Stock (Symbol) |

Enphase (ENPH) |

Stock Price |

$161 |

Sector |

| Industrials & Energy |

Data is as of |

| April 29, 2022 |

Expected to Report |

| July 25 |

Company Description |

Enphase Energy, Inc. is an energy technology company. The Company designs, develops, manufactures, and sells home energy solutions that manages energy generation, energy storage and control, and communications on one platform. Its semiconductor-based microinverter converts energy at the individual solar module level and, combined with its networking and software technologies that provides advanced energy monitoring and control. The Company’s Enphase Home Energy Solution with IQ platform, which is an integrated solar, storage and energy management offering, uses a single technology platform for managing the whole solution. System owners can use Enphase Enlighten to monitor their home’s solar generation, energy storage and consumption from any Web-enabled device. Source: Thomson Financial Enphase Energy, Inc. is an energy technology company. The Company designs, develops, manufactures, and sells home energy solutions that manages energy generation, energy storage and control, and communications on one platform. Its semiconductor-based microinverter converts energy at the individual solar module level and, combined with its networking and software technologies that provides advanced energy monitoring and control. The Company’s Enphase Home Energy Solution with IQ platform, which is an integrated solar, storage and energy management offering, uses a single technology platform for managing the whole solution. System owners can use Enphase Enlighten to monitor their home’s solar generation, energy storage and consumption from any Web-enabled device. Source: Thomson Financial |

Sharek’s Take |

Enphase Energy (ENPH) is seeing strong demand in Europe for its solar energy products. Enphase specializes in solar energy storage, for home or commercial buildings. And the Ukraine-Russia war is creating a need for European countries to get away from oil, coal and nateral gas. Enphase Energy is significantly ramping up its presence in Europe in the coming months and years. The company is quite strong in the Neatherlands, France, and Belgium. New regions include Germany, Italy, Spain and Portugal. Management is optimistic about Germany. Management expects European revenue to jump 40% sequentially this qtr. That’s quarter over quarter — a 40% jump in just three months — not year-over-year. Enphase Energy (ENPH) is seeing strong demand in Europe for its solar energy products. Enphase specializes in solar energy storage, for home or commercial buildings. And the Ukraine-Russia war is creating a need for European countries to get away from oil, coal and nateral gas. Enphase Energy is significantly ramping up its presence in Europe in the coming months and years. The company is quite strong in the Neatherlands, France, and Belgium. New regions include Germany, Italy, Spain and Portugal. Management is optimistic about Germany. Management expects European revenue to jump 40% sequentially this qtr. That’s quarter over quarter — a 40% jump in just three months — not year-over-year.

Enphase Energy is a global energy technology company that designs, manufactures, and sells solar energy solutions to homeowners and commercial owners. Enphase produces fully integrated solar storage solutions that can manage energy generation, storage, control, and communications using one intelligent platform. The company sells their products primarily to distributors who then sell them to solar installers. To date, they already sold and shipped around 45 million microinverters, over 2 million Enphase residential and commercial systems, and deployed them to over 135 countries. Enphase revolutionized the solar industry by introducing the microinverter, a device that connects to a solar panel that efficiently converts sunlight or direct current into alternating current, that’s used in homes. Multiple microinverters are used for a set of panels, so if one malfunctions the others keep working. Most solar panels utilize a single inverter to convert energy from all solar panels, and if that inverter malfunctions, the entire set of panels won’t work. In 2020, ENPH introduced Enphase Encharge 10 and Encharge 3 battery storage systems which powers the world’s first microinverter-based grid independent storage system. These two products have the Always-On feature which keeps homes or businesses powered by solar energy when the grid is down and saves money when the grid is up. ENPH grew its Inverter Market Share from 24% in 2018 to 48% in 2020 (source: @marlin_capital). In 2021, Enphase took the #1 spot in residential supply from SolarEdge, and now Enphase and SolarEdge supply more than 90% of the US market for solar inverters (source: Investors.com). Enphase is also developing Portable Energy System, an off-grid solar and storage system, considered to be a starter kit for homeowners who are on a tight budget. Here are some noteworthy business highlights from last qtr:

ENPH stock has been on my radar for a while. I’ve been waiting to buy on a dip, and this Bear Market has given me an opportunity, so I’m buying today. Analysts give the stock an Estimated Long-Term Growth Rate of 16% a year, but I think the company can grow much faster. In 2021, management repurchased $500 million in stock. Last qtr, the company had a 41% grow profit margin, 15% operating expenses, and 26% operating income. Enphase will be added to the Growth Portfolio. |

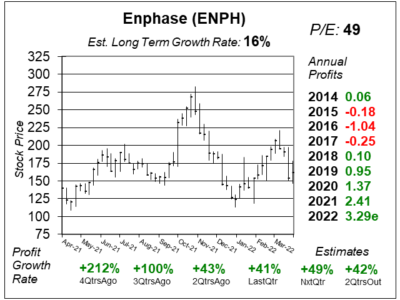

One Year Chart |

This stock’s been volatile. When these charts and tables were done on 4/29, the stock was $161. Today, 5/10, the shares are $150. This stock’s been volatile. When these charts and tables were done on 4/29, the stock was $161. Today, 5/10, the shares are $150.

The P/E was 62 last qtr and this qtr the P/E is 49. My Fair Value is a 45 P/E. The Est. LTG is 16% and this figure is unchanged since last qtr. Qtrly profit growth has been good, and the company has been beating analyst estimates, so I’m thinking profit growth will continue to be +30% in the near future. |

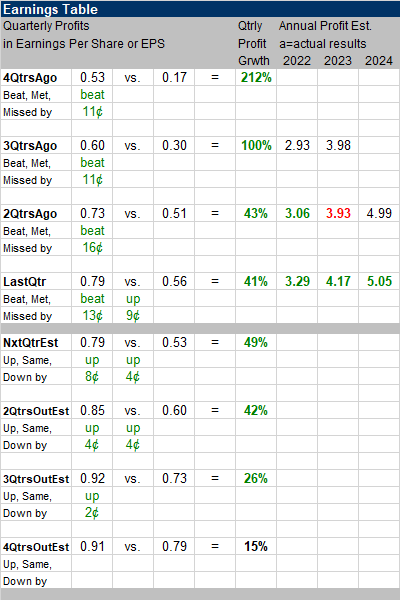

Earnings Table |

Last qtr, Enphase Energy delivered 41% profit growth and surpassed expectations of 18%. Revenue increased 46%, over last year. US sales (84% of company revenue) increased 49%. International sale (16% of revenue) increased 39%. Last qtr, Enphase Energy delivered 41% profit growth and surpassed expectations of 18%. Revenue increased 46%, over last year. US sales (84% of company revenue) increased 49%. International sale (16% of revenue) increased 39%.

Sales performance was attributed to elevated customer demand for Enphase microinverters and batteries, growth in battery shipments, and strong performance in Netherlands, France, and Belgium driven by strong homeowner demand for cheaper energy source. Annual Profit Estimates increased across the board. Global supply chain disruptions are affecting microinverter manufacturing but management said the situation is now stable due to better supply management and availability of alternative suppliers. The company implemented a modest price increase on batteries to combat logistics and component inflation. Here are analysts’ estimates for the upcoming years: Qtrly Profit Estimates are for 49%, 42%, 26%, and 15% profit growth the next 4 qtrs. The company’s factories in China remain open, but there are some hiccups in raw materials. |

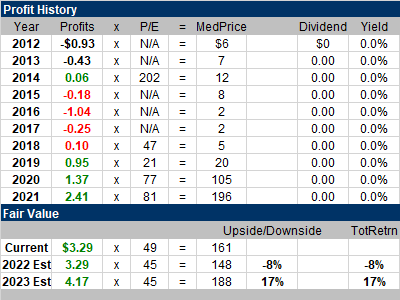

Fair Value |

My Fair Value P/E stays at 45, this qtr. But this is a tough stock to put a valuation on. My Fair Value P/E stays at 45, this qtr. But this is a tough stock to put a valuation on.

My Fair Value is $148 a share, around today’s price. I think the stock is a market leader. |

Bottom Line |

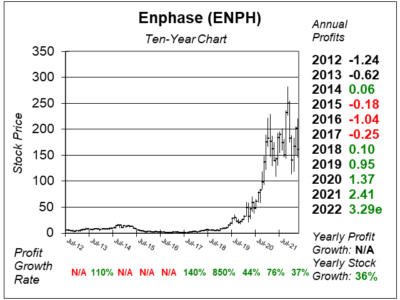

Enphase (ENPH) went from $5 to $26 in 2019, and from $26 to $175 in 2020. So the stock is basically where it was a year-and-a-half ago. Good! Enphase (ENPH) went from $5 to $26 in 2019, and from $26 to $175 in 2020. So the stock is basically where it was a year-and-a-half ago. Good!

Enphase has great momentum right now, and I like the advancements the company is making to its microinverters and batteries. European expansion could be a catalyst next qtr, as sales are expected to jump 40% in just three months. ENPH will be added to the Growth Portfolio. The stock will rank 20th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

20 of 26Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |