Stock (Symbol) |

HubSpot (HUBS) |

Stock Price |

$513 |

Sector |

| Technology |

Data is as of |

| September 18, 2025 |

Expected to Report |

| November 4 |

Company Description |

HubSpot, Inc. provides a cloud-based customer relationship management (CRM) platform that enables companies to attract and engage users. HubSpot, Inc. provides a cloud-based customer relationship management (CRM) platform that enables companies to attract and engage users.

Its CRM Platform is a single code-based software-as-a-service delivered through web browsers or mobile applications. The Company’s CRM platform provides Marketing Hub, Sales Hub, Service Hub, Content Management system (CMS) Hub, and Operations as well as other tools and integrations that enable companies to attract and engage customers throughout the customer experience. Its CRM Platform features include search engine, blogging, Website content management, messaging, chatbots, social media, marketing automation, email, predictive lead scoring, sales productivity, ticketing and helpdesk tools, customer NPS surveys, analytics, and reporting. Source: Refinitiv |

Sharek’s Take |

HubSpot (HUBS) stock has been weak as (1) profit growth has slowed and (2) the software sector is out of favor with investors. The Software industry is weak because investors feel AI will become easier and companies will be able to control the software they need to operate and not have to rely on outside vendors as much. Revenue grew a solid 19% last quarter, but profits increased just 13%. In the earnings call, management pointed out 42% of its Annual Recerring Revenue (ARR) uses HubSports three key hubs: Marketing, Sales, & Service. Sales Hub and Service Hub are thriving, fueled by rapid AI innovation. Sales Hub is seeing strong adoption of AI features like deal intelligence with guided actions to take the next steps. And more than 40% of Service Hub customers are now using AI features. HubSpot (HUBS) stock has been weak as (1) profit growth has slowed and (2) the software sector is out of favor with investors. The Software industry is weak because investors feel AI will become easier and companies will be able to control the software they need to operate and not have to rely on outside vendors as much. Revenue grew a solid 19% last quarter, but profits increased just 13%. In the earnings call, management pointed out 42% of its Annual Recerring Revenue (ARR) uses HubSports three key hubs: Marketing, Sales, & Service. Sales Hub and Service Hub are thriving, fueled by rapid AI innovation. Sales Hub is seeing strong adoption of AI features like deal intelligence with guided actions to take the next steps. And more than 40% of Service Hub customers are now using AI features.

HubSpot offers online software that can keep track of your business’ customers and potential customers, do online marketing campaigns, trace if people are opening your emails, and even automate customer service teams. You can get free plans, upgrade for a small monthly fee, or get a complete suite to run your company. HUBS has more than 1,000 apps in its marketplace that can be integrated into the platform. Average Subscription Revenue per customer was $11,343 at the end of 2024, flat year-over-year. HubSpot is building AI features across its platform, including AI Assistants, AI Agents, and Chatspot. ChatSpot combines ChatGPT with the HubSpot CRM to become an AI assistant, CoPilot. Users can communicate with ChatSpot to perform CRM tasks. The company also launched content assistant which can generate social media text, create blog content, and prepare prospecting emails without leaving HubSpot. HubSpot with AI can make sales teams more efficient, and help reduce labor. The company’s offerings or hubs include:

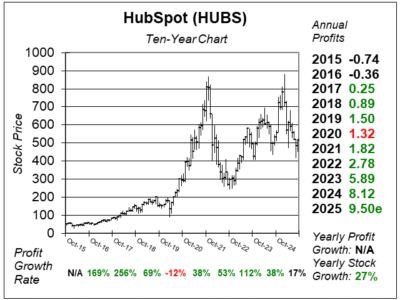

HubSpot software is similar to Salesforce’s, but this service is less expensive. I like the Salesforce comparison as that was one of the best stocks of the 2010’s decade. HubSpot is growing sales and profits faster than Salesforce. Analysts give HUBS an Estimated Long-Term Growth Rate of 20% per year. HUBS doesn’t pay a dividend, but does have a stock buyback program. HUBS is part of our Growth Portfolio. |

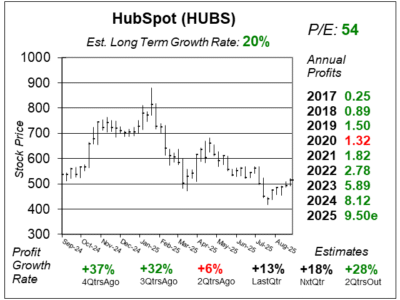

One Year Chart |

HUBS has been going down this year. The stock recently made a 52-week low. HUBS has been going down this year. The stock recently made a 52-week low.

The P/E of 54 is good. This figure was 72 last qtr. The Est. LTG of 20% per year is down from 22% last qtr. Qtrly profit growth has slowed. But Estimates show profit growth may accelerate next qtr. |

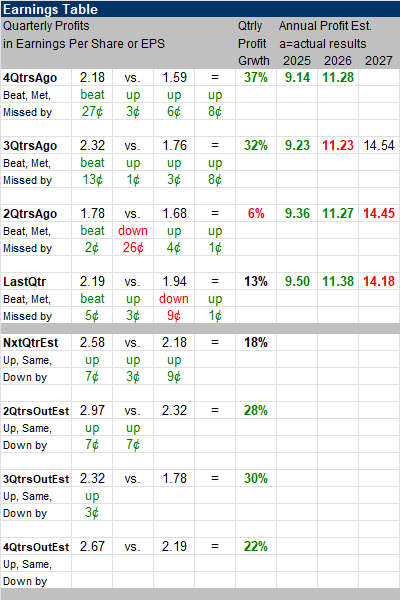

Earnings Table |

Last qtr, HubSpot delivered 13% profit growth and beat estimates of 10% growth. Profit growth was 40% in the year-ago period. Revenue increased 19%, year-over-year and beat estimates of 20%. Operating margin was 17.0% vs 17.2% a year ago. International revenue grew 19% and is now 48% of total revenue. The customer count grew by 18% to 268,000. Billings grew 20%. Average Subscription Value was $11,300 (annually) , flat year-over-year. Last qtr, HubSpot delivered 13% profit growth and beat estimates of 10% growth. Profit growth was 40% in the year-ago period. Revenue increased 19%, year-over-year and beat estimates of 20%. Operating margin was 17.0% vs 17.2% a year ago. International revenue grew 19% and is now 48% of total revenue. The customer count grew by 18% to 268,000. Billings grew 20%. Average Subscription Value was $11,300 (annually) , flat year-over-year.

There’s a lot of good points in the earnings call that highlights the growth of its AI innovation:

Annual Profit Estimates increased for 2025 and 2026 but decreased for 2027. Qtrly Profit Estimates are for 18%, 28%, 30%, and 22% profit growth in the next 4 qtrs. Analysts think HUBS revenue will grow 17% next quarter. |

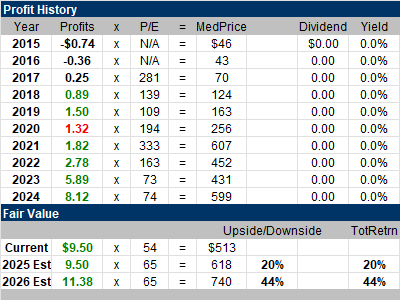

Fair Value |

This qtr with the stock at $513 it sells for 54x 2025 profit estimates. This qtr with the stock at $513 it sells for 54x 2025 profit estimates.

My Fair Value 65x profit estimates, giving us a Fair Value of $618 for 2025. That gives HUBS 20% upside (in my opinion). But, I might reduce my Fair Value P/E ratio next quarter. Software stocks just ain’t what they used to be (unless you’re Palantir). |

Bottom Line |

HubSpot (HUBS) was a stellar investment after its IPO in 2014. In 2020 and 2021 the stock went on a parabolic run higher, and had to digest its gains. The stock then fell in 2022 and rebounded in 2023. Then HUBS went parabolic again in 2024, and peaked in early 2025. HubSpot (HUBS) was a stellar investment after its IPO in 2014. In 2020 and 2021 the stock went on a parabolic run higher, and had to digest its gains. The stock then fell in 2022 and rebounded in 2023. Then HUBS went parabolic again in 2024, and peaked in early 2025.

HubSpot has nice software for small businesses, and large businesses are now liking it too. HubSpot is one of the companies that is actually benefiting from AI. But investors feel the market could get taken over by AI, and that’s a threat to HubSpot’s ambitions. HUBS moves up from 24th to 23rd in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

23 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |