a range of markets, such as automotive original equipment manufacturer (OEM) and automotive aftermarket, electronics, appliance, paper and printing, packaging, food and beverage, and construction; Safety and Graphics, which serves a range of markets for the safety, security and productivity of people, facilities and systems; Electronics and Energy, which serves customers in electronics and energy markets, including solutions for electronic devices, telecommunications networks, electrical products, power generation and distribution, and infrastructure protection; Health Care – markets that include medical clinics and hospitals, pharmaceuticals, dental and orthodontic practitioners, and health information systems, and Consumer, which serves markets that include consumer retail, office retail, home improvement, building maintenance and other markets. Source: Thomson Financial 3M Company operates in five business segments: Industrial, which serves a range of markets, such as automotive original equipment manufacturer (OEM) and automotive aftermarket, electronics, appliance, paper and printing, packaging, food and beverage, and construction; Safety and Graphics, which serves a range of markets for the safety, security and productivity of people, facilities and systems; Electronics and Energy, which serves customers in electronics and energy markets, including solutions for electronic devices, telecommunications networks, electrical products, power generation and distribution, and infrastructure protection; Health Care – markets that include medical clinics and hospitals, pharmaceuticals, dental and orthodontic practitioners, and health information systems, and Consumer, which serves markets that include consumer retail, office retail, home improvement, building maintenance and other markets. Source: Thomson Financial

|

Sharek’s Take

|

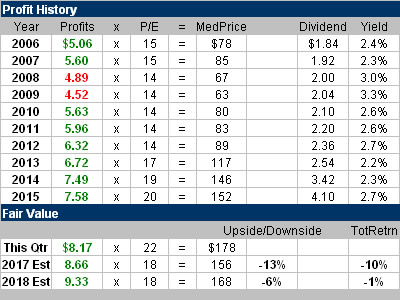

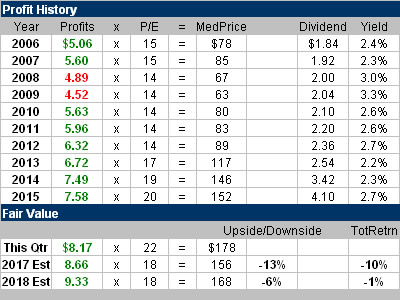

3M (MMM) is having its annual meeting today, and the big takeaway is management expects 2017 profits to fall between $8.45-8.80 vs. current analyst estimates of $8.66. Known for Post-It notes, Minnesota Mining and Manufacturing got its roots in selling sandpaper, and made its first sale in $1906 for $2 — four years after the company was founded. In 1925 Scotch tape was invented, Scotchgard was first sold in 1956, and Thinsulate thermal insulation was introduced in 1979. It 1980 the yellow Post-It note came to market. Today #M has five business divisions: Health Care (31% of 2016 sales), Safety & Graphics which includes yellow safety vests (25%), Industrial (23%), Electronics & Energy (21%, and Consumer including Post-It notes (24%). MMM is a safe stock with an Estimated Long-Term Growth Rate of 8% per year plus a 3% dividend that’s increased every year since 1959. If the company hits the high-end of the 2017 profit range, that would mean profit growth of perhaps 8% next year (with -1% to -3% sales growth from F/X baked in). But at 21x earnings I think the stock is rich. From 2006 to 2012 MMM had a median P/E of 14 or 15 every single year. I think the stock is worth 18x earnings and my current Fair Value for 2017 is $156. 3M (MMM) is having its annual meeting today, and the big takeaway is management expects 2017 profits to fall between $8.45-8.80 vs. current analyst estimates of $8.66. Known for Post-It notes, Minnesota Mining and Manufacturing got its roots in selling sandpaper, and made its first sale in $1906 for $2 — four years after the company was founded. In 1925 Scotch tape was invented, Scotchgard was first sold in 1956, and Thinsulate thermal insulation was introduced in 1979. It 1980 the yellow Post-It note came to market. Today #M has five business divisions: Health Care (31% of 2016 sales), Safety & Graphics which includes yellow safety vests (25%), Industrial (23%), Electronics & Energy (21%, and Consumer including Post-It notes (24%). MMM is a safe stock with an Estimated Long-Term Growth Rate of 8% per year plus a 3% dividend that’s increased every year since 1959. If the company hits the high-end of the 2017 profit range, that would mean profit growth of perhaps 8% next year (with -1% to -3% sales growth from F/X baked in). But at 21x earnings I think the stock is rich. From 2006 to 2012 MMM had a median P/E of 14 or 15 every single year. I think the stock is worth 18x earnings and my current Fair Value for 2017 is $156. |

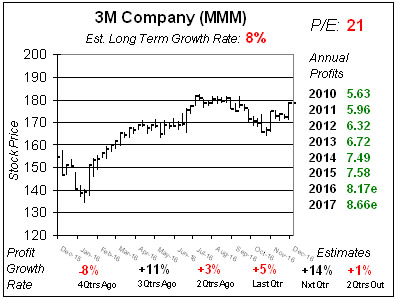

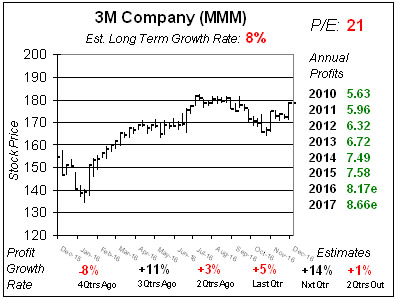

One Year Chart

|

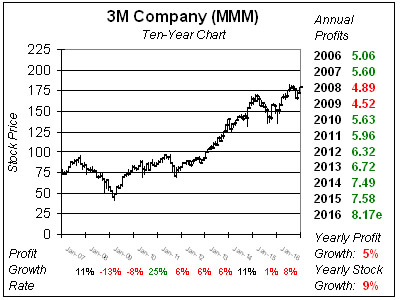

This stock was in the $160s a couple months ago. And it was in the $140s-$150s around the beginning of the year. Now all-of-a-sudden this industrial stock is worth $180? I think that’s a little high. Last qtr the company delivered 5% profit growth and 0% sales growth. Profit growth was helped by stock buybacks. Looking ahead, profits are expected to be 14%, 1%, 8% and 6% the next 4 qtrs. What’s odd is these figures just came down. Perhaps they will rise a little bit now that the annual meeting is taking place. BTW 2017 estimates have gone from $8.91 to $8.94, $8.83 and $8.66 the last 4 qtrs. So this number has been falling. This stock was in the $160s a couple months ago. And it was in the $140s-$150s around the beginning of the year. Now all-of-a-sudden this industrial stock is worth $180? I think that’s a little high. Last qtr the company delivered 5% profit growth and 0% sales growth. Profit growth was helped by stock buybacks. Looking ahead, profits are expected to be 14%, 1%, 8% and 6% the next 4 qtrs. What’s odd is these figures just came down. Perhaps they will rise a little bit now that the annual meeting is taking place. BTW 2017 estimates have gone from $8.91 to $8.94, $8.83 and $8.66 the last 4 qtrs. So this number has been falling. |

Fair Value

|

It’s very odd that this stock had the same P/E for so many years and now all-of-a-sudden its worth 50% more. I feel that’s investors looking for yield, as CD rates remain low. Perhaps higher rates will bring 3M’s P/E down? It’s very odd that this stock had the same P/E for so many years and now all-of-a-sudden its worth 50% more. I feel that’s investors looking for yield, as CD rates remain low. Perhaps higher rates will bring 3M’s P/E down? |

Bottom Line

|

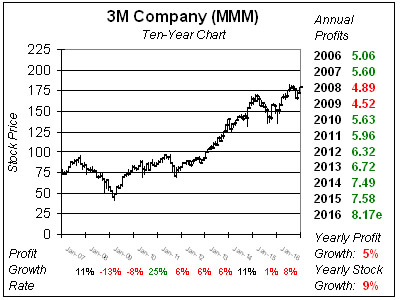

3M is such a good stock, I think families can own it for generations, as this organization is well-positioned for success in 2017 and beyond. But now doesn’t seem to be a good time to take a position. I wish to point out the Yearly Stock Growth of 9% per year is much higher than the Yearly Profit Growth of 5%. To me that signals the stock has gotten ahead of itself. The P/E is also high by historical standards. I feel investors in search of income have pushed this stock to its highs, and when CD rates rise they might take some profits. MMM is on my radar for the Conservative Growth Portfolio, but right now is really only appropriate for large trust funds that demand the highest safety in their stock holdings. 3M is such a good stock, I think families can own it for generations, as this organization is well-positioned for success in 2017 and beyond. But now doesn’t seem to be a good time to take a position. I wish to point out the Yearly Stock Growth of 9% per year is much higher than the Yearly Profit Growth of 5%. To me that signals the stock has gotten ahead of itself. The P/E is also high by historical standards. I feel investors in search of income have pushed this stock to its highs, and when CD rates rise they might take some profits. MMM is on my radar for the Conservative Growth Portfolio, but right now is really only appropriate for large trust funds that demand the highest safety in their stock holdings. |

Power Rankings

|

Growth Stock Portfolio

N/A

Aggressive Growth Portfolio

N/A

Conservative Stock Portfolio

N/A

|

3M Company operates in five business segments: Industrial, which serves a range of markets, such as automotive original equipment manufacturer (OEM) and automotive aftermarket, electronics, appliance, paper and printing, packaging, food and beverage, and construction; Safety and Graphics, which serves a range of markets for the safety, security and productivity of people, facilities and systems; Electronics and Energy, which serves customers in electronics and energy markets, including solutions for electronic devices, telecommunications networks, electrical products, power generation and distribution, and infrastructure protection; Health Care – markets that include medical clinics and hospitals, pharmaceuticals, dental and orthodontic practitioners, and health information systems, and Consumer, which serves markets that include consumer retail, office retail, home improvement, building maintenance and other markets. Source: Thomson Financial

3M Company operates in five business segments: Industrial, which serves a range of markets, such as automotive original equipment manufacturer (OEM) and automotive aftermarket, electronics, appliance, paper and printing, packaging, food and beverage, and construction; Safety and Graphics, which serves a range of markets for the safety, security and productivity of people, facilities and systems; Electronics and Energy, which serves customers in electronics and energy markets, including solutions for electronic devices, telecommunications networks, electrical products, power generation and distribution, and infrastructure protection; Health Care – markets that include medical clinics and hospitals, pharmaceuticals, dental and orthodontic practitioners, and health information systems, and Consumer, which serves markets that include consumer retail, office retail, home improvement, building maintenance and other markets. Source: Thomson Financial 3M (MMM) is having its annual meeting today, and the big takeaway is management expects 2017 profits to fall between $8.45-8.80 vs. current analyst estimates of $8.66. Known for Post-It notes, Minnesota Mining and Manufacturing got its roots in selling sandpaper, and made its first sale in $1906 for $2 — four years after the company was founded. In 1925 Scotch tape was invented, Scotchgard was first sold in 1956, and Thinsulate thermal insulation was introduced in 1979. It 1980 the yellow Post-It note came to market. Today #M has five business divisions: Health Care (31% of 2016 sales), Safety & Graphics which includes yellow safety vests (25%), Industrial (23%), Electronics & Energy (21%, and Consumer including Post-It notes (24%). MMM is a safe stock with an Estimated Long-Term Growth Rate of 8% per year plus a 3% dividend that’s increased every year since 1959. If the company hits the high-end of the 2017 profit range, that would mean profit growth of perhaps 8% next year (with -1% to -3% sales growth from F/X baked in). But at 21x earnings I think the stock is rich. From 2006 to 2012 MMM had a median P/E of 14 or 15 every single year. I think the stock is worth 18x earnings and my current Fair Value for 2017 is $156.

3M (MMM) is having its annual meeting today, and the big takeaway is management expects 2017 profits to fall between $8.45-8.80 vs. current analyst estimates of $8.66. Known for Post-It notes, Minnesota Mining and Manufacturing got its roots in selling sandpaper, and made its first sale in $1906 for $2 — four years after the company was founded. In 1925 Scotch tape was invented, Scotchgard was first sold in 1956, and Thinsulate thermal insulation was introduced in 1979. It 1980 the yellow Post-It note came to market. Today #M has five business divisions: Health Care (31% of 2016 sales), Safety & Graphics which includes yellow safety vests (25%), Industrial (23%), Electronics & Energy (21%, and Consumer including Post-It notes (24%). MMM is a safe stock with an Estimated Long-Term Growth Rate of 8% per year plus a 3% dividend that’s increased every year since 1959. If the company hits the high-end of the 2017 profit range, that would mean profit growth of perhaps 8% next year (with -1% to -3% sales growth from F/X baked in). But at 21x earnings I think the stock is rich. From 2006 to 2012 MMM had a median P/E of 14 or 15 every single year. I think the stock is worth 18x earnings and my current Fair Value for 2017 is $156.