Stock (Symbol) |

Meta Platforms (META) |

Stock Price |

$687 |

Sector |

| Technology |

Data is as of |

| June 4, 2025 |

Expected to Report |

| July 29 |

Company Description |

Meta Platforms Inc., formerly Facebook, Inc., builds technologies that help people find communities and grow businesses. Meta Platforms Inc., formerly Facebook, Inc., builds technologies that help people find communities and grow businesses.

The Company’s products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. The Company operates through two segments: Family of Apps (FoA) and Reality Labs (RL). FoA includes Facebook, Instagram, Messenger, WhatsApp, and other services. RL includes augmented and virtual reality-related consumer hardware, software, and content. Facebook enables people to connect, share, discover and communicate with each other on mobile devices and personal computers. Instagram is a place where people can express themselves through photos, videos, and private messaging, and connect with and shop from their favorite businesses and creators. Messenger is a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices. |

Sharek’s Take |

Meta Platforms (META) CEO Mark Zuckerberg stated AI is transforming everything Meta does, and the company is continuing to increase its investments in AI with a focus on these five major opportunities: Meta Platforms (META) CEO Mark Zuckerberg stated AI is transforming everything Meta does, and the company is continuing to increase its investments in AI with a focus on these five major opportunities:

Each of these is a long-term investment that builds on Meta’s development of general intelligence and leading AI models and infrastructure. Management stated even with significant spending, the company doesn’t need every initiative to succeed in order to see a strong return. However, Zuckerberg concluded that if multiple areas do succeed, Meta believes the payoff will be exceptionally rewarding. Meta Platforms, formerly Facebook, builds applications that enable people to connect and share with friends and family through mobile devices, personal computers, reality headsets, and in-home devices. The company has around 3.43 billion daily users within its Family of Apps. Management has been investing heavily in AI infrastructure, which has boosted ad performance. Meta properties include:

Meta’s stock has been on a wild ride for the past couple of years. The company “bet the farm” on developing a metaverse in 2022. Profits tanked, as did the stock. In 2023, management refocused on its core products and slashed expenses in a year of efficiency. Management cut headcount 22% during 2023 as profits got back on track. For 2024, the company repurchased $30 billion worth of shares as part of its capital return program. It also distributed dividends worth $5 billion. META is part of the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

META stock has been a warrior since earnings as its gone up 25% from $549 to $687. But the negative is the stock went from undervalued to fairly valued. My 2025 Fair Value price target is $687. META stock has been a warrior since earnings as its gone up 25% from $549 to $687. But the negative is the stock went from undervalued to fairly valued. My 2025 Fair Value price target is $687.

The Est. LTG is 12% this qtr, up from 11% last qtr. That’s an analyst estimate of what profits could grow over the next 3-5 years, not estimated stock growth. I think META can grow profits 20% to 25% a year. Qtrly profit Estimates show growth is expected to slow in the coming quarters due to higher spending on AI infrastructure. |

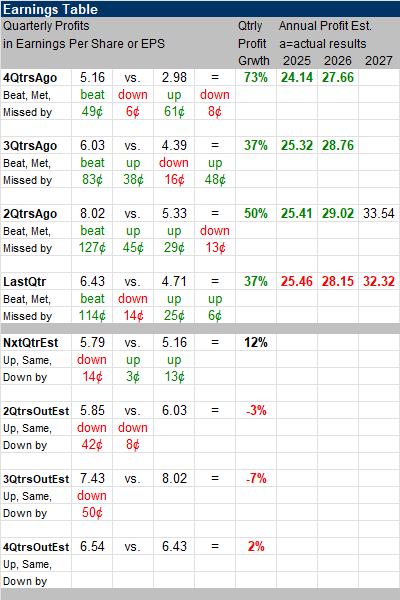

Earnings Table |

Last qtr, Meta generated 37% profit growth and surpassed estimates of 27% growth. Revenue increased 16%, year-on-year above estimates of 14%. Operating Margin moved up to 41% from 38% in the year-ago period. Last qtr, Meta generated 37% profit growth and surpassed estimates of 27% growth. Revenue increased 16%, year-on-year above estimates of 14%. Operating Margin moved up to 41% from 38% in the year-ago period.

Annual Profit Estimates are down this qtr. For 2025, management expects CapEx growth to be in range of $64 billion to $72 billion, driven by additional data center investments to support AI efforts. Note, Meta’s CapEx was $39 billion in 2024. Qtrly Profit Estimates are for 12% -3%, -7%, and 2% profit growth in the next 4 qtrs. Analysts think Meta’s revenue will grow 14% next qtr. |

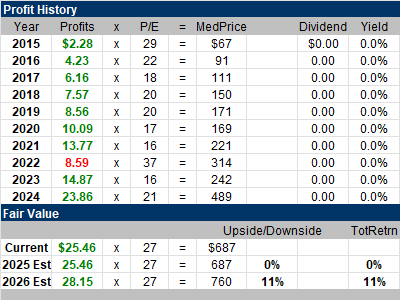

Fair Value |

META’s current P/E is 27 and my Fair Value P/E is 27. So the shares are failry valued in my opinion. META’s current P/E is 27 and my Fair Value P/E is 27. So the shares are failry valued in my opinion.

But this report is so good I can imagine the stock continuing higher. 2026 Est Fair Value sits at $765 a share, giving the stock upside of 11%. |

Bottom Line |

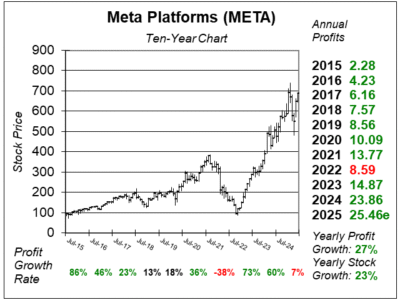

Meta Platforms’ (META) ten-year chart is ugly. The company got off track for a bit and was throwing money at metaverse spending. Then management focused more on cutting expenses, shareholders rejoiced, and the stock rebounded. Now the company is focused on AI and profits are growing nicely. Meta Platforms’ (META) ten-year chart is ugly. The company got off track for a bit and was throwing money at metaverse spending. Then management focused more on cutting expenses, shareholders rejoiced, and the stock rebounded. Now the company is focused on AI and profits are growing nicely.

Meta is executing magnificently right now. The lower profit estimates are ok with investors as the AI spend is improving results as profit magins swell.And my guess is the company will keep beating the street anyway. META slips from 5th to 7th in the Growth Portfolio Power Rankings as the stock’s 2025 upside has gone from +9% to 0% since last qtr. In the Aggressive Growth Portfolio the stock drops from 5th to 9th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

7 of 32Aggressive Growth Portfolio 9 of 13Conservative Stock Portfolio N/A |