Stock (Symbol) |

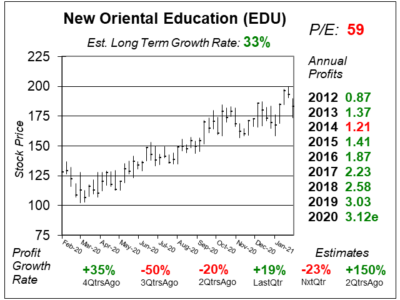

New Oriental Education (EDU) |

Stock Price |

$183 |

Sector |

| Food & Necessities |

Data is as of |

| February 24, 2021 |

Expected to Report |

| April 19 |

Company Description |

New Oriental Education & Technology Group Inc. is a provider of private educational services in China. EDU operates through 7 segments, which include language training and test preparation, primary and secondary school education, online education, content development and distribution, pre-school education, overseas study consulting services and study tour. Source: Thomson Financial New Oriental Education & Technology Group Inc. is a provider of private educational services in China. EDU operates through 7 segments, which include language training and test preparation, primary and secondary school education, online education, content development and distribution, pre-school education, overseas study consulting services and study tour. Source: Thomson Financial |

Sharek’s Take |

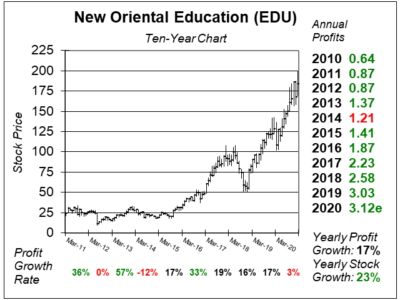

New Oriental Education (EDU), an education provider in China, is expected to see profits soar in the upcoming years. Analysts estimate profits going from $3.12 this year to $4.89 in 2021, $6.76 in 2022 and $8.68 in 2024. A P/E of 35 on $8.68 in profits would be a $304 stock, perhaps in three years, and a 65% gain from the recent quote of $183. New Oriental Education (EDU), an education provider in China, is expected to see profits soar in the upcoming years. Analysts estimate profits going from $3.12 this year to $4.89 in 2021, $6.76 in 2022 and $8.68 in 2024. A P/E of 35 on $8.68 in profits would be a $304 stock, perhaps in three years, and a 65% gain from the recent quote of $183.

New Oriental Educations is China’s largest private education provider with an online network of approximately 17 million students. In fiscal year-ending May 31, 2020 the company had a physical network of 104 schools and 1361 learning centers in 91 cities and approximately 41,400 teachers. The company had higher number of customer service representatives and marketing staff to capture opportunities during the COVID-19 period. And it appears this strategy was successful.Product offerings are divided into seven areas:

New Oriental New Oriental is one of the fastest growing companies in the world. But its a hard stock to handle. I’ve bought and sold it in the past, only to buy it back at a higher price. The stock currently has an Estimated Long-Term Growth Rate of 33%. But the P/E of 59 is high by historical standards. EDU is part of the Growth Portfolio. Let’s see if the 65% upside potential in three years is worth waiting for. |

One Year Chart |

This is a great looking chart, but notice the erratic profit growth. And that 59 P/E is very high. This is a great looking chart, but notice the erratic profit growth. And that 59 P/E is very high.

The Est. LTG of 33% a year is excellent. |

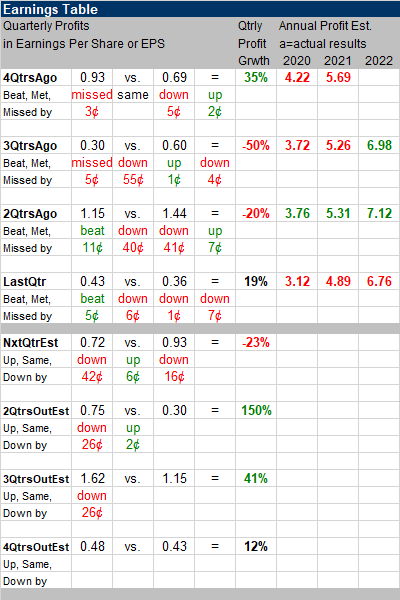

Earnings Table |

Last qtr, EDU had profit growth of 19% and beat estimates of -28%. Revenue increased 13%. K-12 revenue was up 26%, and within that segment Popkids revenue grew 24%. Overseas prep revenue was down 29%. Last qtr, EDU had profit growth of 19% and beat estimates of -28%. Revenue increased 13%. K-12 revenue was up 26%, and within that segment Popkids revenue grew 24%. Overseas prep revenue was down 29%.

Annual Profit Estimates took a big dip this qtr. I don’t like the inconsistency in these numbers. Qtrly Estimates are for -23%, 150%, 41% and 12% profit growth the next 4 qtrs. These figures also fell this qtr. |

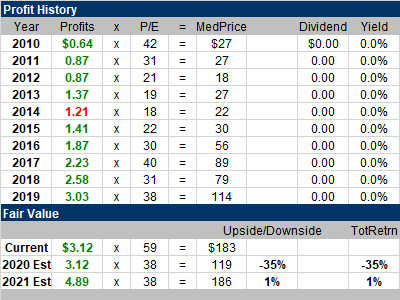

Fair Value |

My Fair Value P/E stays at 38. That puts the stock 35% above my Fair Value for this year. EDU has a fiscal year-end on May 31st. So next qtr I will be looking at 2021’s Fair Value, which is $186. Still that FairValue of $186 is around where the stock is now. My Fair Value P/E stays at 38. That puts the stock 35% above my Fair Value for this year. EDU has a fiscal year-end on May 31st. So next qtr I will be looking at 2021’s Fair Value, which is $186. Still that FairValue of $186 is around where the stock is now. |

Bottom Line |

New Oriental Education (EDU) has been a stock I’ve tracked/owned for around a decade now. Although the yearly stock growth has been good, the stock has been hard to handle. New Oriental Education (EDU) has been a stock I’ve tracked/owned for around a decade now. Although the yearly stock growth has been good, the stock has been hard to handle.

With EDU at its highs again, I wish to sell the stock. I don’t like the up-and-down moves of annual profit estimates. The stock seems like it could be this price a year from now. EDU will be sold from the Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |