Stock (Symbol) |

New Oriental Education (EDU) |

Stock Price |

$84 |

Sector |

| Food & Necessites |

Data is as of |

| December 3, 2018 |

Expected to Report |

| Jan 15 |

Company Description |

New Oriental Education & Technology Group Inc. is a provider of private educational services in China. EDU operates through 7 segments, which include language training and test preparation, primary and secondary school education, online education, content development and distribution, pre-school education, overseas study consulting services and study tour. Source: Thomson Financial New Oriental Education & Technology Group Inc. is a provider of private educational services in China. EDU operates through 7 segments, which include language training and test preparation, primary and secondary school education, online education, content development and distribution, pre-school education, overseas study consulting services and study tour. Source: Thomson Financial |

Sharek’s Take |

New Oriental Education (EDU) has multiple avenues of expansion and is expected to keep growing profits 30% a year long-term. New Oriental Educations is China’s largest private education provider teaching almost 5 million students with 22,000 teachers in more than 899 learning centers (up from 771 a year ago) in 65 cities, in addition to an online network of approximately 17 million students. Product offerings are divided into seven areas: New Oriental Education (EDU) has multiple avenues of expansion and is expected to keep growing profits 30% a year long-term. New Oriental Educations is China’s largest private education provider teaching almost 5 million students with 22,000 teachers in more than 899 learning centers (up from 771 a year ago) in 65 cities, in addition to an online network of approximately 17 million students. Product offerings are divided into seven areas:

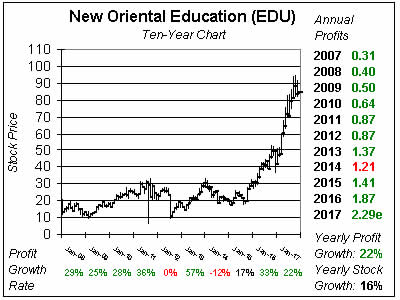

EDU possesses strong sales and profit growth. The company had revenue climb an astounding 30% a year from 2007 to 2017 with record sales each year. Sales are also expected to climb 30% this year. Profits grew 33% last year, are expected to climb 22% this year, then 36% next year and 33% the year after that. New Oriental Education is one of the top growth stocks in the market today. It’s a company capable of growing both profits and its stock price 30% a year. |

One Year Chart |

Last qr New Oriental had sales growth of 24% with enrollment growth of 16%. Profits grew just 15% on the biggest qtr of the year (Fall semester). EDU missed estimates for the 2nd time in 2 qtrs, but profits had been growing briskly. That’s likely to continue, as Estimates are for 71%, 37%, 32% and 23% profit growth the next 4 qtrs. But qtrly and annual estimates all declined last qtr. The P/E of 37 makes the stock a bit overpriced, but just by a little as the stock has a solid Est. LTG of 32% a year. Last qr New Oriental had sales growth of 24% with enrollment growth of 16%. Profits grew just 15% on the biggest qtr of the year (Fall semester). EDU missed estimates for the 2nd time in 2 qtrs, but profits had been growing briskly. That’s likely to continue, as Estimates are for 71%, 37%, 32% and 23% profit growth the next 4 qtrs. But qtrly and annual estimates all declined last qtr. The P/E of 37 makes the stock a bit overpriced, but just by a little as the stock has a solid Est. LTG of 32% a year. |

Fair Value |

My Fair Value is a P/E of 35, which makes the stock fairly valued here (today EDU is $85, these charts and tables were done on 8/1 when the stock was $78). Upside to 2018 is excellent, and gives the stock very good potential. My Fair Value is a P/E of 35, which makes the stock fairly valued here (today EDU is $85, these charts and tables were done on 8/1 when the stock was $78). Upside to 2018 is excellent, and gives the stock very good potential. |

Bottom Line |

New Oriental has been on a run lately, but had some catching up to do after many years of going nowhere. Education in China is thriving, and EDU is the leader in the space. This stock ranks 18th in the Growth Portfolio Power Rankings. I’m considering EDU for the Aggressive Growth Portfolio, but it’s slightly overvalued right now. New Oriental has been on a run lately, but had some catching up to do after many years of going nowhere. Education in China is thriving, and EDU is the leader in the space. This stock ranks 18th in the Growth Portfolio Power Rankings. I’m considering EDU for the Aggressive Growth Portfolio, but it’s slightly overvalued right now. |

Power Rankings |

Growth Stock Portfolio

18 of 38Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |