Stock (Symbol) |

MercadoLibre (MELI) |

Stock Price |

$2058 |

Sector |

| Retail & Travel |

Data is as of |

| November 17, 2025 |

Expected to Report |

| February 24 |

Company Description |

MercadoLibre Inc is a Uruguay-based e-commerce business facilitator of Argentinian origins. MercadoLibre Inc is a Uruguay-based e-commerce business facilitator of Argentinian origins.

The e-commerce products enable retail and wholesale via Internet platforms designed to provide users with a portfolio of services to facilitate commercial transactions. The Company’s geographic coverage includes 18 countries of Latin America. The primary offer is an ecosystem of six integrated e-commerce services: the Mercado Libre Marketplace, the Mercado Libre Classifieds service, the Mercado Pago payments solution, the Mercado Credito financial solutions, the Mercado Envios logistic solutions including shipping, the Mercado Ads advertising platform and the Mercado Shops digital storefront solution. Source: Refinitiv |

Sharek’s Take |

MercadoLibre (MELI) profits came in soft last quarter and are expected to dip again next quarter because the company is choosing to invest heavily. Last qtr, the company delivered 6% profit growth and next qtr it’s expected to fall to -7%. The company is intentionally pouring money into free shipping in Brazil — by lowering free-shipping minimum from 79 Brazillian Real (BRL) to 19 BRL — expanding logistics with more fulfillment centers, and adding slower-delivery options to attract budget shoppers. In Argentina, tough economic conditions also put pressure on margins and their fast-growing credit business — now $11 billion in size — brings higher costs as it expands. But as these investments scale, profitability is projected to rebound sharply with the following quarters expected to grow +30%, +41%, and +74%. MELI is trading short-term margin softness for long-term dominance across e-commerce, fintech, and logistics. MercadoLibre (MELI) profits came in soft last quarter and are expected to dip again next quarter because the company is choosing to invest heavily. Last qtr, the company delivered 6% profit growth and next qtr it’s expected to fall to -7%. The company is intentionally pouring money into free shipping in Brazil — by lowering free-shipping minimum from 79 Brazillian Real (BRL) to 19 BRL — expanding logistics with more fulfillment centers, and adding slower-delivery options to attract budget shoppers. In Argentina, tough economic conditions also put pressure on margins and their fast-growing credit business — now $11 billion in size — brings higher costs as it expands. But as these investments scale, profitability is projected to rebound sharply with the following quarters expected to grow +30%, +41%, and +74%. MELI is trading short-term margin softness for long-term dominance across e-commerce, fintech, and logistics.

MercadoLibre is the largest online commerce platform in Latin America and gives users a portfolio of services to do commercial transactions. The company is like South America’s combination of eBay, PayPal, and Shopify rolled into one. Here’s a quick rundown of the company’s history:

Here are some business highlights from last qtr:

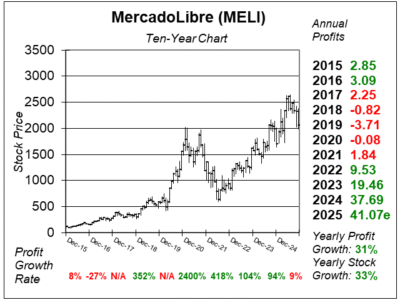

MELI’s numbers are exceptional, especially profit estimates for the years ahead. Analysts give the company an Estimated Long-Term Growth Rate of 32%. This company looks a lot like Amazon did when its profits began rolling in. Analysts estimate MELI’s profits to grow from ~$40 a share in 2025 to maybe $150 in 2029. MELI is a top holding in the Aggressive Growth Portfolio and Growth Portfolio. The stock is weak due to high spending and increased competition. |

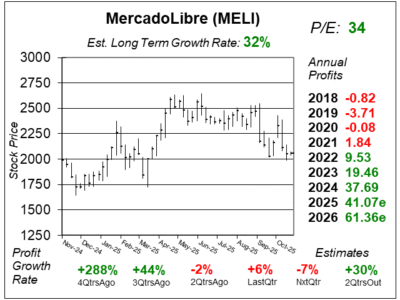

One Year Chart |

MELI stock has been a dissapointment this year. And here you can see why. Quarterly profit growth evaporated. MELI stock has been a dissapointment this year. And here you can see why. Quarterly profit growth evaporated.

The Est. LTG is 32%, same with 2QtrsAgo. That would be a nice profit growth rate. The P/E is 34, down from 53 2QtrsAgo. But this qtr I calculated the P/E in this chart off of next year’s (2026) profit estimates because we are in the company’s Fiscal Q4. Notice in Annual Profits that profits are expected to climb from $41 to $61 in 2026. That’s HUGE. Quarterly profit growth is often erratic with this company. We have to accept this. It’s been that way for years. |

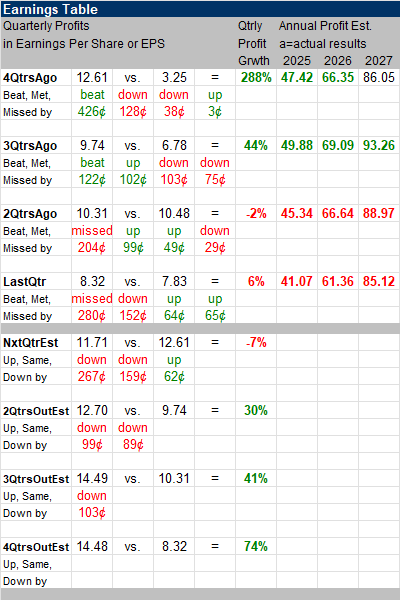

Earnings Table |

Last qtr, MercadoLibre reported 6% profit growth, and missed analyst’s expectation of 42% growth. Revenue increased 39%, year-over-year in US dollars against analyst estimates of 37%. Operating Margin (Income from Operations Margin) was 9.8%, down from 10.5% a year-ago. Last qtr, MercadoLibre reported 6% profit growth, and missed analyst’s expectation of 42% growth. Revenue increased 39%, year-over-year in US dollars against analyst estimates of 37%. Operating Margin (Income from Operations Margin) was 9.8%, down from 10.5% a year-ago.

Here’s geographic revenue growth from last qtr:

Annual Profit Estimates decreased this qtr. That free shipping is taking a bite out of profits. Here’s how annual estimates it looks like: 2025: $41.07 Qtrly Profit Estimates got crushed but still show -7%, 30%, 41%, and 74% profit growth the next 4 qtrs. Analysts think MELI revenue will grow 38% next quarter. |

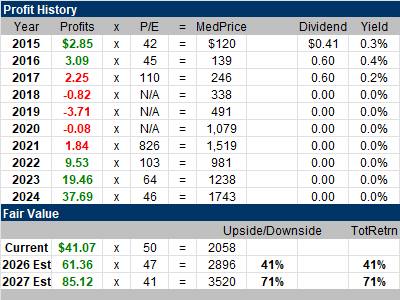

Fair Value |

I’m pricing MELI on a price-to-sales basis. Looking back to past years (2014-2024), MELI’s year-end price-to-sales ratio was: 10, 8, 8, 11, 9, 12, 21, 9, 4, 5, and most recently 4. I’m pricing MELI on a price-to-sales basis. Looking back to past years (2014-2024), MELI’s year-end price-to-sales ratio was: 10, 8, 8, 11, 9, 12, 21, 9, 4, 5, and most recently 4.

This qtr, the stock sells for 4x 2025 revenue estimates, my Fair Value is 5x 2025 revenue: Current: 2025 Fair Value: 2026 Fair Value: |

Bottom Line |

MercadoLibre (MELI) has been a wild stock the past five years. Overall this has been an excellent investment as MELI went public in 2007 and opened at $22 a share. MercadoLibre (MELI) has been a wild stock the past five years. Overall this has been an excellent investment as MELI went public in 2007 and opened at $22 a share.

MercadoLibre missed profit estimates and future estimates got cut as well. But profits are expected to climb mightily in the coming quarters. The valuation is good too. MELI ranks 8th in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

8 of 30Aggressive Growth Portfolio 8 of 15Conservative Stock Portfolio N/A |