The stock market took a step back on Tuesday, following the holiday weekend, as investors awaited Federal Reserve’s Chair Jerome Powell testimony. This held back a market rally that has seen indices reach their highest levels of the year.

The stock market took a step back on Tuesday, following the holiday weekend, as investors awaited Federal Reserve’s Chair Jerome Powell testimony. This held back a market rally that has seen indices reach their highest levels of the year.

Overall, S&P 500 declined 0.5% to 4,389, while NASDAQ went down 0.2% to 13,667.

Tweet of the Day

Palantir $PLTR CEO recently indicates a significant surge in business interest, with more inbound callsfrom prospective customers in the past few weeks than it did throughout the entire previous year.

Intriguingly, the decision-making process has notably shifted as well;…

— Convequity (@convequity) June 18, 2023

Chart of the Day

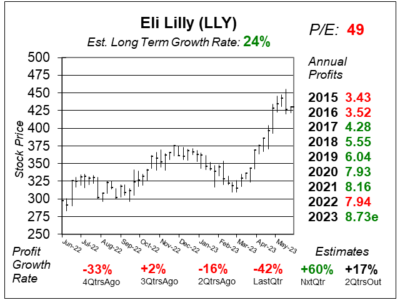

Here is the one-year chart of Eli Lilly (LLY) as of May 31, 2023, when the stock was at $429.

Here is the one-year chart of Eli Lilly (LLY) as of May 31, 2023, when the stock was at $429.

Eli Lilly discovers, develops, manufactures, and markets human pharmaceuticals to approximately 120 countries worldwide. The company’s products are therapies for diabetes, oncology, immunology, and neuroscience.

Eli Lilly has two catalysts that have investors impressed. First is the diabetes drug Mounjaro which is also being used to treat obesity (even though it is not approved for that yet). Sales of Mounjaro blew past analyst estimates last quarter. Second is the company’s Alzheimer’s treatment in Donanemab that slows the cognitive decline with people in the early stages of the disease. The good news about these two treatments has sent the stock soaring.

Quarterly profit growth is expected to improve next quarter as tough comparisons from strong COVID-19 antibody sales will ease. The Estimated Long-Term Growth Rate of 24% is very good.

LLY is part of the Conservative Growth Portfolio.