Stock (Symbol) |

Alphabet (GOOGL) |

Stock Price |

$1420 |

Sector |

| Technology |

Data is as of |

| May 27, 2020 |

Expected to Report |

| July 23 |

Company Description |

Alphabet Inc is a collection of Companies. Alphabet’s collection include Calico, Google’s health and longevity effort; Nest its connected home business; Fiber, its gigabit internet arm; and its investment divisions such as Google Ventures and Google Capital, and incubator projects, such as Google X. Source: Thomson Financial Alphabet Inc is a collection of Companies. Alphabet’s collection include Calico, Google’s health and longevity effort; Nest its connected home business; Fiber, its gigabit internet arm; and its investment divisions such as Google Ventures and Google Capital, and incubator projects, such as Google X. Source: Thomson Financial |

Sharek’s Take |

Coronavirus fears have caused business to surge at Alphabet’s (GOOGL) YouTube and Google Cloud. Company revenue growth was a solid 13% last qtr, and revenue from YouTube ads increased 33% while Google Cloud revenue jumped 52%. These numbers sound great. But the problem with this stock is profit growth was -17% last qtr due to higher expenses. Coronavirus fears have caused business to surge at Alphabet’s (GOOGL) YouTube and Google Cloud. Company revenue growth was a solid 13% last qtr, and revenue from YouTube ads increased 33% while Google Cloud revenue jumped 52%. These numbers sound great. But the problem with this stock is profit growth was -17% last qtr due to higher expenses.

Alphabet is a collection of business, the largest of which is Google. If YouTube and Search ad revenue continue to climb at this pace, it will take 12 years for YouTube ads to be #1. But honestly, Alphabet puts YouTube subscription revenue in with Google Other so I can’t tell how much total YouTube revenue is. Here’s Alphabet’s main divisions, with 2019 annual revenue:

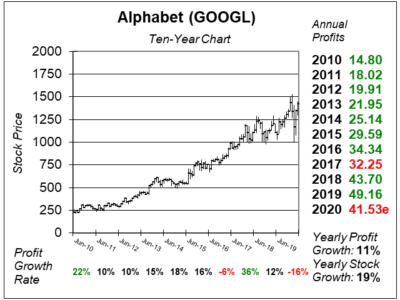

GOOGL is a good buy-and-hold stock. The company has grown profits every year since its IPO outside of 2017 which was only down as it switched its accounting practices to a more conservative stance. The stock has a Est. LTG of 5% a year, but I think that’s too low of a growth rate and consider this a 12% to 15% grower. Management doesn’t pay a dividend, but management does buyback stock. GOOGL is part of the Growth Portfolio and Conservative Growth Portfolio. Profit estimates just got cut, so let’s look at the numbers. |

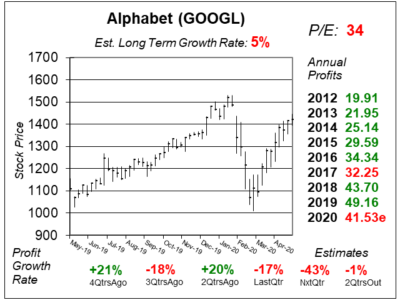

One Year Chart |

This stock crashed when the Coronavirus Bear Market hit, but it quickly rebounded. The company reported earnings a month ago, so the continuation of the uptrend is a positive sign. This stock crashed when the Coronavirus Bear Market hit, but it quickly rebounded. The company reported earnings a month ago, so the continuation of the uptrend is a positive sign.

What’s not positive is negative profit growth and a P/E of 34, which is high. The Estimated Long-Term Growth Rate of 5% is down from 10% 2QtrsAgo, 13% 3QtrsAgo, and 16% 4QtrsAgo. I really don’t understand why this is so low, the Est. LTG should at least be 12%. |

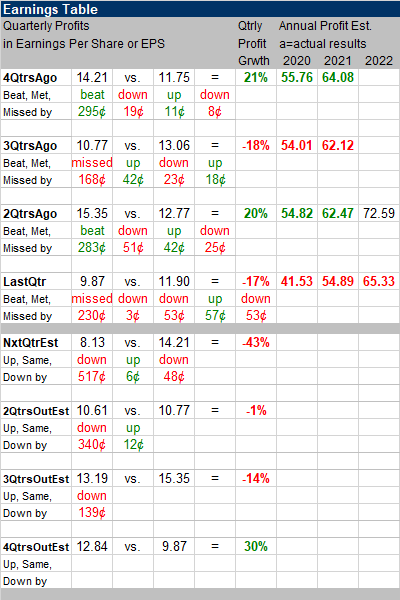

Earnings Table |

Last qtr GOOGL delivered -17% profit growth and missed analyst estimates of 2%. Revenue increased 13%, down from 20% a qtr earlier. Revenue growth was a solid 13% last qtr, but Traffic Acquisition Costs rose 19% and other cost of revenue increased jumped 26%. Data centers and content costs for YouTube TV were some of the biggest factors in the higher expanses, as was higher headcount. Last qtr GOOGL delivered -17% profit growth and missed analyst estimates of 2%. Revenue increased 13%, down from 20% a qtr earlier. Revenue growth was a solid 13% last qtr, but Traffic Acquisition Costs rose 19% and other cost of revenue increased jumped 26%. Data centers and content costs for YouTube TV were some of the biggest factors in the higher expanses, as was higher headcount.

Annual Profit Estimates were slashed. Last qtr the company was expected to make around $55 in profits this year. Now the company is expected to make $55 next year. More on this later. Qtrly profit Estimates are for -43%, -1%, -14% and 30%. |

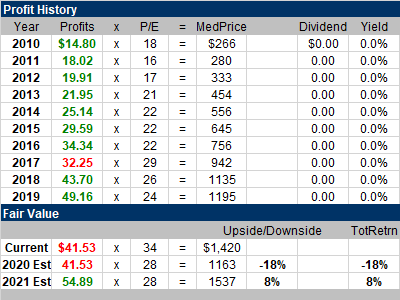

Fair Value |

My Fair Value P/E is 28. My Fair Value P/E is 28.

Last qtr my 2020 Fair Value was $1535. In 2017 GOOGL changed its accounting practices to more conservative accounting, and that’s why profits declined that year. This year it’s higher expenses that are leading to the negative growth. |

Bottom Line |

Alphabet (GOOGL) has been a steady grower this past decade. But note profit growth has lagged stock growth. Expenses are always an issue with this stock. This qtr management said it would address this issue. But I need to see profits grow faster than sales to get excited about this stock. Alphabet (GOOGL) has been a steady grower this past decade. But note profit growth has lagged stock growth. Expenses are always an issue with this stock. This qtr management said it would address this issue. But I need to see profits grow faster than sales to get excited about this stock.

YouTube and Google Cloud are catalysts for the company, and the ride-sharing program Waymo could be big down the road. This is a good stock to buy-and-hold, but it looks to me like this stock could be worth around $1530 next year, giving the stock little upside. But we have to keep an eye on profit estimates. I think business could accelerate rapidly this summer and cause annual profit estimates to rise. In such case, the stock could surpass $1537 very shortly. This qtr, GOOGL stays at 38th in Growth Portfolio Power Rankings. There’s a lot of good growth stocks right now, some I think are better than this one. The stock moves down from 11th to 12th in the Conservative Portfolio Power Rankings. I like the long-term opportunity with YouTube and Google Cloud. |

Power Rankings |

Growth Stock Portfolio

38 of 44Aggressive Growth Portfolio N/AConservative Stock Portfolio 11 of 31 |