Stock (Symbol) |

dLocal (DLO) |

Stock Price |

$26 |

Sector |

| Financial |

Data is as of |

| January 27, 2022 |

Expected to Report |

| February 24 |

Company Description |

Dlocal Ltd, an Uruguay-based company, is focused on enabling global merchants to connect with emerging market users. The Company offers payment platform for emerging markets. Through the Company’s direct application programming interface (API), one technology platform, and one contract, which is collectively referred as the One dLocal model. The Company enables global enterprise merchants to get paid (pay-in) and to make payments (pay-out) online in a safe and efficient manner. The Company’s cloud-based platform powers both cross-border and local-to-local transactions in approximately 29 countries. The Company enables global merchants to connect with over 600 local payment methods across different geographies, which expands their addressable markets. It operates in different verticals and geographies. The Company’s key verticals include retail, streaming, ride hailing, financial institutions, advertising, software as a service (SaaS), travel, e-learning and gaming. Source: Thomson Financial Dlocal Ltd, an Uruguay-based company, is focused on enabling global merchants to connect with emerging market users. The Company offers payment platform for emerging markets. Through the Company’s direct application programming interface (API), one technology platform, and one contract, which is collectively referred as the One dLocal model. The Company enables global enterprise merchants to get paid (pay-in) and to make payments (pay-out) online in a safe and efficient manner. The Company’s cloud-based platform powers both cross-border and local-to-local transactions in approximately 29 countries. The Company enables global merchants to connect with over 600 local payment methods across different geographies, which expands their addressable markets. It operates in different verticals and geographies. The Company’s key verticals include retail, streaming, ride hailing, financial institutions, advertising, software as a service (SaaS), travel, e-learning and gaming. Source: Thomson Financial |

Sharek’s Take |

UPDATE 3/11/2022: Today I’ll be selling shares of dLocal from the Aggressive Growth Portfolio as I lower my equity exposure in client accounts. The stock market is in a swift decline, with speculative stocks like DLO moving up or down 5% a day (or more). That’s too much volatility, especially when the stocks continue to go lower. In addition, I think Visa will advance its cross-border capabilities and move into dLocal’s space. Also, we had anticipated the company reporting earnings on 2/24 but that’s been postponed to 3/15. DLO shares are currently $25. UPDATE 3/11/2022: Today I’ll be selling shares of dLocal from the Aggressive Growth Portfolio as I lower my equity exposure in client accounts. The stock market is in a swift decline, with speculative stocks like DLO moving up or down 5% a day (or more). That’s too much volatility, especially when the stocks continue to go lower. In addition, I think Visa will advance its cross-border capabilities and move into dLocal’s space. Also, we had anticipated the company reporting earnings on 2/24 but that’s been postponed to 3/15. DLO shares are currently $25.

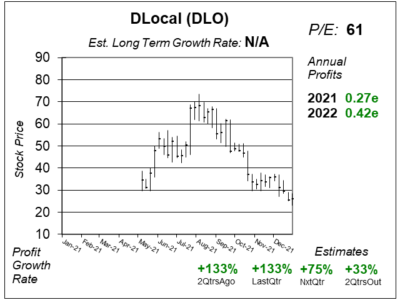

dLocal (DLO) was a new issue (IPO) in 2021 that opened at $31, ran up to $73, and is now $26. The company helps big companies take payments in emerging markets. dLocal deals with multiple payment mentions from different countries, develops software for higher conversion rates while addressing fraud prevention, and deals with regulatory adan tax issues in the countries it operates in. The problem is these big boys want discounts. Thus, DLO has had profit margins pressured lower. Adjusted EBITA Margin declined to 38% from 41% in the year-ago period. And that’s what has investors spooked. Management claims overall margin in 2021 will be similar to 2020. In addition, DLO is an IPO from last year, and recent IPOs have been weak, as have FinTech stocks. dLocal enables large global merchants to get paid and make payments in different emerging markets. The One dLocal cloud-based platform has the ability to do cross-border and local-to-local transactions with greater than 600 payment methods in roughly 32 countries worldwide. 2021 geography additions include the Dominican Republic,Vietnam, Malasia, Guatemala, Thailand, and El Salvador. The company is entirely business-to-business (B2B) focused, and has expertise in foreign exchange management, compliance, tax frameworks, regulations, and fraud prevention, and this makes it easy for large enterprises to do e-commerce with less hassles. Here’s a great video on what dLocal does. Customers include Amazon, Microsoft, Nike, Zara, Uber, Booking.com and Spotify. Growth opportunity comes from adding more clients, enhancing the One dLocal platform, and adding more countries. The company earns revenue from payment processing fees fees charged to merchants. These fees include a Merchant Discount Rate (MDR) and an F/X service fee when funds from different currencies have to be converted. DLO stock is in an awful downtrend, but the numbers (outside margins) look great:

DLO’s revenues and profits are growing ultra-rapidly, but margin pressures are freaking out investors — not just with this stock but across the FinTech industry. DLO’s revenue grew from $36 million in 2019 to $104 million in 2020. 2021 estimates are currently $240 million. 2022’s are $400 million. During the last 6 qtrs, DLO has had revenue climb from $21 million to $31 million, $35 million, $40 million, $59 million, and $69 million. DLO was added to the Aggressive Growth Portfolio last qtr. It’s one of my worst performing holdings as its down around 50% from the $65 I bought in at, but the overall impact in the portfolio was -1% as I only invested 2% of funds in this new issue. |

One Year Chart |

This stock reported earnings during November and the stock fell around 25% the next trading day. The company missed profit estimates by just a penny, but EBITA margin fell to 38% from 41% in 2021. This stock reported earnings during November and the stock fell around 25% the next trading day. The company missed profit estimates by just a penny, but EBITA margin fell to 38% from 41% in 2021.

The P/E of 69 seems high, but this company is just getting started. Profit estimates for this year are $0.27, but analysts have the company making around $1 in three years. There is no Est. LTG as this is a recent IPO. |

Earnings Table |

Last qtr, DLocal posted 133% profit growth but missed estimates of 167% growth. Revenue advanced 123%, over last year. During the last 6 qtrs, DLO has had revenue climb from $21 million to $31 million, $35 million, $40 million, $59 million, and to $69 million. Total Payment Volume (TPV) rose 217% to $1.8 billion from $572 million over a year ago. Existing merchants accounted for 85% of company sales while new merchants represented 38% of it. Use of digital mobile wallet in Asia Pacific is higher than other regions. Use of cash and bank transfers are prevalent in Middle East and Africa. Last qtr, DLocal posted 133% profit growth but missed estimates of 167% growth. Revenue advanced 123%, over last year. During the last 6 qtrs, DLO has had revenue climb from $21 million to $31 million, $35 million, $40 million, $59 million, and to $69 million. Total Payment Volume (TPV) rose 217% to $1.8 billion from $572 million over a year ago. Existing merchants accounted for 85% of company sales while new merchants represented 38% of it. Use of digital mobile wallet in Asia Pacific is higher than other regions. Use of cash and bank transfers are prevalent in Middle East and Africa.

Sales benefited from robust performance of existing and new merchants online from ride hailing, streaming, advertising and software as a service. Annual Profit Estimates are for exceptional growth the next four years: Qtrly Profit Estimates are excellent with 125%, 67%, 43%, and 71% profit growth expected the next 4 qtrs. |

Fair Value |

This stock is very tough to get a fair valuation on. Last qtr I thought the stock was worth 80x annual revenue, as the stock was selling for 79x revenue. This was way off target. This qtr I push it down to 25x revenue: This stock is very tough to get a fair valuation on. Last qtr I thought the stock was worth 80x annual revenue, as the stock was selling for 79x revenue. This was way off target. This qtr I push it down to 25x revenue:

Current: 2022 Fair Value 2023 Fair Value |

Bottom Line |

dLocal (DLO) has been a flash then a crash since it came public last year. The charts look horrible. dLocal (DLO) has been a flash then a crash since it came public last year. The charts look horrible.

But we are in a Bear Market for growth stocks — especially recent IPOs. So the stock could bounce back in a big way. But I have my attention pointed to profit margins moving forward. DLO ranks 31st in the Aggressive Growth Portfolio Power Rankings. Last qtr the stock ranked 24th. UPDATE 3/11/2022: Today I’ll be selling shares of dLocal from the Aggressive Growth Portfolio as I lower my equity exposure in client accounts. The stock market is in a swift decline, with speculative stocks like DLO moving up or down 5% a day (or more). That’s too much volatility, especially when the stocks continue to go lower. In addition, I think Visa will advance its cross-border capabilities and move into dLocal’s space. Also, we had anticipated the company reporting earnings on 2/24 but that’s been postponed to 3/15. DLO shares are currently $25. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |