Stock (Symbol) |

Meta Platforms (META) |

Stock Price |

$697 |

Sector |

| Technology |

Data is as of |

| February 3, 2025 |

Expected to Report |

| April 22 |

Company Description |

Meta Platforms Inc., formerly Facebook, Inc., builds technologies that help people find communities and grow businesses. Meta Platforms Inc., formerly Facebook, Inc., builds technologies that help people find communities and grow businesses.

The Company’s products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. The Company operates through two segments: Family of Apps (FoA) and Reality Labs (RL). FoA includes Facebook, Instagram, Messenger, WhatsApp, and other services. RL includes augmented and virtual reality-related consumer hardware, software, and content. Facebook enables people to connect, share, discover and communicate with each other on mobile devices and personal computers. Instagram is a place where people can express themselves through photos, videos, and private messaging, and connect with and shop from their favorite businesses and creators. Messenger is a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices. |

Sharek’s Take |

Meta Platforms (META) is making a bold move in Artificial Intelligence, investing heavily to develop the ultimate AI assistant. Because of this focused investment on AI for 2025, the company now expects CapEx to be in range of $60 billion to $65 billion up from the range of $38 billion to $40 billion. Note, Meta’s Capital Expenditures was only $39.23 billion for full year 2024. Mark Zuckerberg made it clear that his vision is set to make Meta AI the most widely used and advanced AI assistant in the world. Meta AI is an AI assistant that can perform a variety of tasks, including answering questions, generating images, and providing recommendations. It’s available in Meta’s apps, including Facebook, WhatsApp, Messenger, and Instagram. Meta Platforms (META) is making a bold move in Artificial Intelligence, investing heavily to develop the ultimate AI assistant. Because of this focused investment on AI for 2025, the company now expects CapEx to be in range of $60 billion to $65 billion up from the range of $38 billion to $40 billion. Note, Meta’s Capital Expenditures was only $39.23 billion for full year 2024. Mark Zuckerberg made it clear that his vision is set to make Meta AI the most widely used and advanced AI assistant in the world. Meta AI is an AI assistant that can perform a variety of tasks, including answering questions, generating images, and providing recommendations. It’s available in Meta’s apps, including Facebook, WhatsApp, Messenger, and Instagram.

Meta Platforms, formerly Facebook, builds applications that enable people to connect and share with friends and family through mobile devices, personal computers, reality headsets, and in-home devices. The company has around 3.29 billion daily users within its Family of Apps. Management has been investing heavily in AI infrastructure, which has boosted ad performance. In the 2023 Q4 earnings call, management stated it had world-class infrastructure and by the end of 2024 would have 350,000 NVIDIA H100s, and with other computers, it will be around 600,000 H100 equivalents to compute. Facebook’s short video feature Reels allows users to take videos and then add effects and music to share. Reels is a new catalyst for the company. Meta properties include:

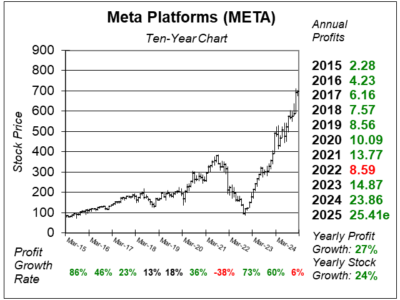

Meta’s stock has been on a wild ride for the past couple of years. The company “bet the farm” on developing a metaverse in 2022. Profits tanked, as did the stock. In 2023, management refocused on its core products and slashed expenses in a year of efficiency. Management cut headcount 22% during 2023 to 67,317 as profits got back on track, headcount was 74,067 as of December 31, 2024, an increase of 10% year-over-year. For 2024, the company repurchased $29.75 billion worth of shares as part of its capital return program. It also dustributed dividends worth $5.07 billion for the full year 2024. This stock has been climbing higher. META is part of the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

META stock continue to trend higher, and recently reached $700 level. The stock was around $500 a year ago, and around $150 two years ago. META stock continue to trend higher, and recently reached $700 level. The stock was around $500 a year ago, and around $150 two years ago.

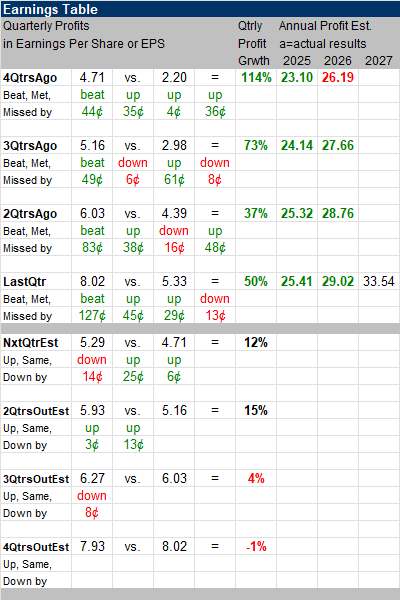

The Est. LTG is 11% this qtr, down from 17% last qtr. That’s an analyst estimate of what profits could grow over the next 3-5 years, not estimated stock growth. I think META can grow profits 20% to 25% a year. Qtrly profit Estimates show growth is expected to slow, but take note the company has been beating the street by a bunch in each of the last 4 qtrs. |

Earnings Table |

Last qtr, Meta generated 50% profit growth and surpassed estimates of 27% growth. Revenue increased 21%, year-on-year above estimates of 17%. Notice in the table how the company has whipped profit estimates in the past four quarters. Operating Margin moved up to 48% from 41% in the year-ago period. Last qtr, Meta generated 50% profit growth and surpassed estimates of 27% growth. Revenue increased 21%, year-on-year above estimates of 17%. Notice in the table how the company has whipped profit estimates in the past four quarters. Operating Margin moved up to 48% from 41% in the year-ago period.

Annual Profit Estimates are up slightly this qtr. For 2025, management expects CapEx growth to be in range of $60 billion to $65 billion, driven by increased investment to support generative AI and core business. Note, Meta’s CapEx was only $39.23 billion for the full year 2024. Qtrly Profit Estimates are for 12% 15%, 4%, and -1% profit growth in the next 4 qtrs. Analysts think Meta’s revenue will grow 14% next qtr. |

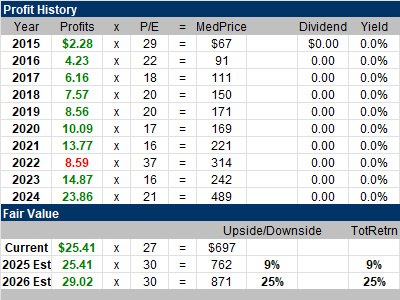

Fair Value |

My Fair Value P/E is 30. The current P/E is 27. My Fair Value P/E is 30. The current P/E is 27.

This stock has 9% upside to my $762 Fair Value for 2025, and 25% upside when we look to 2026. |

Bottom Line |

Meta Platforms’ (META) ten-year chart is ugly. The company got off track for a bit and was throwing money at metaverse spending. Then management focused more on cutting expenses, shareholders rejoiced, then the stock rebounded. Now the company is focused on efficiency, and profits are growing nicely. Meta Platforms’ (META) ten-year chart is ugly. The company got off track for a bit and was throwing money at metaverse spending. Then management focused more on cutting expenses, shareholders rejoiced, then the stock rebounded. Now the company is focused on efficiency, and profits are growing nicely.

Meta is executing magnificently right now. Revenue is climbing nicely with the help of AI while profit margins rise. The only negative here is 2025 upside just declined from 24% to 9% since last qtr. META stays 5th in the Growth Portfolio Power Rankings. In the Aggressive Growth Portfolio the stock drops from 6th to 9th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

5 of 32Aggressive Growth Portfolio 9 of 15Conservative Stock Portfolio N/A |